In the dynamic world of forex trading, timing is everything. Understanding the most opportune moments to enter and exit trades can significantly impact your profitability. For Indian traders, who form a sizable portion of the forex market, tailoring their trading strategies to their local time zone is essential. This article delves into the intricacies of Indian timing for forex trading EUR/USD, providing insights into market dynamics, optimal trading hours, and effective strategies to maximize returns.

Image: www.youtube.com

Introduction to Forex Trading in India

Forex trading, involving the exchange of currencies, has gained immense popularity in India in recent years. Indian traders account for a substantial share of the global forex market, owing to the country’s favorable demographics, rising internet penetration, and increasing financial literacy. Unlike traditional stock market trading, forex markets operate 24 hours a day, five days a week, offering traders unmatched flexibility and potential profit-making opportunities.

Indian Time Zone and Currency Considerations

India falls under the Indian Standard Time (IST) zone, which is 5 hours and 30 minutes ahead of Coordinated Universal Time (UTC). This time difference must be considered when analyzing forex market movements and determining trade entry and exit points. Additionally, Indian traders must be familiar with the behavior of the Indian rupee (INR) against other major currencies, particularly the US dollar (USD).

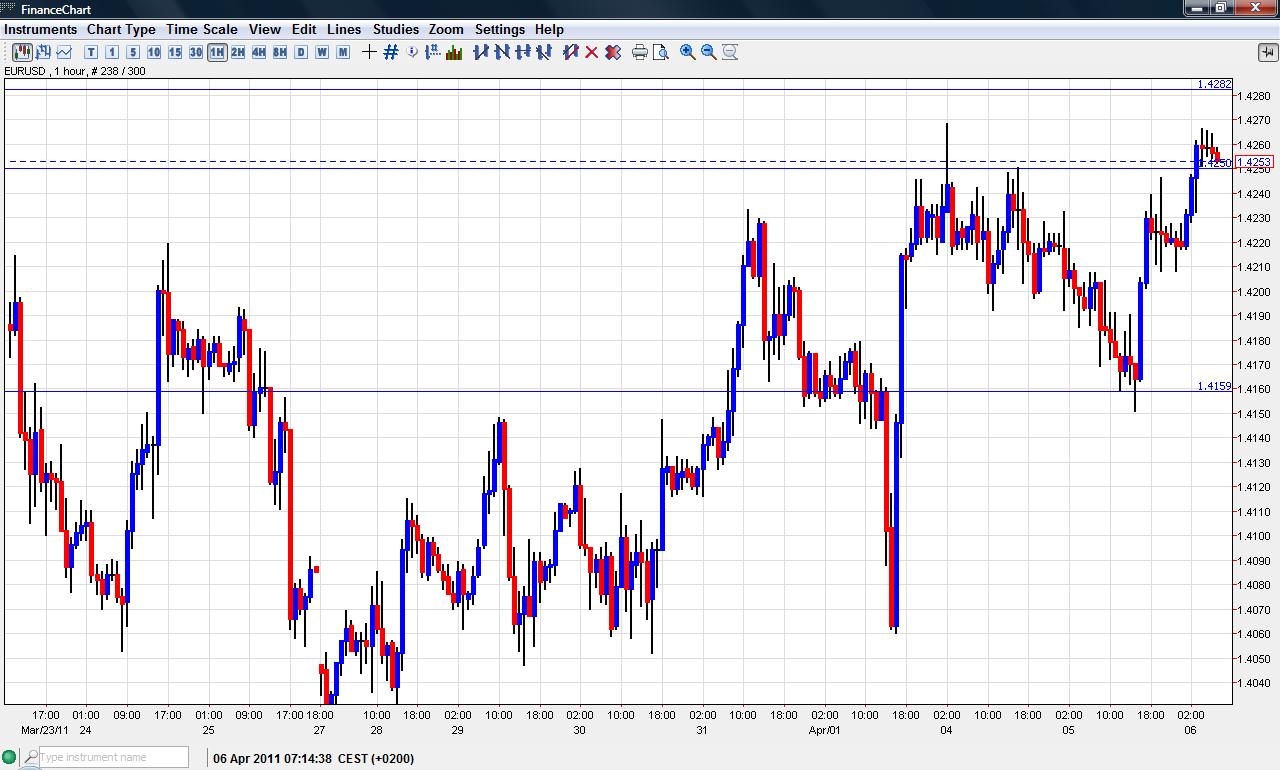

Understanding EUR/USD Market Dynamics

EUR/USD is one of the most actively traded currency pairs in the forex market, representing the exchange rate between the euro and the US dollar. Understanding the market dynamics influencing EUR/USD fluctuations is crucial for successful trading. Economic data releases, political events, interest rate decisions, and geopolitical developments can all impact the value of these currencies. Regularly monitoring market news and analyzing economic indicators is essential for gauging market sentiment and making informed trading decisions.

Image: statstrading.blogspot.com

Optimal Trading Hours for EUR/USD

Identifying the optimal trading hours for EUR/USD is critical for Indian traders. Indian markets overlap with major trading sessions, including the London session (08:00 – 17:00 UTC) and the New York session (13:00 – 22:00 UTC). However, due to the time difference, these sessions occur during the morning and afternoon hours in India. During these periods, market liquidity is at its peak, and price movements tend to be more significant.

Effective Trading Strategies for Indians

Indian traders can employ various trading strategies tailored to their specific time zone and market conditions. Scalping involves taking multiple small profits over a short period, while day trading involves buying and selling currencies within the same trading day. Swing trading and position trading involve holding trades for longer periods, capturing broader market trends. Choosing the appropriate strategy depends on individual risk tolerance, time availability, and market analysis skills.

Risk Management for Indian Forex Traders

Risk management is paramount in forex trading. Indian traders should always implement robust risk management measures to protect their capital. This includes setting clear stop-loss levels, managing position sizes, and diversifying their portfolio across multiple currency pairs. It is also crucial to avoid overtrading and impulsive decision-making, which can lead to significant losses.

Indian Timing For Forex Trading Eur Usd

https://youtube.com/watch?v=LXZmne-2Z0g

Conclusion

As the forex market continues to evolve, Indian traders must equip themselves with the knowledge and skills required to navigate the complexities of the industry. By understanding Indian timing, currency behavior, market dynamics, and risk management principles, Indian traders can position themselves for success in EUR/USD trading. Remember, consistent learning, sound analysis, and disciplined trading practices are key to maximizing returns and minimizing losses in this fast-paced financial landscape.