Introduction

Image: www.loomsolar.com

In this era of seamless global connectivity, travelers seek convenience and security in managing their finances abroad. The HDFC Forex Card has emerged as a sought-after solution, promising ease of access to foreign currency. However, navigating the intricacies of using this card in Indian ATMs can be a perplexing task. Fear not! This comprehensive guide will unravel the mysteries and empower you with the knowledge to utilize your HDFC Forex Card in Indian ATMs with ease.

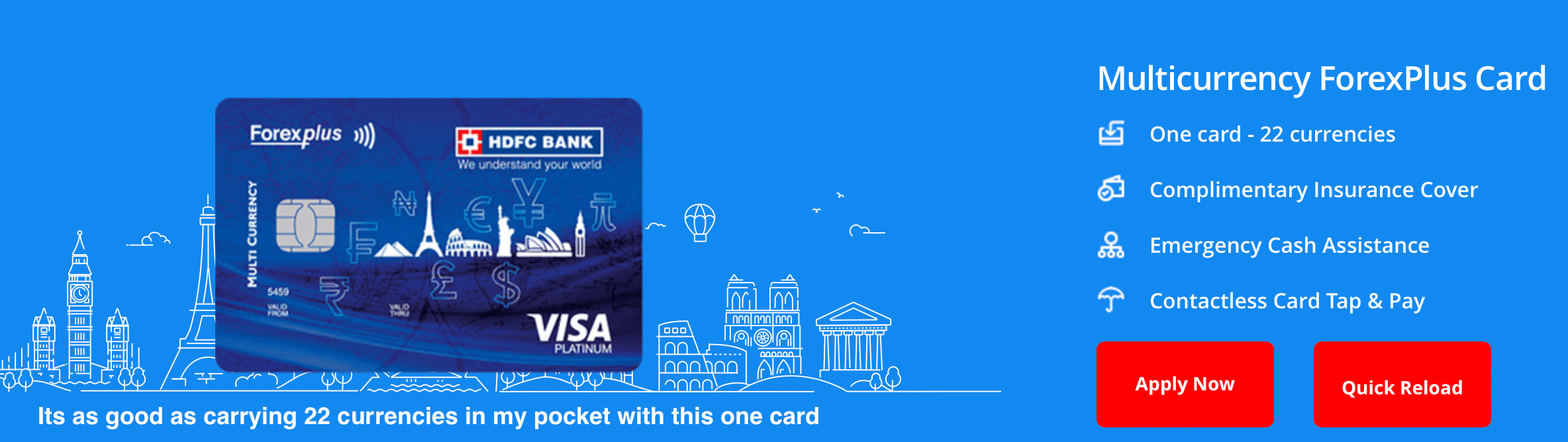

Understanding the Basics: HDFC Forex Card

An HDFC Forex Card is a prepaid card loaded with foreign currency, allowing you to make purchases and withdraw cash abroad without carrying physical cash. It offers competitive exchange rates and protects against currency fluctuations, making it a preferred choice for international travelers.

Can I Use My HDFC Forex Card in Indian ATMs? Yes, You Can!

The answer is a resounding yes! You can use your HDFC Forex Card in ATMs across India to withdraw Indian currency. This added functionality provides immense convenience, allowing you to seamlessly access your funds wherever you are in the country.

Steps to Use Your HDFC Forex Card in Indian ATMs

-

Locate an ATM: Choose an ATM that accepts international cards, such as those of Visa or MasterCard.

-

Insert Your Card: Insert your HDFC Forex Card into the ATM slot.

-

Select Language: Opt for the preferred language on the ATM screen.

-

Enter PIN: Enter your HDFC Forex Card’s PIN number.

-

Select Withdrawal: Choose the “Withdrawal” option.

-

Enter Amount: Key in the amount of Indian currency you wish to withdraw.

-

Confirm Transaction: Verify the details and confirm the transaction.

-

Collect Cash: Once the transaction is complete, collect your withdrawn Indian currency from the ATM.

Important Considerations

-

Transaction Fees: Some ATMs may charge a transaction fee for withdrawals. It is advisable to check with your bank or the ATM provider beforehand.

-

Exchange Rate: The exchange rate applied to the withdrawal will be the prevailing HDFC rate on the transaction date.

-

Daily Withdrawal Limit: HDFC may impose daily withdrawal limits for Forex Cards. Verify the specific limits applicable to your card before using it.

Expert Insights

“The HDFC Forex Card is a valuable tool for travelers who need a secure andconvenient way to access funds abroad,” explains financial expert Mr. Ajay Maheshwari. “Its availability for use in Indian ATMs is a significant advantage, allowing travelers to easily replenish their local currency.”

Actionable Tips

-

Plan Ahead: Inform HDFC Bank about your travel plans to avoid any potential issues with your card’s usage.

-

Be Aware of Charges: Check with your bank or ATM provider to ascertain any applicable transaction fees.

-

Carry Alternate Payment Options: Consider bringing a small amount of local currency or a backup debit or credit card for contingencies.

Conclusion

Using your HDFC Forex Card in Indian ATMs is not only possible but also incredibly convenient. By following these simple steps and adhering to the important considerations, you can confidently access Indian currency during your travels. Embrace the ease of international finance and make the most of your overseas adventures with the HDFC Forex Card.

Image: windsorwhock2002.blogspot.com

Can I Use My Hdfc Forex Card In Indian Atm