Trading accounts are like digital keys to the vast world of online investments. They connect individuals with financial markets, enabling them to buy and sell securities like stocks, bonds, and currencies. But with so many options available, choosing the right online account can feel like navigating a maze. Just imagine trying to find the right key for a treasure chest without knowing how many keys exist or what each key unlocks. This journey to find the right online trading account can be daunting, but with careful consideration and the right information, it can be a rewarding experience.

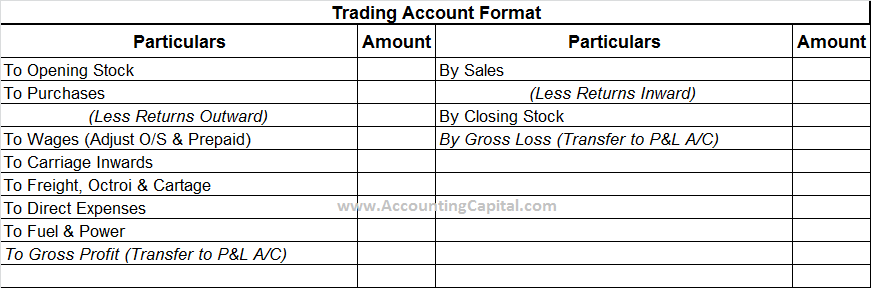

Image: www.accountingcapital.com

The concept of online account trading may seem intimidating at first, but it’s actually very accessible and empowering. It allows individuals to control their investments from the comfort of their homes, eliminating the need for traditional brokers and their steep fees. Think of it like shopping online: a convenient way to purchase products from the comfort of your living room. Online account trading does the same for investments, providing a transparent and efficient way to manage your financial future.

The Rise of Online Trading: Democratizing Financial Markets

The rise of online account trading is a testament to the growing accessibility of financial markets. No longer limited to institutions and high-net-worth individuals, online trading platforms have opened doors for ordinary people to participate in the global financial system. This democratization has empowered individuals to take control of their investment decisions, fostering financial literacy and encouraging a more active role in personal wealth management.

The evolution of online trading platforms has been fueled by technological advancements. As internet access has become ubiquitous and smartphones have become powerful computing devices, the ability to trade online has become easier and more accessible than ever before.

Understanding the Basics: The Keys to Online Account Trading

Online account trading is the process of buying and selling financial instruments like stocks, bonds, currencies, and commodities through a digital platform. Imagine it as a virtual marketplace where you can choose from a variety of offerings and place your orders electronically. But to navigate this marketplace, you need to understand the essential components of online account trading.

Types of Online Trading Accounts:

Different types of trading accounts cater to different investment goals and risk appetites. Here are some common types:

- Brokerage Accounts: Traditionally known for stock trading, they offer access to a broad range of investment options.

- Robo-Advisors: These platforms automate investment strategies based on an investor’s risk tolerance and financial goals.

- Margin Accounts: These accounts provide the ability to leverage borrowed funds to amplify potential returns (and losses).

- Options Trading Accounts: These accounts grant access to the complex world of options contracts, allowing investors to control assets without owning them.

Image: 60pips.com

Brokerage Fees and Trading Costs:

Before opening an account, it’s essential to understand the associated fees. These fees can vary significantly, impacting the profitability of your investments. Here’s a breakdown of common fees:

- Commission Fees: Charges levied per trade, usually calculated based on the trade size or type of security.

- Account Maintenance Fees: Monthly charges for maintaining the account.

- Inactivity Fees: Fees charged if the account has minimal activity.

- Margin Interest: Interest charged on borrowed funds used for margin trading.

Trading Platforms and Their Features:

The trading platform is your interface to the market. Choose a platform that offers the features you need, including:

- Real-time Data: Essential for making informed decisions.

- Advanced Charting Tools: Visualize market trends and identify patterns.

- Order Types: Various order types provide flexibility in executing trades.

- Research and Analysis Tools: Access market news, fundamental data, and expert analysis.

Risk Management: A Crucial Aspect of Online Trading

Online trading comes with inherent risks. Managing these risks is essential for protecting your hard-earned money. Key risk management principles include:

- Diversification: Spreading investments across different asset classes to mitigate risk.

- Position Sizing: Allocating an appropriate amount of capital to each trade based on your risk tolerance.

- Stop-Loss Orders: Automatic orders to limit potential losses on a trade.

- Regular Monitoring: Keeping a close eye on your portfolio and market developments.

The Evolution of Online Trading: Embracing New Technologies

The world of online trading is constantly evolving, driven by technological advancements and changing investor preferences. Here are some key trends:

Artificial Intelligence (AI) and Machine Learning:

AI and machine learning are revolutionizing online trading by automating tasks like market analysis, risk management, and even trade execution. These algorithms can identify patterns in vast datasets, assisting traders in making more informed decisions.

Mobile Trading Applications:

Smartphones have become the primary device for accessing financial markets. Mobile trading applications offer seamless access to accounts and real-time data, allowing traders to stay connected on the go.

Social Trading Platforms:

Social trading platforms connect traders, enabling them to share ideas, strategies, and even copy each other’s trades. These platforms foster a community feel, allowing individuals to learn from experienced traders.

Expert Advice for Navigating the Online Trading Landscape:

With numerous online trading platforms available, it can be overwhelming to choose the right one. Here are some expert tips:

1. Define Your Investment Goals and Risk Tolerance:

Before starting, clearly define your investment goals and your appetite for risk. This will guide your choice of trading platform and investment strategy.

2. Thoroughly Research and Compare Platforms:

Research different platforms, paying close attention to the features, fees, and customer support they offer. Look for reputable platforms with a strong track record and robust security measures.

3. Start Small and Gradually Increase Your Investments:

It’s best to start with a small investment, especially if you’re new to online trading. As you gain experience and confidence, you can gradually increase your investment amount.

4. Prioritize Education and Continuously Learn:

The world of finance is constantly evolving, so prioritize ongoing education. Stay updated on new trends, strategies, and technologies. There are numerous online resources and courses available to enhance your understanding.

Frequently Asked Questions (FAQ):

Here are answers to some common questions about online account trading:

Q: Is online account trading safe?

A: Online trading platforms are generally safe, but you need to choose reputable platforms with robust security measures. Look for platforms that use encryption technology to protect your data and have a strong track record of safeguarding customer funds.

Q: What are the advantages of online account trading?

A: Online trading offers several advantages, including convenience, accessibility, lower fees, and greater control over your investments.

Q: What are the risks associated with online account trading?

A: Online trading involves risks such as market volatility, fraud, and cyberattacks. It’s crucial to understand these risks and implement appropriate risk management strategies.

Q: Do I need prior experience to start online trading?

A: While prior experience is helpful, it’s not necessary to start online trading. There are platforms designed for beginners, offering educational resources and tools to help you learn the ropes.

Online Account Trading

Conclusion: Embrace the Power of Online Account Trading

Online account trading has democratized financial markets, allowing individuals to participate and control their investments. By understanding the basics, researching platforms, and managing risks effectively, you can unlock the potential of online trading to achieve your financial goals.

Are you interested in exploring the world of online account trading? Share your thoughts and questions below.