Introduction

In the vibrant world of foreign exchange (forex) trading, the conversion rate reigns supreme as the pivotal metric that quantifies the success of a trader’s strategies. It serves as the beacon, guiding traders towards profitability and illuminating the path to financial freedom. But what exactly is the conversion rate in forex trading, and how can traders harness its power to reap bountiful rewards? In this comprehensive guide, we embark on an enlightening journey to unravel the intricacies of conversion rate and equip aspiring forex traders with the tools to maximize their profits through strategic implementation.

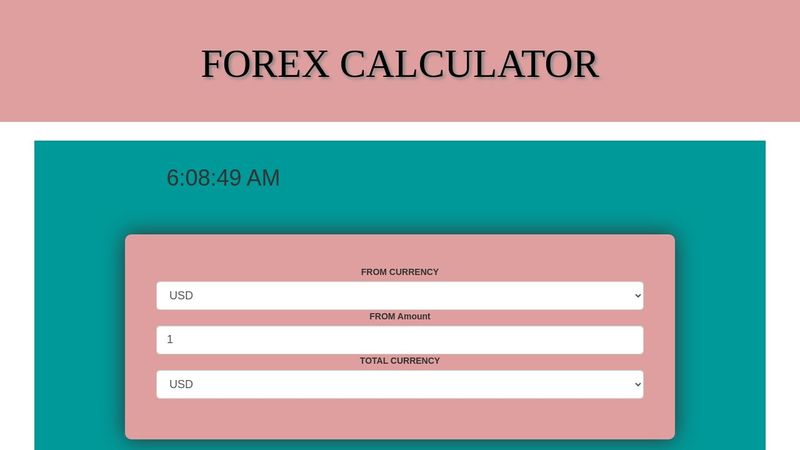

Image: codepen.io

Unveiling the Essence of Conversion Rate

In forex trading, the conversion rate refers to the ratio of profitable trades executed by a trader relative to the total number of trades undertaken over a specific period. It is a crucial performance indicator, reflecting the efficiency of a trader’s strategy and ability to identify and capitalize on market opportunities. A high conversion rate signifies a trader’s skill in consistently generating wins, while a low conversion rate suggests room for improvement in strategy and execution.

Factors Influencing Conversion Rate

The conversion rate in forex trading is a multi-faceted phenomenon influenced by a myriad of factors, including:

1. Trading Strategy

A meticulously crafted trading strategy serves as the cornerstone of a successful forex trader. It outlines the specific rules and criteria used to identify trading opportunities, determine entry and exit points, and manage risk. A well-defined strategy is essential for achieving a high conversion rate.

Image: s3.amazonaws.com

2. Technical Analysis

Technical analysis involves studying historical price data to identify patterns and trends that can inform trading decisions. By utilizing technical indicators and charting techniques, traders can gain valuable insights into market behavior and increase their probability of success.

3. Market Conditions

The overall market conditions, such as volatility, liquidity, and macroeconomic factors, significantly impact the conversion rate. Traders must adapt their strategies and trading style to the prevailing market environment to enhance their chances of profitability.

4. Risk Management

Effective risk management practices are paramount in Forex trading. Proper position sizing, stop-loss orders, and risk-reward ratios help traders mitigate losses and preserve capital, ultimately contributing to a positive conversion rate.

5. Psychological Factors

Emotional control and discipline play a crucial role in forex trading. Traders must overcome common psychological pitfalls, such as fear, greed, and overconfidence, to maintain a clear and rational mindset that promotes sound decision-making.

Strategies for Enhancing Conversion Rate

Aspiring forex traders can implement a multitude of strategies to elevate their conversion rates and achieve consistent profitability:

1. Refining Trading Strategy

Regularly review and refine your trading strategy based on past performance and market conditions. Embrace a data-driven approach, analyzing historical results to identify areas for improvement and optimization.

2. Mastering Technical Analysis

Enhance your technical analysis skills by learning and applying advanced trading indicators, charting techniques, and statistical modeling. Seek mentorship from experienced traders or enroll in educational courses to expand your analytical capabilities.

3. Adapting to Market Conditions

Remain attuned to the ever-changing market dynamics and adjust your trading style accordingly. By understanding the underlying factors driving market behavior, you can better align your strategies with the prevailing conditions.

4. Implementing Strict Risk Management

Establish strict risk management rules and adhere to them diligently. Calculate risk-reward ratios meticulously, determine optimal position sizes, and place stop-loss orders strategically to minimize losses and protect your capital.

5. Cultivating Psychological Discipline

Control your emotions and cultivate a disciplined trading mindset. Avoid impulsive decisions, and stick to your trading plan even during periods of volatility or emotional turbulence. Practice mindfulness techniques to stay focused and objective.

Conversion Rate In Forex Numerical

Conclusion

The conversion rate in forex trading serves as an indispensable metric for gauging the effectiveness of a trader’s strategies and execution. By comprehending the multifaceted nature of conversion rate and implementing the strategies outlined above, aspiring forex traders can elevate their performance, maximize their profits, and achieve financial freedom. Remember, the path to forex trading success is paved with knowledge, discipline, and an unwavering commitment to continuous improvement.