Introduction

The foreign exchange market (forex) is the colossal marketplace where currencies from around the globe are traded. Currency pairs fluctuate in value constantly, driven by a myriads of economic, political, and geopolitical factors, providing ample opportunities for traders to profit. One crucial aspect that sets the forex market apart is the exceptional liquidity, which allows traders to buy or sell currencies with almost unparalleled ease and immediacy. This article delves into the complexities of forex liquidity, illuminating its significance and exploring the advantages it offers in the world of currency trading.

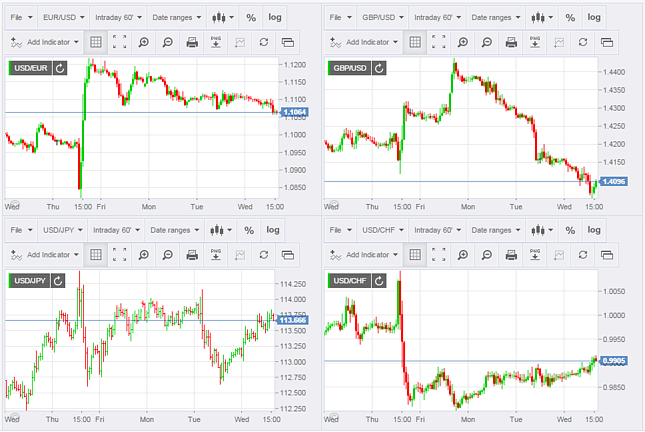

Image: www.youtube.com

Liquidity, in the financial context, refers to the ability to swiftly convert assets into cash without incurring substantial losses. When a market is liquid, it ensures that buyers and sellers can execute trades at fair prices with minimal slippage or delays. In the forex market, liquidity is of paramount importance due to the enormous trading volume, which often surpasses trillions of dollars per day. This liquidity facilitates seamless order placement and execution, bolstering trader confidence and enabling them to respond promptly to market movements.

Factors Influencing Forex Liquidity

The extraordinary liquidity of the forex market stems from several key factors:

- Market Participation: The forex market attracts a vast and diverse array of participants, including central banks, commercial banks, investment funds, corporations, and retail traders. This broad participation contributes significantly to the market’s overall depth and liquidity.

- 24/7 Operation: Unlike traditional stock exchanges, the forex market operates 24 hours a day, 5 days a week, allowing traders worldwide to access the market whenever they deem fit. This continuous trading environment further enhances liquidity as there are always buyers and sellers present.

- Technological Advancements: Sophisticated trading platforms and electronic communication networks (ECNs) have streamlined the process of executing forex trades. These technologies enable real-time order matching and instant execution, reducing latency and increasing liquidity.

Benefits of Liquidity in the Forex Market

The exceptional liquidity of the forex market offers several advantages to traders:

- Faster Order Execution: With a highly liquid market, buy and sell orders can be fulfilled quickly and efficiently, minimizing the risk of slippage (the difference between the expected and executed price).

- Enhanced Price Discovery: The constant exchange of currencies in a liquid market ensures that the prices accurately reflect supply and demand, enabling traders to make informed decisions based on real-time market conditions.

- Reduced Transaction Costs: Liquidity promotes competitive bid-ask spreads, which represent the difference between the price at which traders can buy (bid) or sell (ask) a currency pair. Tighter spreads imply lower transaction costs, which can accumulate over time and impact a trader’s profitability.

Impact of Liquidity on Forex Trading Strategies

The liquidity of the forex market influences trading strategies in many ways:

- Scalping: Liquidity is vital for scalpers, who seek to profit from tiny price movements over extremely short time frames. A liquid market ensures speedy order execution, minimizing the impact of slippage on their profits.

- Day Trading: Day traders hold positions for a single trading day and seek to capitalize on intraday price fluctuations. Liquidity allows day traders to enter and exit trades swiftly, adjusting their strategies as market conditions evolve.

- Position Trading: Position traders maintain positions for extended periods, often spanning weeks or months. While liquidity is less crucial for these traders, it still plays a role in ensuring that large orders can be filled without significantly affecting market prices.

Image: currency-trading-forex.com

Currency Easily Available In Any Forex Market

https://youtube.com/watch?v=zdNSf1oqT8U

Conclusion

Liquidity is the lifeblood of the forex market, enabling traders to buy and sell currencies with unmatched ease and efficiency. This remarkable level of liquidity stems from a combination of factors, including widespread market participation, 24/7 operation, and technological advancements. The benefits of liquidity in forex trading are far-reaching, including faster order execution, enhanced price discovery, reduced transaction costs, and the flexibility to support various trading strategies. Whether you are a seasoned veteran or a novice entering the forex market, understanding and leveraging liquidity are essential components of successful trading.