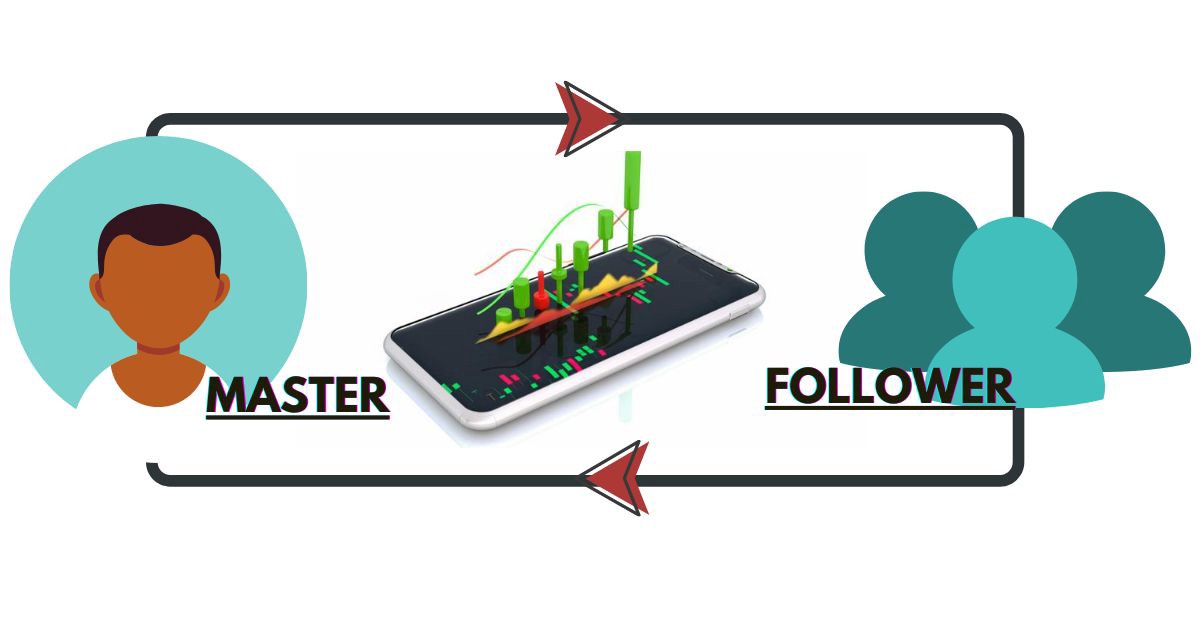

In the labyrinthine universe of financial trading, where countless strategies and techniques vie for attention, there shines a beacon of simplicity: copytrading. This innovative approach to trading offers a lifeline to aspiring investors, enabling them to harness the wisdom and success of seasoned professionals. Embark on this enriching journey as we unveil the enigmatic realm of copytrading, empowering you with the knowledge and confidence to navigate its promising waters.

Image: www.incomementorbox.com

What is Copytrading?

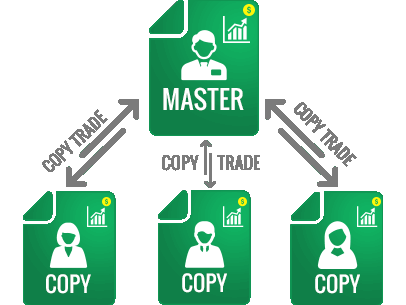

Simply put, copytrading is a groundbreaking technique that allows you to replicate the trades executed by experienced traders in real-time. Driven by a powerful blend of technology and human expertise, copytrading platforms bridge the gap between aspiring and accomplished traders. By mirroring the trades of proven performers, individuals can gain exposure to potentially lucrative opportunities without the arduous learning curve typically associated with financial markets.

Benefits of Copytrading

The allure of copytrading lies in its myriad benefits. Firstly, it provides access to the expertise of professional traders, enabling investors of all levels to leverage the knowledge and experience of market veterans. Secondly, copytrading simplifies the trading process, allowing individuals to trade even if they lack prior knowledge or time to monitor markets constantly. Furthermore, it enhances risk management, as investors can spread their risk across multiple trades executed by different traders.

Who is Copytrading Ideal For?

Copytrading proves to be an ideal solution for a diverse range of individuals. Beginners with limited trading experience can harness the platform to embark on their trading journey with the guidance of experts. Seasoned traders seeking to diversify their portfolios can explore copytrading as a means to tap into new strategies and potentially lucrative opportunities. Additionally, individuals seeking passive income streams may find copytrading to be an attractive option.

Image: www.fullertonmarkets.com

How to Choose a Copytrading Provider

Selecting a reputable copytrading provider is paramount for a seamless and successful experience. Consider the provider’s track record, fees, transparency, and customer support. Thoroughly evaluate their trading strategies, risk management policies, and trader selection criteria to ensure they align with your financial objectives and risk tolerance.

Tips for Effective Copytrading

To maximize your copytrading endeavors, consider these invaluable tips:

- Diversify your portfolio by following multiple traders to mitigate risk.

- Monitor your trades regularly to ensure they remain aligned with your risk appetite.

- Avoid emotional trading and let logic guide your decision-making.

- Utilize stop-loss orders to limit potential losses.

- Stay updated with market trends and news to make informed choices.

What Is Copytrading

Conclusion

Copytrading has emerged as a game-changing solution for investors of all backgrounds, offering a unique blend of simplicity, expertise, and risk mitigation. If you are an aspiring trader or an experienced investor seeking to augment your portfolio, copytrading merits your exploration. By embracing this innovative technique, you can tap into the wisdom of seasoned traders and empower yourself with the knowledge and confidence to navigate the financial markets successfully. Remember, the world of copytrading beckons, offering a path to financial empowerment.