Introduction

Traveling and conducting transactions abroad can be daunting, especially when managing foreign exchange. Forex cards have emerged as a convenient solution for handling international payments, offering numerous advantages over traditional cash and traveler’s checks. However, the task of converting Forex card USD to Indian currency requires careful planning and understanding of the process. This comprehensive guide provides a step-by-step approach to ensure a smooth and hassle-free currency exchange.

Image: howtotradeonforex.github.io

Understanding Forex Cards

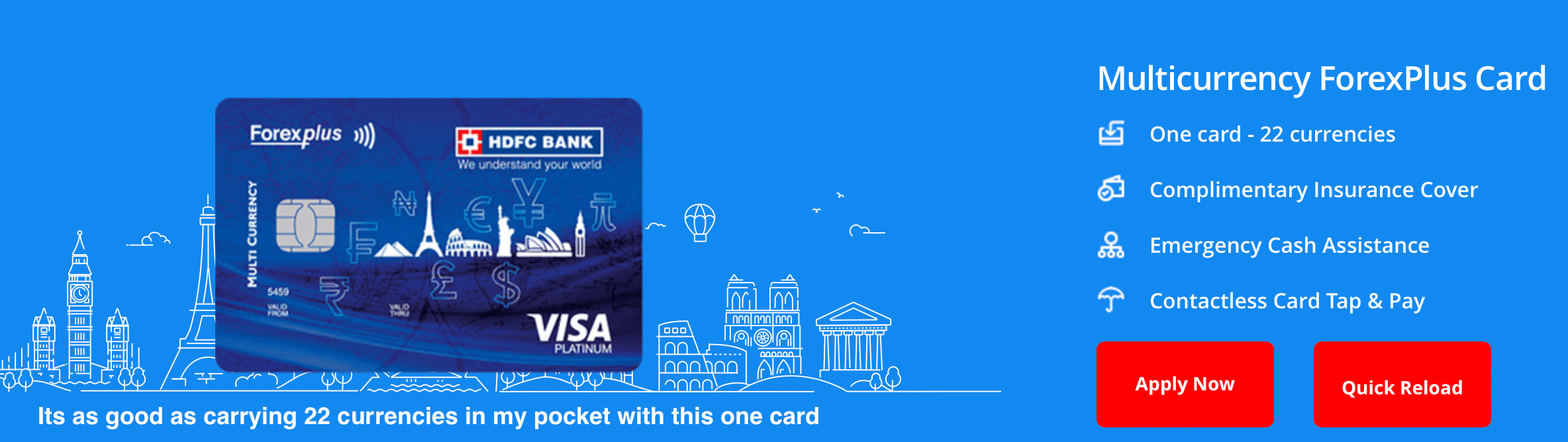

Forex cards are prepaid cards designed for international travel that allow individuals to store and use multiple currencies. They eliminate the need to carry large amounts of cash or traveler’s checks, reducing the risk of theft or loss. Forex cards offer competitive exchange rates and transparent fees, making them a cost-effective alternative to other currency exchange methods. Moreover, they are widely accepted at ATMs, point-of-sale terminals, and online stores worldwide.

Steps to Convert Forex Card USD to Indian Currency

- Check the Balance: Before initiating the exchange process, check the balance on your Forex card to confirm the available USD balance.

- Find a Currency Exchange Service: Identify a reputable currency exchange service in India that offers competitive exchange rates and low fees. Consider online platforms or physical branches of banks or authorized dealers.

- Provide Necessary Documents: When visiting a physical currency exchange service, bring your Forex card, passport, and any other identification documents as required.

- Complete the Exchange Form: Fill out the currency exchange form, indicating the amount of USD you wish to convert and the desired currency (Indian Rupee).

- Verification and Approval: The currency exchange service will verify your documents and calculate the amount of Indian Rupee you will receive based on the prevailing exchange rate and applicable fees.

- Receive Indian Currency: Once the verification process is complete, you will receive the equivalent amount of Indian Rupee in cash or a bank draft.

Tips for Exchanging Forex Card USD to Indian Currency

- Compare Exchange Rates: Before choosing a currency exchange service, compare exchange rates from multiple providers to secure the most favorable rate.

- Negotiate Fees: Inquire about the applicable fees and negotiate if possible, especially when exchanging larger amounts of currency.

- Avoid Airports: Currency exchange services at airports typically offer less competitive rates and higher fees. Plan your currency exchange needs in advance and visit a reputable service outside the airport.

- Be Aware of Scams: Exercise vigilance and be wary of unauthorized currency exchange services or individuals offering suspiciously high exchange rates.

- Keep Receipts: Retain the receipts from your currency exchange transactions for future reference and potential disputes.

- Use Authorized Dealers: For better exchange rates and security, consider exchanging your Forex card USD at authorized dealers or banks that are regulated by the Reserve Bank of India (RBI).

![7+ Best Forex Card in India for Students [Multi-Currency]](https://www.earticleblog.com/wp-content/uploads/2022/09/Best-Forex-Card-in-India-1024x538.jpg)

Image: www.earticleblog.com

Alternative Methods of Currency Exchange

Besides Forex cards, there are alternative methods for converting USD to Indian currency, such as:

- Banks: Banks offer currency exchange services, but their exchange rates and fees may vary. It’s advisable to compare rates and choose the most competitive option.

- Money Changers: Money changers can be found in various locations, such as airports and tourist areas. However, it’s essential to be cautious and verify the genuineness of the service before exchanging currency.

- Online Currency Exchanges: Several online platforms allow you to exchange currency digitally. Ensure that the platform is reputable and provides secure payment options.

How To Change Forex Card Usd To Indian Currency

Conclusion

Converting Forex card USD to Indian currency is a straightforward process that can be managed effectively by following the steps outlined in this guide. By choosing a reputable currency exchange service, comparing exchange rates, and being aware of potential scams, you can ensure a hassle-free and secure currency exchange experience. By adopting these practices, you can optimize your travel budget and enjoy a seamless international experience.