Forex Trading: A Gateway to Financial Empowerment

Forex trading, a financial arena where currencies are exchanged, presents individuals with the compelling opportunity to shape their financial futures. In this dynamic realm, the pursuit of profit necessitates the adoption of effective trading strategies; enter Joget 2E. This time-honored approach has empowered countless traders, bestowing upon them the knowledge and tools to navigate the complexities of forex markets.

Image: tradewinst.nl

Unraveling the Joget 2E Strategy: A Foundation for Success

Developed by Julian Komaromi, Joget 2E is an intricate trading strategy that is grounded in technical analysis, an analytical approach that deciphers market trends by examining historical price data. This strategy’s effectiveness lies in its versatility; it can be applied across a wide array of currency pairs and timeframes, empowering traders to capitalize on market fluctuations irrespective of prevailing conditions. At its core, Joget 2E hinges on the principle of identifying and trading within consolidation periods, which are characterized by a period of relative market stability.

Decoding Consolidation Periods: The Key to Strategic Success

Within the realm of forex trading, consolidation periods manifest as lateral price movements, where the market lacks a pronounced directional bias. These periods are often preceded by a surge in volatility, creating a unique opportunity for traders to capitalize on the subsequent shift in market momentum. Joget 2E practitioners adeptly identify these consolidation phases by observing the formation of specific candlestick patterns, such as the Harami or Inside Bar formations, which signal a potential reversal or continuation of the prevailing trend.

Embracing Trend Lines: Pillars of Price Direction

Trend lines serve as indispensable tools for traders employing the Joget 2E strategy, offering a visual representation of market direction and the boundaries of consolidation periods. By connecting a series of price highs or lows, trend lines delineate the upper and lower boundaries of a trading range, providing invaluable insights into potential support and resistance levels. Identifying and understanding these levels is crucial for discerning probable price movements and planning entry and exit points.

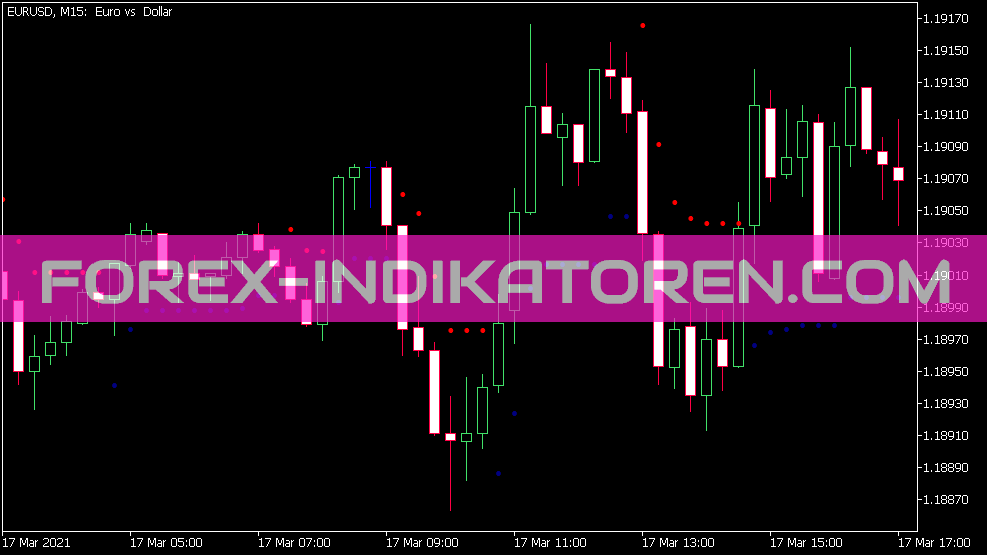

Image: www.forex-indikatoren.com

Embracing Indicators: Enhancing Precision in Market Assessment

Technical indicators play a pivotal role in the Joget 2E strategy, furnishing traders with additional data points to refine their trading decisions. One widely employed indicator is the Moving Average, which smooths out price fluctuations, revealing the underlying trend. By analyzing the relationship between price action and moving averages, traders can gauge market momentum and spot potential entry and exit points. Other indicators, such as oscillators and momentum indicators, offer further insights into market conditions, enabling traders to make more informed and profitable trading decisions.

Risk Management: The Bedrock of Trading Success

While the Joget 2E strategy provides a roadmap for navigating forex markets, it is imperative to underscore the inherent risks associated with trading. Sound risk management practices are the cornerstone of trading longevity, and the Joget 2E strategy is no exception. Establishing well-defined risk parameters, such as setting stop-loss orders to limit potential losses, is paramount. Additionally, diversifying trades across multiple currency pairs and employing prudent position sizing strategies mitigate risk and enhance trading resilience.

Mastering Market Psychology: Cultivating Emotional Discipline

Trading psychology is an often overlooked yet critical aspect of the Joget 2E strategy. Understanding the emotional roller coaster that accompanies trading is indispensable in executing rational and profitable decisions. Fear, greed, and overconfidence are common emotional pitfalls that can sabotage trading endeavors. Developing emotional discipline, remaining steadfast in the face of losses, and maintaining a level-headed approach during periods of profit are essential traits for consistent success.

Continuous Learning: The Path to Trading Excellence

The financial landscape is constantly evolving, demanding that traders embrace continuous learning to stay abreast of market developments and refine their strategies. Forex traders employing the Joget 2E strategy should diligently follow financial news and market analysis to stay informed about global economic events that may impact currency valuations. Additionally, seeking mentorship from experienced traders and attending webinars or workshops can significantly accelerate the learning process, providing valuable insights and practical knowledge to enhance trading prowess.

Joget 2e Forex Trading Strategy

https://youtube.com/watch?v=iEXVss-s2WY

Conclusion: Empowering Traders with Knowledge and Skill

Embracing the Joget 2E strategy, a time-tested approach rooted in technical analysis, provides traders with the essential tools and knowledge to navigate the complexities of forex markets with heightened confidence. By meticulously identifying consolidation periods, utilizing trend lines and technical indicators, and implementing sound risk management practices, traders can harness the potential of this strategy to achieve their financial aspirations. Remember, the pursuit of trading success is a continuous journey marked by learning, discipline, and unwavering dedication. So, embrace the challenge, embark on the path of mastery, and conquer forex markets with the unparalleled power of Joget 2E.