Prologue: Your Financial Passport to the World

In today’s interconnected world, international travel and business transactions have become commonplace. Whether you’re jetting off on an exotic adventure or expanding your entrepreneurial horizons overseas, having access to a reliable and convenient payment solution is paramount. Here’s where the SBI Forex Card shines as your indispensable financial companion, unlocking a world of seamless transactions without the hassles of currency exchange.

Image: cardinsider.com

A Deep Dive into SBI Forex Card: Understanding its Essence

Issued by the State Bank of India (SBI), a renowned financial institution with a global presence, the SBI Forex Card operates as a prepaid card that empowers you to make purchases and withdraw cash in foreign currencies. It offers a plethora of advantages, including:

-

Eliminating Cross-Currency Charges: Say goodbye to exorbitant currency conversion fees that can drain your budget. The SBI Forex Card eliminates these hidden costs, allowing you to maximize your funds for travel expenses or business investments.

-

Convenience at Your Fingertips: No need to carry bulky cash or worry about currency exchange scams. The SBI Forex Card provides peace of mind with its universal acceptance at millions of merchant terminals and ATMs worldwide.

-

Competitive Exchange Rates: SBI offers competitive exchange rates, ensuring you get the best value for your money. This can result in significant savings over time, especially when making large transactions.

-

Enhanced Security: The SBI Forex Card is equipped with state-of-the-art security measures, including chip and PIN technology and 24/7 fraud monitoring. This safeguards your funds and provides you with peace of mind while traveling or conducting business abroad.

-

Access to SBI Global Network: As a cardholder, you gain access to SBI’s extensive global network, which includes over 200,000 ATMs in over 200 countries. This extensive reach ensures you’ll always have access to your funds, wherever your travels may take you.

Creating Your SBI Forex Card: A Step-by-Step Guide

Obtaining your SBI Forex Card is a straightforward process:

-

Eligibility Criteria: To be eligible, you must be an Indian resident with a valid passport and permanent address within India.

-

Application Process: You can apply for the card online through SBI’s website or by visiting any designated SBI branch.

-

Documents Required: Keep your passport, PAN card, and proof of residence handy for verification purposes.

-

Fees: You may have to pay a nominal processing fee and issuance fee. The specific charges may vary depending on the type of card you choose.

-

Loading Funds: Once your card is issued, you can load it with the desired amount of foreign currency by transferring funds from your SBI account or through designated forex dealers.

Utilizing Your SBI Forex Card Like a Pro

Using your SBI Forex Card is a breeze:

-

Transactions: Make purchases or withdraw cash at merchant terminals or ATMs displaying the MasterCard or Visa logo.

-

Currency Conversion: The card automatically converts the transaction amount into the local currency using SBI’s competitive exchange rates.

-

Balance Inquiry: Monitor your balance and transaction history anytime via SMS, internet banking, or IVR.

-

Lost or Stolen Card: In case of card loss or theft, promptly report it to SBI’s 24/7 helpline and freeze your card to prevent unauthorized usage.

