Embarking on international travels holds boundless opportunities for adventure, exploration, and cultural immersion. However, managing currency exchange and ensuring access to funds seamlessly can be a daunting task. Enter the ICICI Forex Card, an innovative financial solution engineered to provide a secure and hassle-free way for Indian travelers to navigate global currencies.

Image: fincards.in

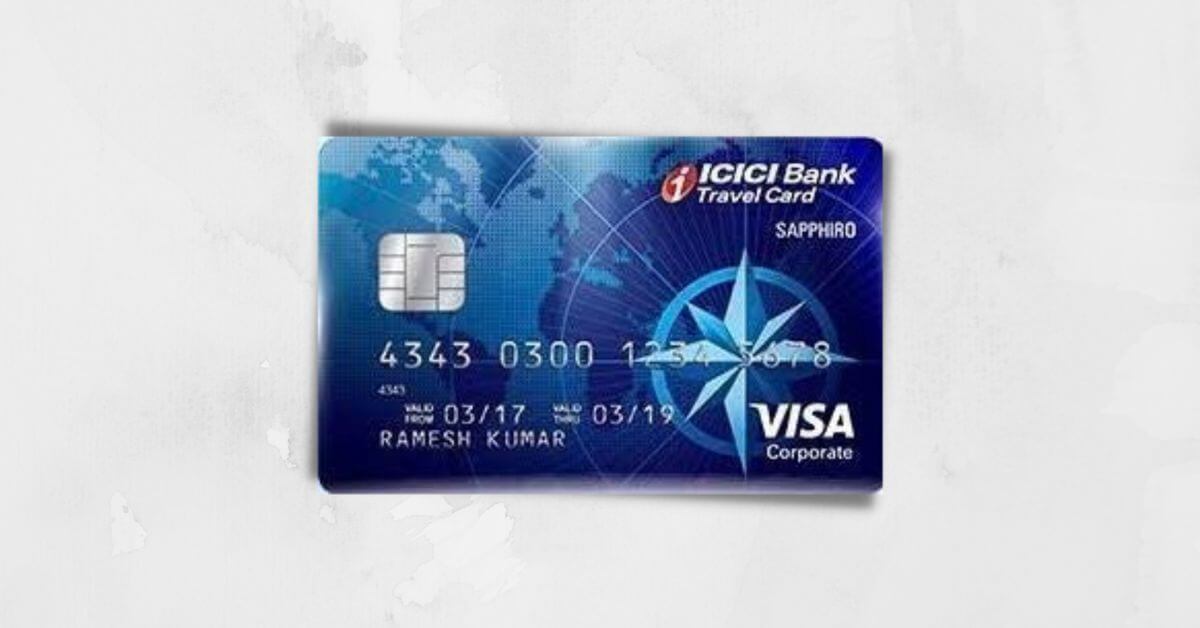

What is an ICICI Forex Card?

An ICICI Forex Card is a prepaid travel card loaded with a specific amount of foreign currency. Issued by ICICI Bank, one of India’s leading financial institutions, it enables travelers to carry and spend foreign currency conveniently without the need to exchange physical notes or cash traveler’s cheques. This eliminates the risks associated with carrying large amounts of cash and the potential for unfavorable exchange rates.

Benefits and Advantages of Using an ICICI Forex Card

- Peace of Mind: Protect your hard-earned money from theft or loss while traveling abroad.

- Competitive Exchange Rates: Enjoy competitive exchange rates locked in at the time of purchase, shielding you from market fluctuations.

- Global Acceptance: Use your ICICI Forex Card at millions of Visa and MasterCard-accepting outlets worldwide.

- Cashless Transactions: Avoid the hassle of carrying large amounts of cash and the inconvenience of exchanging currency at unfavorable rates.

- Additional Benefits: Access exclusive perks such as travel insurance, fraud protection, and dedicated customer support.

How to Use Your ICICI Forex Card

- Load Funds: Visit an ICICI Bank branch or use the ICICI Mobile Banking app to load the desired amount of foreign currency onto your card.

- Activate Card: Before traveling, activate your card through the ICICI iMobile app or by calling the customer care helpline.

- Set PIN: Choose a memorable 4-digit PIN to secure your card.

- Use Abroad: Swipe or insert your card at any Visa or MasterCard-accepting merchant globally.

- Manage Card: Monitor your transactions, balance, and other details through the ICICI Mobile Banking app or the ICICI Bank website.

Image: www.cardexpert.in

Tips for Using Your ICICI Forex Card

- Plan ahead and estimate your travel expenses to determine the appropriate amount of funds to load onto your card.

- Notify your bank about your travel dates and destinations to avoid unauthorized transactions on your card.

- Keep your card details confidential and avoid sharing your PIN with anyone.

- Check your balance regularly and top up as needed to avoid insufficient funds during your trip.

- Utilize ATMs to withdraw cash in the local currency if required, but be aware of any applicable withdrawal fees.

nets Payment: An Alternative to Traditional Payments

In addition to the convenience of the ICICI Forex Card, travelers can also leverage the power of nets Payment. This unique payment system connects directly to your bank account, enabling seamless cashless transactions in Singapore and supporting over 150,000 acceptance points.

With nets Payment, you can enjoy:

- Instant Payments: Make real-time payments without worrying about currency conversion delays.

- QR Code Transactions: Scan QR codes displayed at merchants to pay effortlessly.

- No Additional Charges: Avoid transaction fees or currency conversion surcharges.

By combining the ICICI Forex Card with nets Payment, travelers can experience the ultimate convenience and peace of mind while managing their finances overseas.

Icici Forex Card Nets Payment

Conclusion

International travel should be an enriching and enjoyable experience. With the ICICI Forex Card and nets Payment, Indian travelers can embark on their global adventures with the confidence that their financial needs are taken care of. By embracing these innovative solutions, they can safeguard their money, enjoy competitive exchange rates, and make payments seamlessly, allowing them to focus on creating unforgettable memories.