Have you ever dreamt of navigating the exhilarating world of financial markets, but hesitated due to the potential risks involved? Fear not, aspiring trader! There exists a golden bridge between curiosity and real-world trading – the **MT5 demo account**. This virtual playground offers a safe and risk-free environment to test your trading strategies, hone your skills, and gain invaluable experience before venturing into the real market.

Image: www.metaquotes.net

An MT5 demo account simulates the live trading environment, providing you with access to the same powerful trading platform, real-time market data, and comprehensive analytical tools. But here’s the catch – you trade with virtual funds, allowing you to experiment with different trading strategies, analyze market trends, and even make mistakes without risking a single cent of your hard-earned money.

Unlocking the Potential: The Perks of MT5 Demo Accounts

Imagine having a dedicated space to practice your trading skills without the pressure of potential financial loss. This is exactly what a MT5 demo account offers, providing a myriad of benefits that can propel your trading journey forward:

1. Risk-Free Experimentation:

The most significant advantage of a MT5 demo account is the ability to experiment with different trading strategies without exposure to real financial risk. You can try out various trading styles, test your risk management techniques, and familiarize yourself with the platform’s functionalities – all without losing a penny. This freedom to experiment without fear of consequences empowers you to discover your preferred trading approach and refine your skills.

2. Mastering the MT5 Trading Platform:

The MT5 platform is renowned for its versatility and advanced features, providing a comprehensive suite of tools for technical analysis, order execution, and account management. A demo account allows you to explore the platform’s intricacies at your own pace, familiarize yourself with its features, and optimize your trading workflow. By understanding the platform’s functionalities, you can maximize its potential and execute your trades with confidence.

Image: www.fpmarkets.com

3. Real-Time Market Data and Analysis:

The MT5 demo account provides access to real-time market data, including prices, charts, and indicators. This allows you to analyze market trends, identify potential trading opportunities, and develop your technical analysis skills. You can practice using different chart patterns, technical indicators, and fundamental analysis tools to develop your trading strategy and make informed decisions.

4. Building Confidence and Discipline:

While trading involves inherent risk, the freedom to experiment and learn without financial pressure fosters confidence. As you gain experience and build successful trading strategies on your demo account, you’ll develop a stronger understanding of market dynamics and the ability to manage your emotions during trading. This increased confidence can translate into a more disciplined and successful trading approach when you transition to live trading.

5. A Stepping Stone to Live Trading:

The demo account serves as a crucial bridge between theoretical knowledge and practical experience. It allows you to test your trading strategies, refine your skillset, and build confidence before taking the plunge into live trading. Having this solid foundation in place can greatly increase your chances of success when you start trading with real money.

Navigating the World of MT5 Demo Accounts: A Practical Guide

Now that you understand the myriad benefits of using a MT5 demo account, let’s delve into the practical aspects of setting one up and maximizing its potential:

1. Choosing an MT5 Broker:

The first step is to select a reputable MT5 broker that offers demo accounts. Different brokers may have varying features, trading conditions, and account types. Research different brokers, compare their offerings, and choose one that aligns with your trading preferences and risk appetite. Consider factors like spreads, commissions, leverage, and the availability of educational resources.

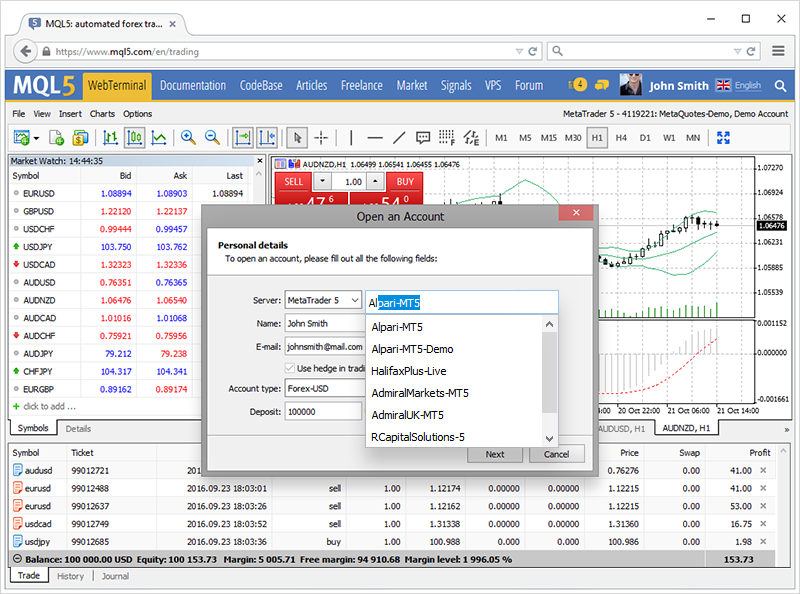

2. Opening a Demo Account:

Once you’ve chosen a broker, opening a demo account is typically a straightforward process. You’ll need to provide basic information, such as your name, email address, and phone number. Some brokers may require you to verify your identity, especially if you plan to transition to a live account in the future. The registration process is usually quick and hassle-free.

3. Setting Your Trading Parameters:

Upon successfully opening your demo account, you can start setting your trading parameters. This includes defining the amount of virtual funds you want to use, your trading timeframe, and your preferred types of orders. Familiarize yourself with the platform’s functionalities, explore different trading tools, and customize your workspace to optimize your trading experience.

4. Experimenting with Trading Strategies:

Now comes the exciting part – testing your trading strategies. Start with simple strategies and gradually increase the complexity as you gain more confidence and experience. Experiment with different indicators, timeframes, and risk management techniques to find what works best for you. Keep a journal of your trading decisions, noting your successes and failures, and analyze your performance to identify areas for improvement.

5. Continuously Learning and Refining:

The journey of becoming a successful trader is ongoing. Continuously learn from your experiences, stay updated on market trends, and refine your strategies based on the latest developments and insights. Analyze your performance regularly, identify weaknesses, and seek opportunities for growth. Remember, trading is a dynamic field, and continuous learning is key to staying ahead of the curve.

Beyond the Virtual Realm: Bridging the Gap to Live Trading

The MT5 demo account provides an invaluable training ground, but it’s just the first step in your trading journey. Successfully transitioning to live trading requires careful planning, discipline, and a well-defined strategy. Here are some key considerations when making the leap:

1. Gradual Transition:

Don’t rush into live trading. Start with a small amount of capital and gradually increase it as you gain more confidence and experience. This approach allows you to manage risk and minimize potential losses while gaining valuable experience in the real market.

2. Strong Risk Management Plan:

A robust risk management plan is essential for trading success. Define your risk tolerance, set stop-loss orders for each trade, and ensure you never risk more than a predetermined percentage of your capital on any single trade. This discipline will help you stay in the game for the long term.

3. Emotional Control:

The unpredictable nature of the market can trigger emotional reactions. Learn to manage your emotions and avoid making impulsive decisions based on fear, greed, or hope. Focus on your strategy, stick to your plan, and avoid chasing losses or getting carried away by profits.

Mt5 Demo Account

Conclusion: Your Gateway to Trading Mastery

The MT5 demo account is a powerful tool that can empower aspiring traders of all levels. It offers a safe and risk-free environment to experiment with various trading strategies, master the MT5 platform, and build confidence before venturing into the real market. By utilizing the benefits of a demo account, you can gain valuable experience, refine your skills, and lay a strong foundation for a successful trading journey. Remember, continuous learning, disciplined execution, and a sound risk management approach are crucial for long-term success in the dynamic world of financial markets.