Unlocking the Potential of Forex in Canada

For individuals in Canada, navigating financial responsibilities such as EMIs (equated monthly installments) can be a prudent move. As a result, exploring unconventional methods to facilitate these payments, like forex, has gained traction. Forex, short for foreign exchange, involves the trading of various global currencies. Let’s delve into the intricacies of using forex for EMI payments in Canada, examining its benefits, potential risks, and legal implications.

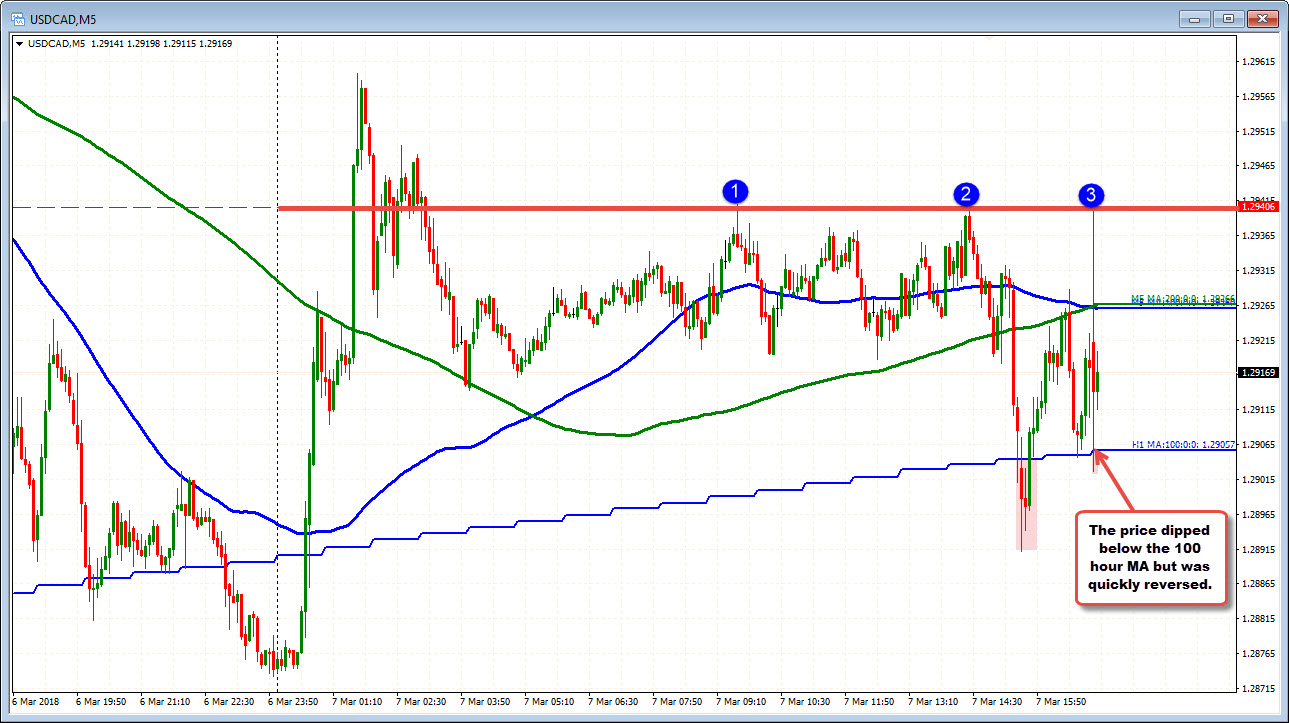

Image: mt4forexrobotreview.blogspot.com

How Forex Functions for EMI Payments

In essence, forex trading involves converting one currency into another at prevailing market rates. When leveraging forex to make EMI payments, individuals exchange their preferred currency into the currency required for the EMI payment, often the Canadian dollar. By capitalizing on favorable exchange rates, this approach can potentially result in cost savings compared to traditional methods.

For instance, if an individual owes an EMI of 1,000 Canadian dollars but possesses US dollars, they can convert their US dollars into Canadian dollars through a forex broker. If the exchange rate at that moment is 1.3 US dollars to 1 Canadian dollar, they would require approximately 769 US dollars to fulfill their EMI obligation, potentially saving on transfer fees and currency exchange markups.

Advantages of Forex for EMI Payments:

-

Potential Savings: Currency fluctuations can present opportunities for cost-effective EMI payments.

-

Flexibility: Forex allows for payments in various currencies, catering to diverse financial obligations.

-

Convenience: Online forex platforms provide a convenient and accessible means of currency exchange.

Risks and Considerations:

-

Market Volatility: Forex markets are inherently volatile, and adverse currency fluctuations could impact payment amounts.

-

Transaction Fees: Forex brokers typically charge transaction fees, which can affect overall costs.

-

Legal Compliance: Utilizing forex for EMI payments requires adherence to Canadian foreign exchange regulations.

Image: tradefxp.com

Latest Trends and Legal Implications

In Canada, forex trading is regulated by the Investment Industry Regulatory Organization of Canada (IIROC). Individuals engaging in forex trading for EMI payments must ensure compliance with IIROC guidelines. Additionally, reporting foreign exchange transactions exceeding certain thresholds to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is mandatory.

Tips and Expert Advice

-

Monitor Exchange Rates: Staying abreast of currency fluctuations can help identify favorable exchange rates for EMI payments.

-

Utilize a Reputable Forex Broker: Choose a licensed and regulated forex broker to ensure transparency and security.

-

Consider Currency Hedging: Hedging strategies can mitigate currency risks and stabilize payment amounts.

FAQ

Q: Is using forex for EMI payments legal in Canada?

A: Yes, as long as individuals adhere to Canadian foreign exchange regulations.

Q: What are the implications of not reporting forex transactions to FINTRAC?

A: Failure to report transactions exceeding the stipulated thresholds can result in fines or penalties.

Can We Use Forex For Emi In Canada

Conclusion

While forex offers potential benefits for EMI payments in Canada, it is crucial to proceed with caution and thorough research. Understanding market dynamics, choosing a reputable forex broker, and adhering to legal requirements are essential for optimizing this approach. By embracing a strategic and informed approach, individuals can harness the power of forex to navigate their financial obligations effectively.

So, are you ready to explore the potential of forex for EMI payments in Canada? Join the conversation and share your thoughts and experiences.