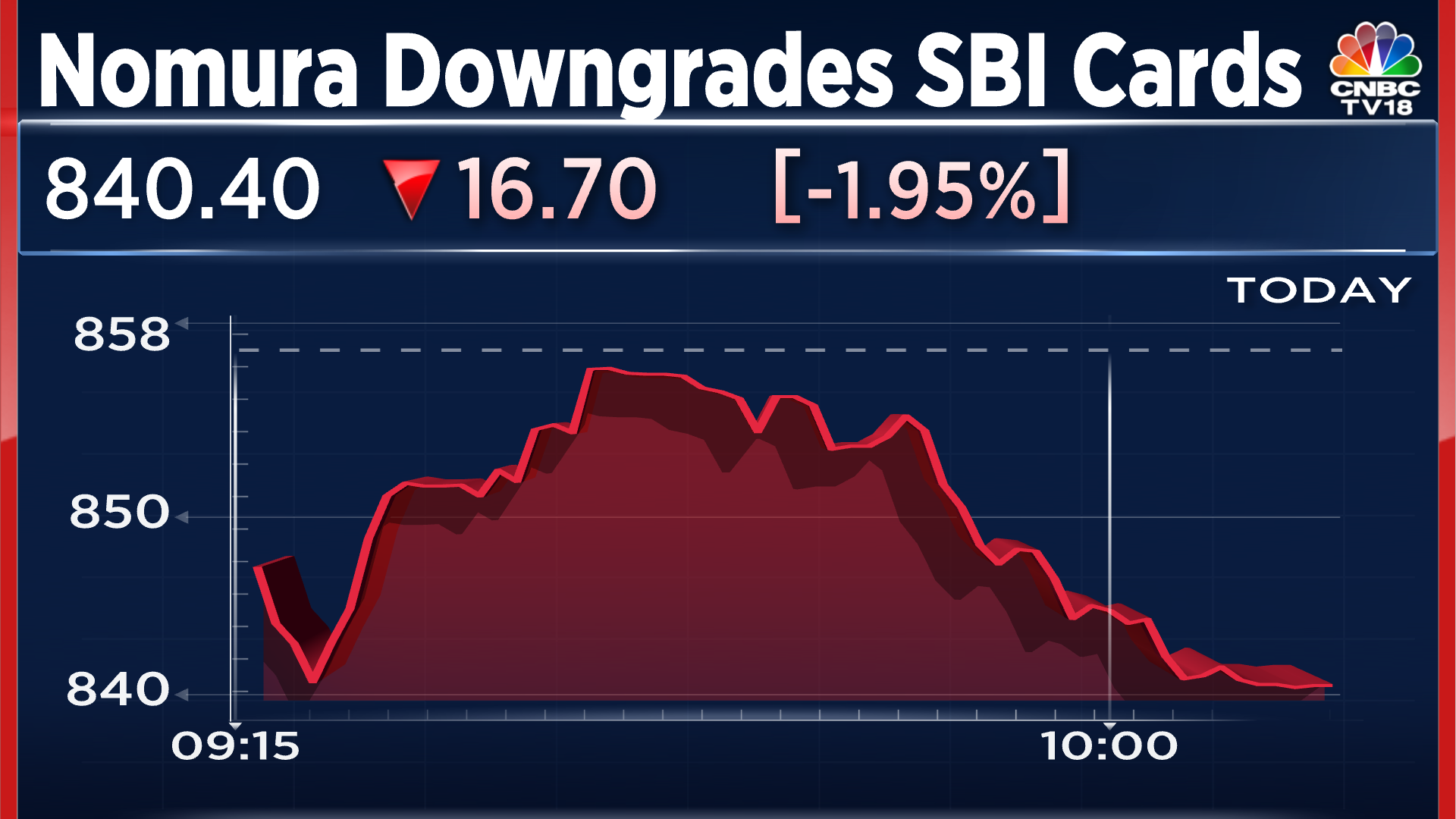

Image: www.cnbctv18.com

Expert Insights and Tips for Optimal Card Utilization

To make the most of your SBI Forex Card:

-

Plan Ahead: Determine the foreign currencies you’ll need for your travel or business trip and load your card accordingly.

-

Compare Rates: Keep an eye on currency exchange rates to find the most favorable time to load funds onto your card.

-

Avoid Dynamic Currency Conversion: When making purchases, opt for the local currency conversion option instead of Dynamic Currency Conversion (DCC) to avoid unfavorable exchange rates.

-

Monitor Transactions: Regularly check your balance and transaction history to keep track of your expenses and identify any discrepancies.

-

Notify SBI: Before traveling abroad, inform SBI about the dates and countries you’ll be visiting to ensure uninterrupted card usage.

How To Make Sbi Forex Card

Conclusion: Your Financial Ally in the Global Marketplace

The SBI Forex Card is an indispensable tool for anyone venturing into the global marketplace. Its convenience, competitive exchange rates, and enhanced security measures empower you to navigate the world of international transactions with confidence. Whether you’re a frequent traveler, a global businessperson, or simply someone who values financial flexibility, the SBI Forex Card is your key to a seamless and stress-free experience. Embrace its power, expand your horizons, and embrace the boundless opportunities that await.