Introduction:

Imagine being able to harness the power of global currency exchange markets, unlocking untold wealth potential. Forex trading, the buying and selling of currency pairs, has captivated investors worldwide with its allure of immense profits. But embarking on this exciting journey requires proper preparation and a steadfast understanding of how to study forex pairs effectively.

Image: nurtasapra.blogspot.com

In this comprehensive guide, we will delve into the intricacies of forex pair trading, empowering you with the knowledge, techniques, and strategies to navigate the dynamic currency markets with confidence.

Deep Dive into Forex Pair Trading:

Understanding Currency Pairs:

Forex trading involves exchanging one currency for another, known as a currency pair. The most commonly traded pairs include the euro/US dollar (EUR/USD), US dollar/Japanese yen (USD/JPY), and British pound/US dollar (GBP/USD). Each pair represents the relative value of one currency against another.

Market Conditions:

Currency pairs are influenced by a myriad of macroeconomic factors, including economic growth, interest rates, political stability, and global events. Understanding these factors provides invaluable insights into future price movements.

Trading Platforms and Tools:

Numerous trading platforms offer access to forex markets, providing tools for technical analysis, charting, and order execution. Choose a platform that aligns with your trading style and offers reliable market data.

Technical Analysis:

Technical analysts use historical price data to identify patterns and predict future price movements. Candlestick patterns, moving averages, and oscillators are commonly used tools for forecasting trends.

Fundamental Analysis:

Fundamental analysts study economic indicators, news events, and geopolitical developments to assess the intrinsic value of currencies. This approach provides a deeper understanding of market movements.

Risk Management:

Forex trading involves inherent risks. Employ risk management strategies such as stop-loss orders, position sizing, and leverage management to minimize potential losses.

Expert Insights and Actionable Tips:

From the Desk of Marcus Stanton, Forex Trading Expert:

“Embrace a disciplined approach, constantly monitor market conditions, and never trade with more capital than you can afford to lose.”

5 Essential Tips for Success:

- Practice Regularly: Trade on demo accounts before risking real capital.

- Combine Technical and Fundamental Analysis: Leverage both approaches for a comprehensive understanding.

- Choose High-Liquidity Pairs: Avoid less liquid pairs, as they are prone to greater volatility and slippage.

- Set Realistic Profit Targets: Aim for modest gains over extended periods rather than chasing quick profits.

- Seek Mentorship and Education: Engage with experienced traders or attend workshops to enhance your knowledge and skills.

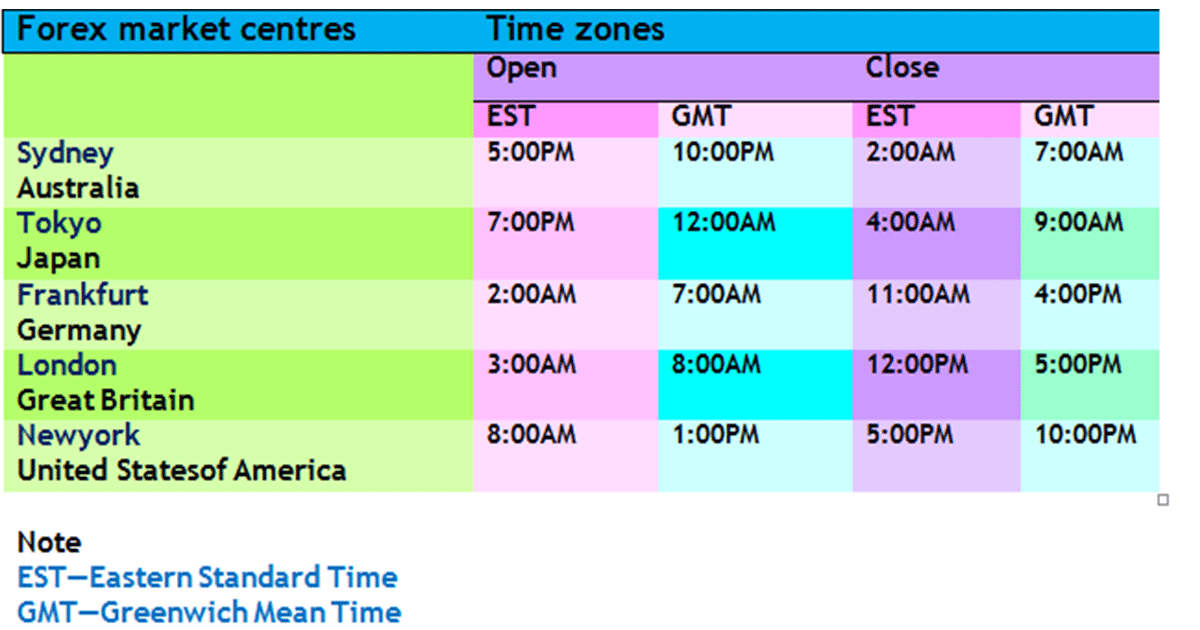

Image: www.babypips.com

How To Study Today Forex Pair

Conclusion:

Mastering forex pair trading requires dedication, discipline, and a comprehensive understanding of market dynamics. By embracing the insights and strategies outlined in this guide, you can embark on this thrilling financial journey with confidence. Remember, Rome wasn’t built in a day, and consistent effort will ultimately reward you with the trading prowess you seek.