In the realm of currency trading, understanding the behavior and trends of major forex pairs is a crucial skill that can differentiate between success and failure.

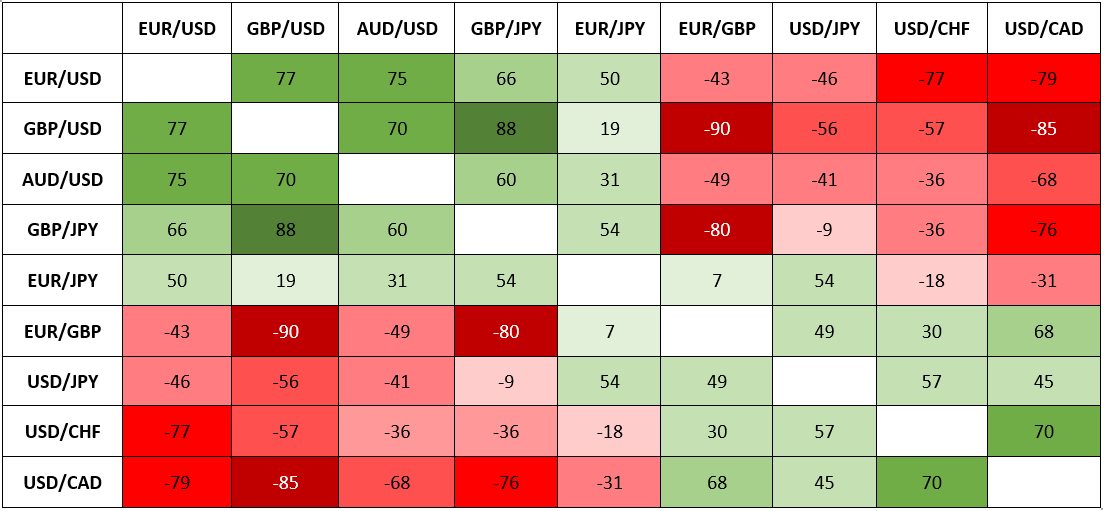

Image: www.cmcmarkets.com

By studying historical data, identifying patterns, and analyzing market conditions, traders can make informed decisions that optimize their profit potential. This comprehensive guide will delve into the intricacies of charting major forex pairs, equipping you with the knowledge and tools to navigate the currency markets with confidence.

Understanding Forex Charts

A forex chart is a graphical representation of the price movements of a currency pair over a specified time period. Each point on the chart reflects the exchange rate between the two currencies at that particular moment.

The vertical axis of the chart represents the price, while the horizontal axis represents time. Forex charts come in different types, including line charts, bar charts, and candlestick charts, each offering different perspectives on price action.

Major Forex Pairs

The forex market is primarily driven by the trading of eight currency pairs, known collectively as major forex pairs. These pairs are:

- EUR/USD (Euro / US Dollar)

- USD/JPY (US Dollar / Japanese Yen)

- GBP/USD (British Pound / US Dollar)

- USD/CHF (US Dollar / Swiss Franc)

- USD/CAD (US Dollar / Canadian Dollar)

- AUD/USD (Australian Dollar / US Dollar)

- NZD/USD (New Zealand Dollar / US Dollar)

Charting Major Forex Pairs

Charting major forex pairs involves analyzing various aspects of the market, including:

- Trend Analysis: Identifying the overall direction of the market, whether bullish or bearish.

- Support and Resistance Levels: Identifying price levels where price action tends to pause or reverse.

- Moving Averages: Plotting the average price of a currency pair over a defined period, smoothing out price fluctuations.

- Volume and Volatility: Analyzing trading volume and volatility to gauge market sentiment and expected movements.

- Technical Indicators: Utilizing mathematical formulas to identify potential trading opportunities.

By combining these analyses, traders can create a comprehensive picture of the forex market and make informed trading decisions.

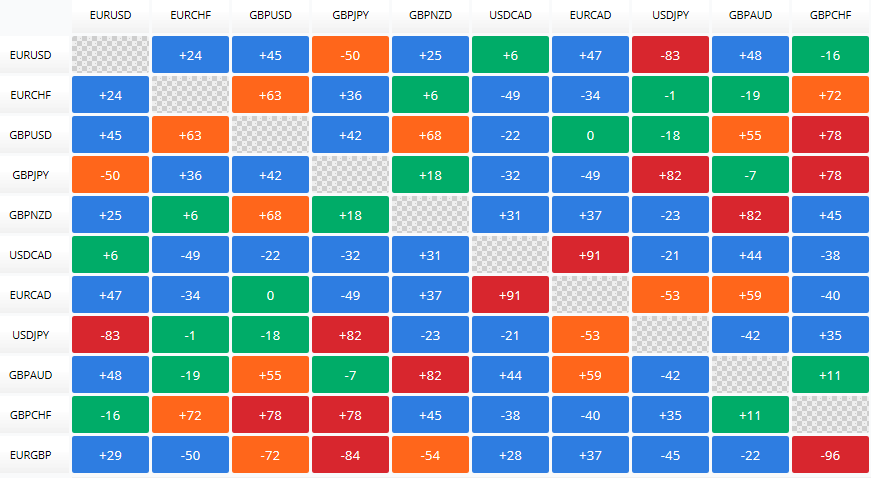

Image: atozmarkets.com

Tips and Expert Advice

Here are some helpful tips and expert advice for charting major forex pairs:

- Utilize multiple timeframes: Analyze charts from different timeframes to gain a more comprehensive view of market dynamics.

- Understand the economic factors: Stay updated on economic news and events that may impact currency values.

- Risk management is crucial: Determine appropriate stop-loss and take-profit levels to manage risks and protect profits.

- Emotional control is key: Stay disciplined and avoid trading based on emotions or impulses.

- Seek mentorship and education: Learn from experienced traders and continuously enhance your skills.

By adhering to these recommendations, you can improve your chances of success in the forex market.

Frequently Asked Questions

Q: What is the best way to learn forex charting?

A: Practice regularly with historical data, study technical analysis, and seek mentorship from experienced traders.

Q: How do I choose the right trading strategy?

A: Consider your risk tolerance, trading style, and available capital when selecting a strategy that aligns with your objectives.

Q: Is it possible to earn a consistent profit from forex trading?

A: While consistent profits are achievable, they require dedication, discipline, and consistent application of sound trading principles.

Charting The Major Forex Pairs Focus On Major Currencies Pdf

Conclusion

Charting major forex pairs is an essential skill for currency traders. By mastering the art of technical analysis, understanding the nuances of each currency pair, and implementing sound trading strategies, you can harness the power of market movements and unlock profit potential in the forex markets.

Are you eager to embark on the exciting journey of Forex trading? Embrace the knowledge shared in this guide, dedicate yourself to learning, and stay committed to your goals. The rewards of success can be substantial for those who possess the dedication and perseverance to navigate the forex market.