Forex Cards: A Lifeline for International Travelers

Venturing abroad and encountering foreign currencies can be a daunting experience. The need for a reliable and convenient way to manage your finances while traveling led to the introduction of forex cards. These prepaid cards are designed specifically for international payments, offering a secure and cost-effective solution.

Image: fintra.co.in

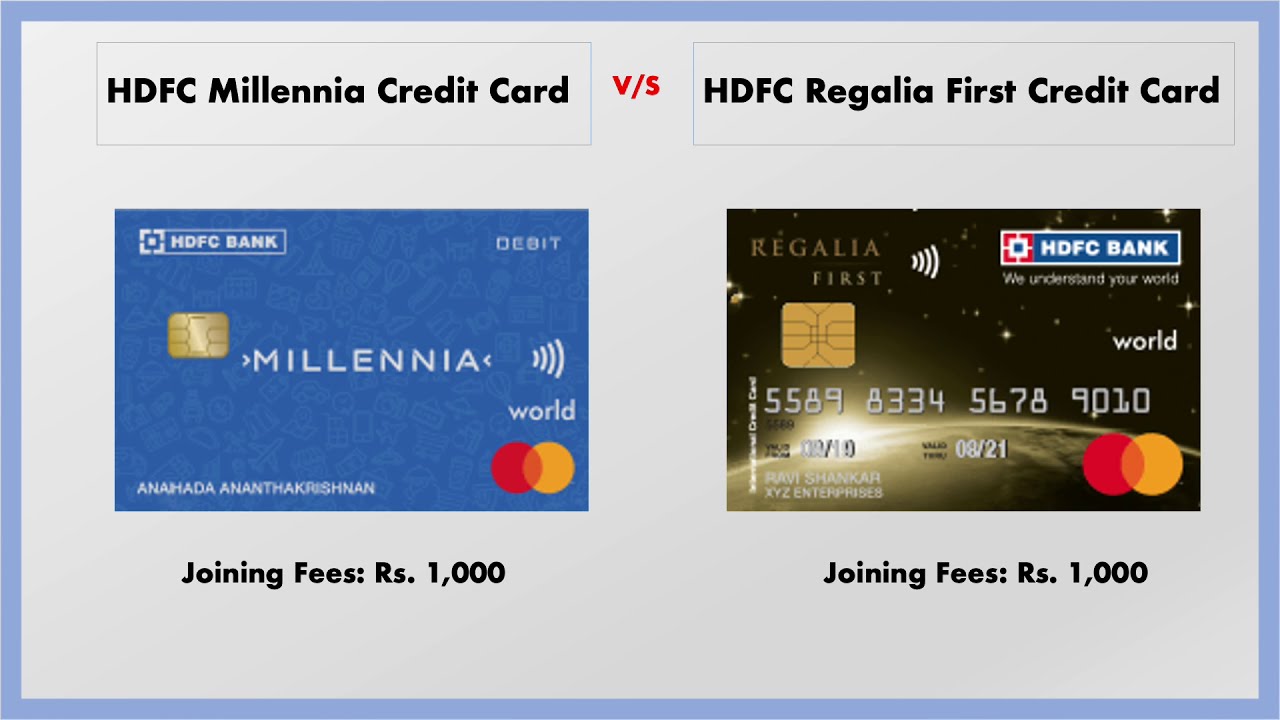

HDFC Regalia First is a premium credit card from India that has gained immense popularity due to its wide range of benefits and features. While it primarily serves as a powerful credit card, a common question among users is whether it can be used as a forex card.

HDFC Regalia First Card: The Dual Nature

Fortunately, the answer is yes! HDFC Regalia First cardholders can enjoy the added convenience of using their cards as forex cards when traveling abroad. This feature makes it a versatile financial tool that caters to the needs of international travelers.

Advantages of Using HDFC Regalia First as a Forex Card

- Competitive Exchange Rates: HDFC Bank offers competitive exchange rates for currency conversion, ensuring that you get the most value for your money.

- Zero Foreign Currency Markup Fee: Unlike many other forex cards, HDFC Regalia First does not charge any additional fees for transactions made in foreign currencies.

- Global Acceptance: The card is widely accepted at ATMs, POS terminals, and online merchants worldwide, providing you with easy access to your funds wherever you go.

- Convenience: Carrying cash while traveling abroad can be risky and inconvenient. With HDFC Regalia First, you can simply use your card to make payments and avoid the hassle of exchanging currency.

- Enhanced Security: The card is equipped with advanced security features to protect you from fraudulent transactions, giving you peace of mind while you travel.

How to Use HDFC Regalia First as a Forex Card

- Preload Your Card: Visit your nearest HDFC Bank branch or use the mobile banking app to load the funds you need for your trip.

- Activate International Usage: Before traveling abroad, call HDFC Bank’s customer service to activate international usage on your card.

- Choose Your Currency: When making a transaction in a foreign country, select the local currency at the POS terminal or ATM.

- Enjoy Global Convenience: Use your HDFC Regalia First card as you would a normal credit card, making payments and withdrawing cash as needed.

Image: www.youtube.com

Insider Tips and Expert Advice

- Notify HDFC Bank About Your Travel Plans: Inform the bank about your travel dates and destinations to prevent your card from being blocked due to suspicious activity.

- Carry Multiple Payment Modes: While HDFC Regalia First is a reliable forex card, it’s always a good idea to have a backup payment method, such as a secondary credit card or cash.

- Keep Track of Your Expenses: Regular monitoring of your card balance is crucial to avoid overspending or exceeding your credit limit.

- Monitor Exchange Rates: Stay updated on foreign exchange rates to ensure that you’re getting the most value for your money.

- Consider Insurance: Travel insurance can provide additional protection against unforeseen circumstances, such as lost cards or medical emergencies.

Frequently Asked Questions (FAQ)

Q: Is there a daily or monthly limit for using HDFC Regalia First as a forex card?

A: Yes, there are daily and monthly limits set by HDFC Bank for forex transactions. These limits vary depending on your card tier and account type.

Q: Can I withdraw cash using HDFC Regalia First in foreign countries?

A: Yes, you can withdraw cash from ATMs abroad using your HDFC Regalia First card. However, there may be fees associated with ATM withdrawals.

Q: What is the process to report a lost or stolen HDFC Regalia First card while traveling abroad?

A: In case of a lost or stolen card, immediately call HDFC Bank’s customer service hotline and block your card. You can also file a police report and request a replacement card from the bank.

Can Hdfc Regalia First Card Use As Forex Card

Conclusion

HDFC Regalia First card is not only a powerful credit card but also a convenient forex card solution. With its competitive exchange rates, zero foreign currency markup fees, and global acceptance, it provides an easy and secure way to manage your finances while traveling abroad.

Are you planning an international trip? Consider unlocking the benefits of HDFC Regalia First card and enjoy a hassle-free financial experience on your next adventure.