Introduction:

In the captivating and fast-paced world of forex trading, margin requirements play a pivotal role, safeguarding both the trader and the broker. It not only dictates the amount of leverage a trader can employ but also influences the risk profile of their trading strategies. Understanding these requirements is paramount for every aspiring forex trader to navigate the markets effectively and responsibly. This comprehensive guide will delve into the intricacies of forex margin requirements, empowering you with the knowledge to make informed trading decisions.

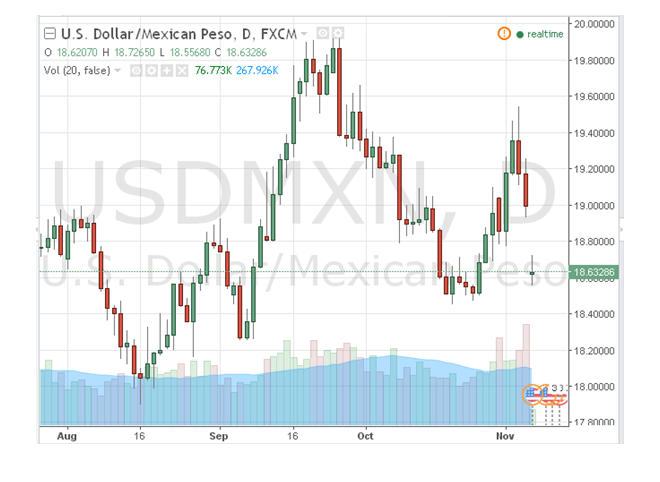

Image: www.forexnewsnow.com

What are Forex Margin Requirements?

Simply put, margin requirements are the minimum amount of capital a trader must maintain in their trading account to enter and hold a leveraged position. It is expressed as a percentage of the overall trade value. For instance, a 1% margin requirement implies that a trader needs to deposit $100 to open a position worth $10,000. Margin requirements vary depending on the currency pair being traded, the broker, and the leverage offered.

The Purpose of Margin Requirements:

Margin requirements serve a dual purpose:

- Protecting Brokers: They safeguard brokers against potential losses incurred due to adverse market movements. By requiring traders to deposit a certain amount of funds, brokers can mitigate the financial risks associated with leverage.

- Protecting Traders: Margin requirements prevent traders from overexposing their capital to undue risk. By limiting the leverage available, they help traders manage their potential losses and avoid catastrophic account liquidation.

How Forex Margin Requirements Work:

To fully comprehend how margin requirements operate, let’s consider an example. Suppose a trader desires to open a position in EUR/USD, worth $10,000, with a leverage of 100:1. In this scenario, the trader would need to maintain a margin of 1% of the trade value, which amounts to $100. This $100 would serve as collateral for the trade, ensuring that the broker is protected in the event of a market downturn.

Image: www.forex.academy

Impact of Leverage on Margin Requirements:

Leverage is a double-edged sword in forex trading. It magnifies potential profits but concurrently amplifies losses. The leverage offered by a broker will directly influence the margin requirement. Higher leverage leads to lower margin requirements, allowing traders to control larger positions with a smaller capital outlay. However, it also intensifies the risk exposure, which must be carefully considered before employing leverage.

Types of Margin Requirements:

In the forex market, there are several types of margin requirements a) Initial Margin, b) Maintenance Margin, and c) Margin Call. An Initial Margin refers to the minimum amount of funds required to open a position, while a Maintenance Margin is the minimum level of margin that must be maintained in the account throughout the trade’s life. A Margin Call is a demand from the broker requiring the trader to deposit additional funds when the account’s equity falls below the Maintenance Margin level.

Managing Forex Margin Requirements:

Prudent management of forex margin requirements is vital for successful trading. Traders should:

- Calculate Margin Requirements: Determine the margin requirement for each trade based on the leverage employed and the trade size.

- Maintain Adequate Margin: Ensure that sufficient margin is maintained in the trading account to cover potential losses and prevent Margin Calls.

- Monitor Margin Levels: Regularly check margin levels and adjust positions if necessary to avoid exceeding the Maintenance Margin threshold.

- Consider Risk Tolerance: Traders should align their margin usage with their personal risk tolerance and trading strategy.

Conclusion:

Forex margin requirements play a crucial role in the forex market, facilitating leverage while safeguarding both the broker and the trader. Understanding and managing these requirements are imperative for traders to navigate the complexities of forex trading and mitigate potential risks. By adhering to sound margin management practices, traders can effectively control their leverage, protect their capital, and maximize their trading potential.

Forex Margin Requirements

Additional Tips:

- Choose a broker with transparent and competitive margin requirements.

- Use a trading platform that provides real-time margin monitoring.

- Develop a trading plan that outlines your margin usage strategy.

- Conduct thorough research before executing any trade, especially when using high leverage.