The clock is ticking down to Nvidia’s quarterly earnings report, and the tech world is holding its breath. Will the company continue its meteoric rise, fueled by the insatiable demand for artificial intelligence (AI) and gaming chips? Or will the recent market volatility and macroeconomic headwinds cast a shadow on its future prospects?

Image: seekingalpha.com

For investors, Nvidia’s earnings call is a pivotal moment. The company’s performance is seen as a bellwether for the broader semiconductor industry, with implications for everything from cloud computing to autonomous driving. But beyond the numbers, there are crucial trends and developments that investors are eagerly watching for, offering a glimpse into Nvidia’s future trajectory and the potential impact on the technology landscape.

The AI-Powered Growth Engine

Nvidia’s dominance in the AI chip market is undeniable. Its GPUs, originally designed for gaming, have become the workhorse of AI development, powering everything from image recognition to natural language processing. The company’s recent success is fueled by the rapid adoption of AI across industries, from healthcare to finance to retail.

Key Metrics to Watch:

- Data Center Revenue: This segment, driven by AI workloads and high-performance computing, is a major growth driver for Nvidia. Investors will be looking for signs of continued momentum and expansion into new markets.

- AI Chip Sales: Nvidia’s flagship A100 and H100 chips are crucial for AI training and inference. Watch for updates on demand, supply chain constraints, and the introduction of new products.

- Partnerships and Acquisitions: Nvidia’s strategic alliances with cloud providers and its acquisition of companies like Mellanox and Arm point towards its ambitions in the AI ecosystem. Updates on these partnerships will be closely watched.

The Gaming Juggernaut: Staying Ahead of the Curve

While AI is propelling Nvidia’s growth, the gaming segment remains a vital revenue generator. The company’s GeForce GPUs are synonymous with high-performance gaming, and the ever-evolving landscape of PC and mobile gaming presents both opportunities and challenges.

Image: futurumresearch.com

Key Metrics to Watch:

- Gaming Revenue: Investors will be analyzing gaming revenue growth, particularly in light of competition from AMD and the economic slowdown. Any signs of weakening demand or price pressure will be scrutinized.

- GeForce RTX Sales: Nvidia’s RTX line of GPUs, featuring real-time ray tracing and AI-powered features, has redefined gaming visuals. Continued adoption of these products is crucial for its market position.

- New Hardware Launches: Nvidia’s ability to innovate and release new gaming hardware with compelling features is key to maintaining its competitive edge. Announcements of new graphics cards or other gaming products will be eagerly anticipated.

Navigating the Macroeconomic Storm

Nvidia’s earnings call will take place against the backdrop of a challenging macroeconomic environment. Inflation, rising interest rates, and supply chain disruptions are impacting the semiconductor industry and consumer spending. Nvidia’s ability to navigate these headwinds will be a key focus for investors.

Key Metrics to Watch:

- Inventory Levels: Nvidia’s inventory levels and supply chain management will be closely watched, with any signs of stockpiles or production constraints raising concerns.

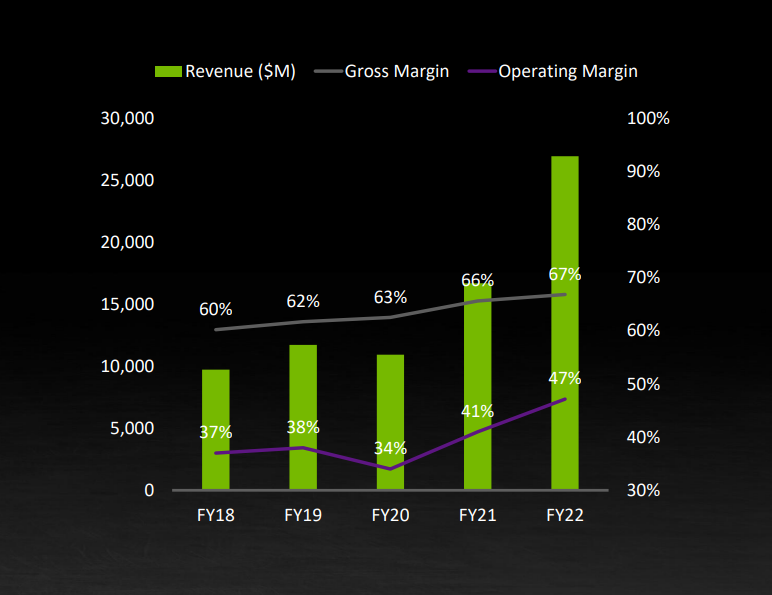

- Gross Margins: Nvidia’s gross margins, a measure of profitability, will provide insight into its pricing power and ability to offset rising costs.

- Outlook: Nvidia’s outlook for the coming quarters will be a crucial indicator of its growth trajectory and resilience in the face of economic headwinds.

Beyond the Numbers: The Future of Computing

Nvidia is not just a chipmaker; it’s a company shaping the future of computing. The company’s vision extends beyond gaming and AI, encompassing fields like autonomous vehicles, metaverse, and high-performance computing.

Key Areas to Watch:

- Autonomous Driving: Nvidia’s Drive platform is a leading solution for autonomous vehicle development. Investors will be looking for progress in deployments and partnerships with car manufacturers.

- Metaverse: Nvidia’s Omniverse platform is designed to build and operate virtual worlds. The company’s involvement in this emerging technology will be a key area of focus.

- High-Performance Computing: Nvidia’s GPUs are used in scientific research, financial modeling, and other demanding applications. Updates on this segment will highlight its role in innovation and discovery.

Nvidia Earnings Time

Conclusion: A Quarter Filled with Opportunity

Nvidia’s earnings call is not just about numbers; it’s a pivotal moment to assess the company’s strategy, its position in the ever-evolving technology landscape, and its potential for future growth. By analyzing the key metrics and trends mentioned above, investors can gain valuable insights into Nvidia’s performance and its prospects for the future. So, stay tuned, the game is on.