Many aspects of forex trading might seem enigmatic, including the notion of a recognized capital markup (RCM). Can an RCM be claimed in forex trading, one might wonder? This article will clarify the RCM idea and its applicability to forex trading, providing answers to your burning questions and arming you with valuable insights.

Image: forexwikitrading.com

RCM in Forex Trading Explained

Forex brokers provide traders with access to financial markets, using a variety of account types, including retail and professional accounts. Retail accounts are designed for individual traders, while professional accounts cater to high-net-worth individuals and entities.

According to the European Securities and Markets Authority (ESMA), professional traders in the European Economic Area (EEA) are eligible to claim RCM. RCM refers to the difference between the price at which a broker buys an instrument and the price at which it is sold to a client. In other words, it is the broker’s markup on the spread.

However, as retail forex traders are not considered professional traders under ESMA guidelines, they are not eligible to claim RCM.

Latest Trends and Future Developments

Regulators worldwide are continuously reviewing and updating their financial market regulations, including those governing forex trading. The future of RCM claims in forex trading may depend on regulatory changes and the evolution of industry practices.

One notable development is the Financial Conduct Authority’s (FCA) proposal to ban retail traders from using leverage in CFD and Forex trading. If implemented, this could significantly impact the profitability of forex trading for non-professional traders, and may prompt some to explore alternative trading strategies, instruments, or jurisdictions.

Tips and Expert Advice

Navigating the forex market as a retail trader requires a prudent approach, sound money management, and a comprehensive understanding of the risks involved. Here are a few tips to guide your trading journey:

- Conduct Thorough Research: Before venturing into forex trading, educate yourself about the market, different trading strategies, and risk management techniques.

- Start Small: Begin trading with a small amount of capital that you can afford to lose. As your knowledge and experience grow, you can gradually increase your investment.

- Use a Demo Account: Reputable forex brokers often provide demo accounts that allow you to practice trading in a simulated environment without risking real funds.

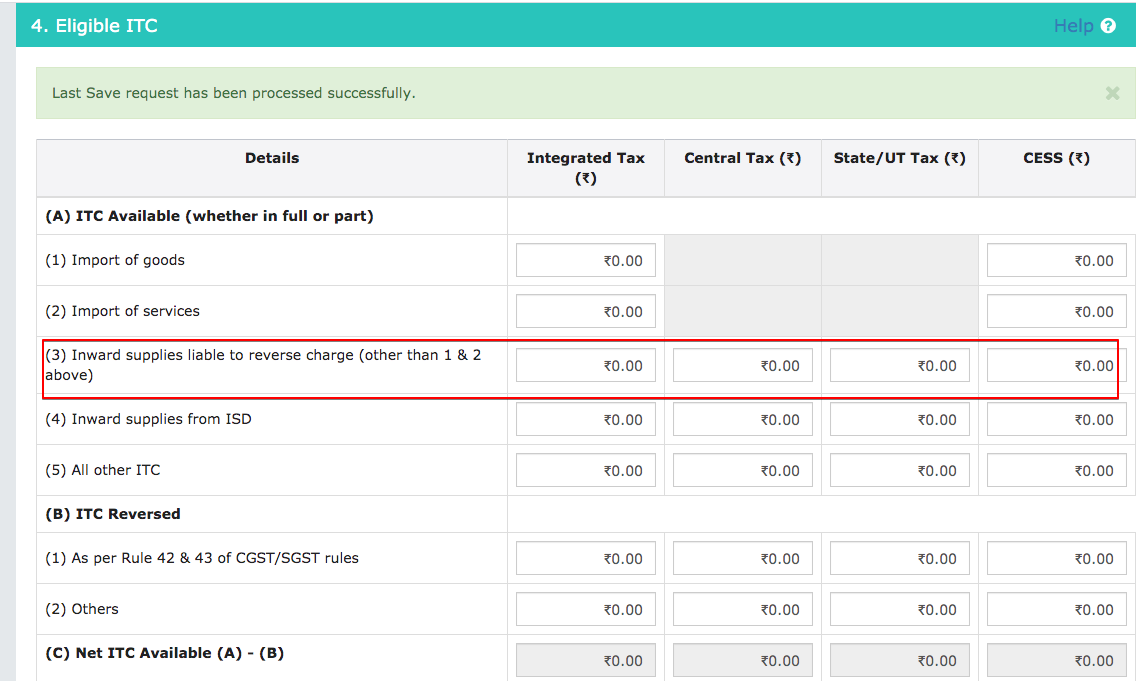

Image: www.consultease.com

Frequently Asked Questions (FAQ)

Q: Are retail forex traders required to pay taxes on their profits?

A: Tax laws vary by country. Consult a local tax professional for guidance on the tax implications of forex trading in your jurisdiction.

Q: What are the risks of forex trading?

A: Forex trading involves significant risk. The value of currencies can fluctuate rapidly, potentially resulting in substantial losses.

Conclusion

Understanding the concept of recognized capital markup (RCM) and its relevance in forex trading is crucial for any trader. While retail traders in the European Economic Area are not eligible to claim RCM, they can still engage in responsible and informed forex trading by adhering to sound practices and utilizing available resources.

Cai I Claim Rcm In Forex Trading

Interested in a Forex Journey?

Join our exclusive online community, connect with fellow traders, share insights, and access valuable resources to empower your forex trading endeavours. Click below to learn more: