Introduction

Image: www.forex.academy

In today’s interconnected world, international travel and business ventures are more common than ever before. Managing finances across borders can be daunting, with currency exchange rates fluctuating constantly. The Axis Multi Currency Card offers an innovative solution, allowing you to navigate the complexities of currency exchange with ease. By delving into the capabilities of this unique financial tool, this comprehensive guide will empower you to unlock the potential of foreign exchange (forex) and enhance your global financial experiences.

Forex Basics: Empowering Global Transactions

Forex, short for foreign exchange, refers to the conversion of one currency into another. Whether you’re purchasing souvenirs on an overseas trip or conducting cross-border business, understanding forex fundamentals is crucial. Currency exchange rates, influenced by various economic factors, determine the value of your money in foreign markets.

The Axis Multi Currency Card: Your Global Financial Companion

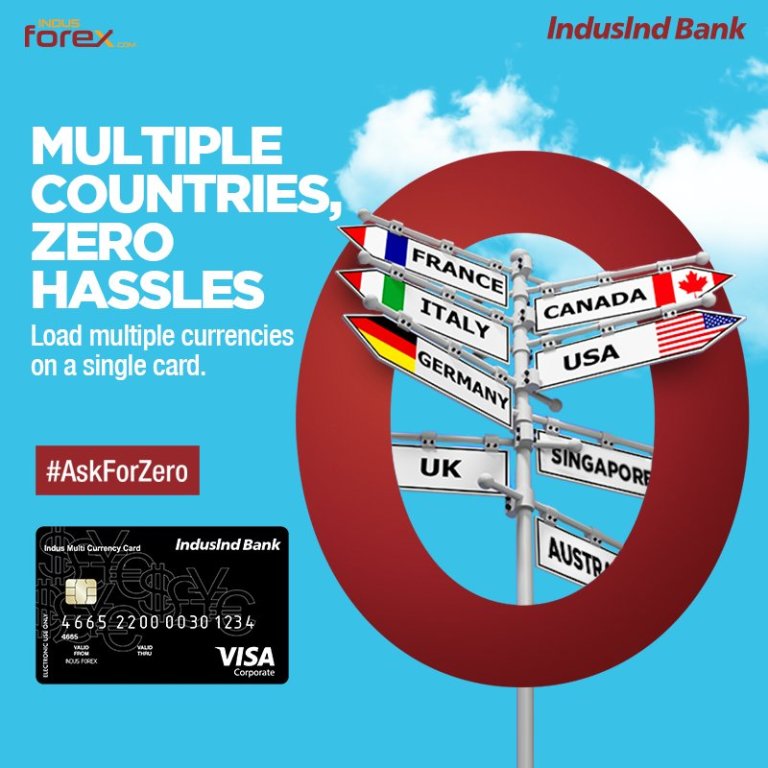

The Axis Multi Currency Card is specially designed to simplify forex transactions for travelers and business professionals. By maintaining multiple currency balances on a single card, it eliminates the need for carrying bulky cash or exchanging currency at unfavorable rates. The card’s real-time exchange rate feature ensures you receive competitive rates every time you make a purchase or withdraw cash abroad.

Unlocking the Benefits of the Axis Multi Currency Card

This innovative card offers a myriad of advantages that make international financial transactions effortless and cost-effective:

-

Convenience: Carry multiple currencies on a single card, eliminating the hassle of carrying cash or visiting multiple currency exchange bureaus.

-

Competitive Exchange Rates: Access real-time exchange rates to ensure optimal value for your currency conversions.

-

Zero Currency Conversion Fee: Enjoy savings with no additional charges for currency conversion, maximizing the value of your funds.

-

Global Acceptance: The Axis Multi Currency Card is accepted worldwide, providing unparalleled convenience for your global endeavors.

-

Enhanced Security Features: Safeguard your finances with advanced security measures, including chip and pin technology and fraud protection.

Navigating Forex with the Axis Multi Currency Card

To make the most of the Axis Multi Currency Card’s capabilities, understanding the basics of forex is essential. Here are a few tips to guide you:

-

Choose the Right Currency: Research the currencies of the countries you’ll be visiting to identify which ones you’ll need on your card.

-

Monitor Currency Rates: Keep an eye on currency fluctuations to make informed decisions about when to exchange your funds.

-

Use the Card Wisely: Limit large cash withdrawals or purchases that may incur additional fees.

Expert Insights: Maximizing Value with the Axis Multi Currency Card

To optimize your experience with the Axis Multi Currency Card, veteran travelers and financial professionals offer their expert insights:

-

Plan Ahead: Load multiple currencies onto your card before your trip to avoid last-minute currency exchange needs.

-

Be Aware of Transaction Limits: Familiarize yourself with the card’s withdrawal and spending limits to ensure you have sufficient funds available.

-

Consider Travel Insurance: Protect your financial well-being during your travels with comprehensive travel insurance.

Conclusion

The Axis Multi Currency Card is an indispensable tool for individuals seeking seamless and cost-effective international financial transactions. By unlocking the power of forex and leveraging the card’s unparalleled features, you can navigate global markets confidently. Whether you’re a seasoned traveler or a business professional venturing abroad, the Axis Multi Currency Card empowers you to manage finances effortlessly, embrace new experiences, and maximize your global financial potential.

Image: onlineforexcard.wordpress.com

Can We Do Currency Forex With Axis Multi Currency Card