Introduction

Navigating the world of foreign exchange can be a daunting task, especially when managing your finances. As a frequent traveler, you may have opted for a forex card, like those offered by BookMyForex and Axis Bank, to streamline your currency exchange needs. To ensure a seamless travel experience, monitoring your forex card balance is crucial. This article provides a comprehensive guide on effectively checking the balance of your BookMyForex and Axis Bank forex cards, empowering you to stay informed and in control of your finances while abroad.

Image: www.forex.academy

Checking Your BookMyForex Forex Card Balance

Checking your BookMyForex forex card balance is a straightforward process that can be completed within minutes. Here’s how you can do it:

-

Visit the BookMyForex Website: Navigate to the BookMyForex website (https://www.bookmyforex.com/) and log in to your account.

-

Go to ‘Manage Card’: Once you have logged in, select the ‘Manage Card’ option from the menu bar.

-

View Your Balance: On the ‘Manage Card’ page, you will find a section that displays your current forex card balance. You can also view a detailed transaction history of your forex card.

-

Set up SMS/Email Alerts: For real-time balance updates, consider setting up SMS or email alerts. You can do this by clicking on the ‘Settings’ tab on the ‘Manage Card’ page.

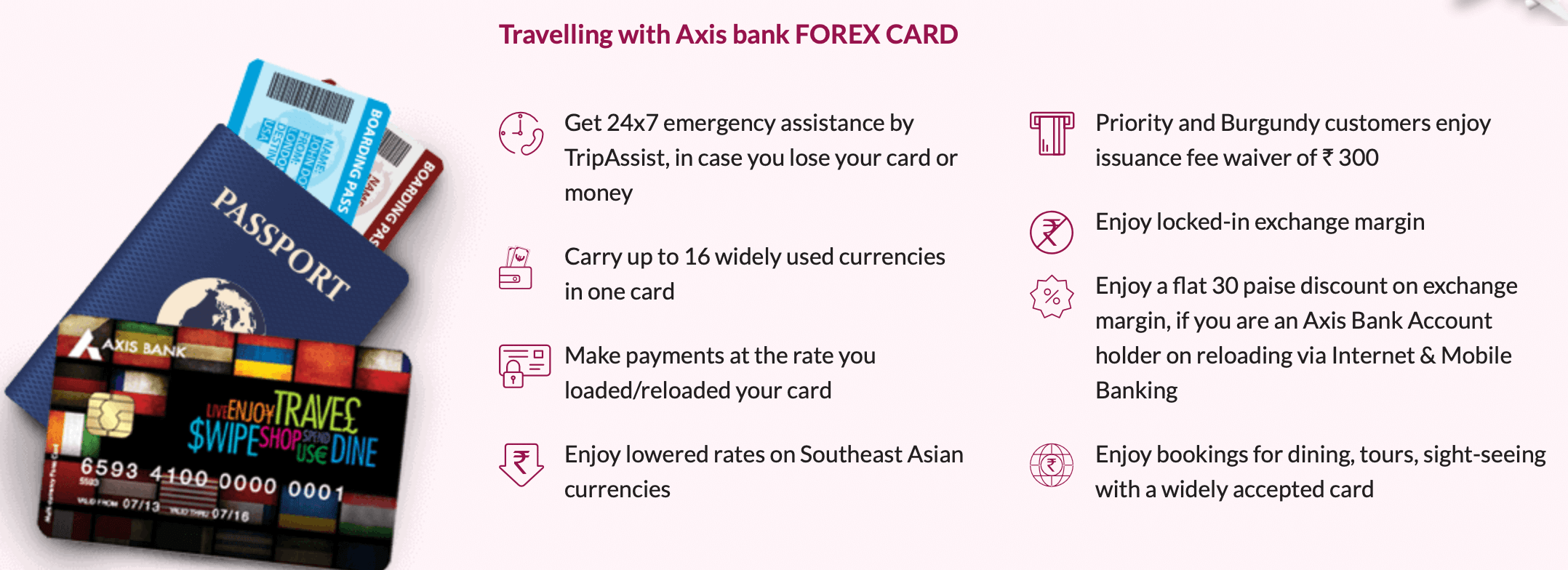

Checking Your Axis Bank Forex Card Balance

If you hold an Axis Bank forex card, you can easily check your balance using the following methods:

-

NetBanking: Log in to your Axis Bank NetBanking account, navigate to the ‘Cards’ section, and select your forex card to view the balance.

-

Mobile Banking Application: Download the Axis Bank mobile banking application on your smartphone. Once you have logged in, select the ‘Forex Card’ option to check your balance.

-

SMS Banking: You can also get your forex card balance via SMS. Send an SMS to ‘5676782’ in the following format: FB

Last four digits of your Axis Bank forex card number. -

Customer Care: If you face any difficulties or require immediate assistance, you can reach out to Axis Bank’s customer care at 1860-419-5555 or 1800-103-5555.

-

ATM: Visit any Axis Bank ATM and insert your forex card. Enter your PIN and select the ‘Balance Inquiry’ option to view your card balance.

Importance of Monitoring Your Forex Card Balance

Checking your forex card balance regularly is essential for several reasons:

-

Avoid Overspending: Keep track of your expenses to avoid overspending and stay within your budget.

-

Stay Informed: Monitor your balance to ensure that there are no unauthorized transactions or suspicious activities.

-

Plan Ahead: Knowing your balance helps you plan your expenses and currency requirements effectively.

-

Top-Up as Needed: Stay informed about your balance to top up your forex card when necessary, ensuring you have sufficient funds for your travel expenses.

Image: windsorwhock2002.blogspot.com

Tips for Enhanced Forex Card Management

-

Set Balance Alerts: Set up SMS or email alerts to receive real-time notifications when your balance reaches a certain threshold.

-

Keep Physical Records: Maintain a physical record of your transactions, including receipts and currency exchange rates, for reference.

-

Stay Updated: Regularly check the BookMyForex or Axis Bank websites for any updates, promotions, or changes in forex rates.

-

Utilize Credit Cards in Conjunction: Consider using your credit cards in conjunction with your forex card for flexibility and convenience.

-

Avoid Dynamic Currency Conversion: Be mindful of dynamic currency conversion and opt for local currency transactions whenever possible to avoid unfavorable exchange rates.

Bookmyforex And Axis Bank Forex Card Where To Check Balance

Conclusion

Monitoring your BookMyForex or Axis Bank forex card balance is crucial for hassle-free travel. By following the steps outlined in this guide, you can easily check your balance and gain peace of mind while abroad. Remember to check your balance regularly, stay informed about your expenses, and take advantage of the various features offered by your forex card issuer to maximize its benefits. With proper management, your forex card can be an indispensable tool for managing your finances abroad, ensuring a smooth and enjoyable travel experience.