Begin the Forex Expedition

Embark on an enthralling odyssey into the captivating realm of Forex trading, where fortunes are forged, and legends are made. The Forex Factory, a veritable treasure trove of knowledge, awaits your exploration, unveiling the mysteries of currency exchange and the strategies that have empowered traders to conquer this lucrative market.

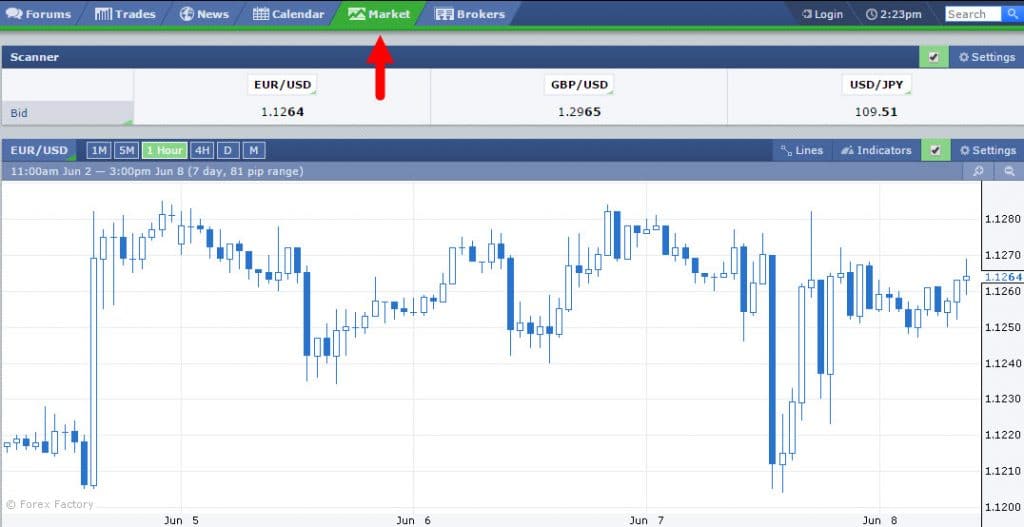

Image: forexrobotranking2.blogspot.com

Step into the shoes of seasoned Forex traders and discover the secrets that have propelled them to newfound wealth. Witness their mastery of technical analysis, as they decipher intricate market patterns and identify hidden opportunities. Delve into the intricacies of fundamental analysis, as they navigate the global economic landscape, anticipating market shifts with uncanny precision.

Unraveling the Best Trading Strategies

Within the vast expanse of Forex strategies, a select few have risen to unparalleled prominence, becoming the cornerstone of successful traders worldwide. Join us in our quest to unveil these time-tested tactics, meticulously crafted to maximize your trading potential and lead you towards the path of financial freedom.

1. The Moving Average Crossover

As its name suggests, this strategy revolves around identifying when moving averages, a staple of technical analysis, intersect. Traders monitor short-term and long-term moving averages, seeking the perfect moment to buy or sell as they cross paths. This strategy’s simplicity and effectiveness have made it a timeless favorite among traders of all levels.

2. The Relative Strength Index (RSI)

Traders rely on the RSI to gauge whether a currency pair is overbought or oversold. By analyzing price momentum, the RSI indicates when a market has reached unsustainable extremes, providing valuable insights for determining potential reversals and entering opportune trades. Its versatility makes it applicable to a wide range of trading timeframes.

3. The Bollinger Bands

In the world of Forex trading, the Bollinger Bands reign supreme as a measure of market volatility. These bands, comprised of three lines, serve as visual guides, highlighting areas of high and low volatility. Skilled traders use these bands to identify potential trend reversals and pinpoint ideal entry and exit points.

4. The Fibonacci Retracement

Based on the enigmatic Fibonacci sequence, this strategy guides traders in identifying crucial support and resistance levels. These levels, once identified, serve as guideposts, predicting potential price movements and enabling traders to anticipate potential trading opportunities. Its mathematical elegance and historical accuracy have made it an indispensable tool for both novice and seasoned traders.

5. The Ichimoku Kinko Hyo

Translating to “one glance equilibrium chart,” the Ichimoku Kinko Hyo is a comprehensive trading strategy that harnesses multiple technical indicators to provide a holistic market assessment. Its diverse components, including cloud formations and trend-defining lines, offer a comprehensive representation of price action, facilitating informed trading decisions.

Tactics from the Trenches

Beyond these core strategies, seasoned traders have refined their craft, developing innovative approaches that have yielded exceptional results. Join us as we delve into these specialized tactics:

1. The Price Action Strategy

This strategy disregards technical indicators, instead focusing on raw price movements. Traders meticulously study candlestick patterns and chart formations, seeking to decipher the underlying market sentiment and anticipate future price behavior. This approach requires immense patience and discipline but offers potentially lucrative rewards.

2. The Scalping Strategy

For those seeking rapid profits, scalping offers an exhilarating opportunity. This strategy involves entering and exiting trades in rapid succession, capitalizing on small price fluctuations. While the profits may be incremental, the cumulative effect can be substantial, especially for traders with a keen eye for market movements.

3. The News Trading Strategy

News events have a profound impact on the Forex market, creating windows of high volatility. News traders capitalize on these moments, analyzing economic data releases and geopolitical events to predict market reactions and execute trades accordingly.

The Blueprint for Success

While diverse strategies abound, the path to Forex trading success is paved with a few immutable principles:

-

Practice and Discipline: Consistency is paramount. Practice your strategies on a demo account before venturing into the live market. Adhere to predefined trading rules, avoiding emotional decision-making.

-

Risk Management: Protect your capital with proper risk management techniques. Never risk more than you can afford to lose and employ stop-loss orders to mitigate losses.

-

Emotional Control: Trading can be an emotional roller coaster. Cultivate self-discipline to remain composed during market fluctuations. Avoid impulsive decisions and stick to your trading plan.

-

Education and Adaptation: The Forex market is constantly evolving. Engage in ongoing education to stay abreast of the latest trends and refine your strategies. Adaptability is key to navigating the ever-changing market conditions.

Image: www.pinterest.com

Best Trading Strategy Forex Factory

The Final Frontier

Embarking on the Forex trading journey is akin to exploring the vastness of space. With knowledge as your compass and perseverance as your fuel, you can navigate the market’s complexities and emerge as a seasoned trader. Remember, the path to success is paved with continuous learning, disciplined execution, and unwavering emotional control.