Imagine stepping into the bustling realm of the foreign exchange (forex) market, a global stage where currencies dance and fortunes can be made. For Indian traders eager to explore this dynamic arena, understanding the nuances is paramount. In this comprehensive guide, we’ll delve into the depths of the Indian forex market, providing invaluable tips to navigate its complexities and seize opportunities.

Image: www.mql5.com

The forex market, the largest financial market globally, offers immense potential for savvy traders. However, it’s important to recognize the inherent risks involved and always trade with caution. With preparation and knowledge, Indian traders can unlock the market’s immense potential.

Understanding the Indian Forex Market Dynamics

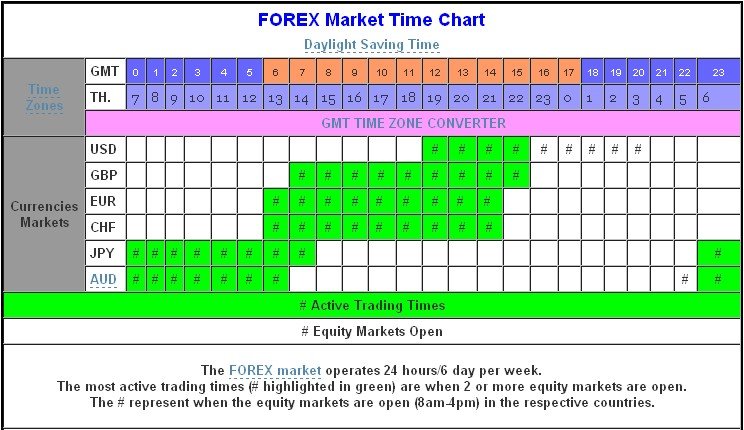

Grasping the fundamentals of the Indian forex market is crucial. The Indian Rupee (INR) is the primary currency traded against various foreign currencies, including the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), and British Pound (GBP). Various factors influence the INR’s value, such as economic indicators (e.g., inflation, GDP growth), policy changes, and global developments.

Essential Trading Tools and Resources

To navigate the forex market effectively, traders must equip themselves with the right tools and resources. This includes understanding currency pairs, using technical analysis tools (e.g., charts, indicators), and staying informed with news, economic data, and market expert opinions. Utilizing demo accounts or virtual trading platforms also allows traders to practice and refine their strategies risk-free.

Leveraging Technical and Fundamental Analysis

To make informed trading decisions, a combination of fundamental analysis and technical analysis is recommended. Fundamental analysts study economic, political, and financial factors that can impact a currency’s value. Technical analysts, on the other hand, examine historical price patterns, indicators, and other statistical tools to predict future price movements.

Image: www.telegraphindia.com

Embracing Risk Management Strategies

In the realm of forex trading, risk management is paramount. Implementing appropriate risk management strategies is crucial to protect profits and minimize potential losses. This includes setting stop-loss orders to limit drawbacks, managing leverage (borrowing to amplify profits and losses), and diversifying portfolios to mitigate risks.

Psychology and Discipline in Trading

The psychological aspect of trading often overlooked but equally important. Trading requires discipline, emotional control, and the ability to manage stress. Developing a consistent trading plan and adhering to it can help traders avoid impulsive decisions that could lead to losses. Remaining informed, continually learning, and seeking guidance from experienced traders can enhance trading skills and knowledge.

Understanding Market Trends and Patterns

Successful forex traders often possess a deep understanding of market trends and patterns. By analyzing historical data and current market movements, they can anticipate future price movements and make informed trades. Regularly tracking news and economic events that can impact the forex market is also essential.

Exploring Trading Platforms and Brokers

Choosing the right trading platform and broker is crucial for a seamless trading experience. Different platforms offer different features and functionalities, so selecting one that aligns with your trading strategy is important. Additionally, consider factors like spreads (trading costs), commissions, and customer support when selecting a broker.

Education and Continuous Learning

The forex market is constantly evolving, and it’s imperative for traders to remain updated with the latest market developments and advancements. Regularly accessing educational resources, attending webinars, and engaging with market experts can help expand your knowledge and improve trading strategies.

Currency Tips Forex Market In India

Conclusion

Delving into the Indian forex market presents both opportunities and challenges. By thoroughly understanding the market dynamics, equipping yourself with the right tools, leveraging risk management strategies, and embracing a disciplined approach, you can navigate the complexities of forex trading and maximize your potential for success.