Captivating Introduction:

As a seasoned trader, I vividly recall an instance where I witnessed firsthand the profound impact of support and resistance levels in determining market dynamics. Amidst the relentless ebb and flow of currency prices, these levels served as steadfast beacons, guiding my trading decisions and maximizing my profitability. Embark on this enlightening journey as we delve into the intricacies of support and resistance strategies, empowering you with the knowledge to conquer the formidable forex market.

Image: www.pinterest.com

** Unraveling Support and Resistance: The Pillars of Currency Trading**

Definition and Significance:

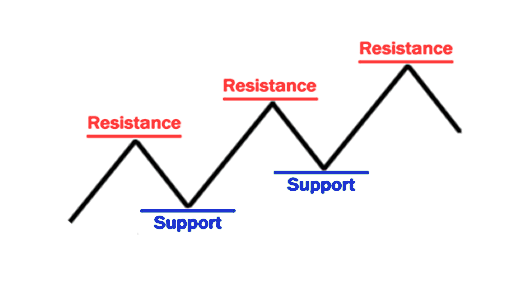

In essence, support and resistance levels represent price boundaries within which an asset’s value tends to oscillate. Support refers to the price level at which a falling asset encounters a surge in buying pressure, preventing further decline. Conversely, resistance signifies the price level at which a rising asset faces selling pressure, hindering its upward trajectory. These levels are pivotal in shaping market sentiment and providing traders with valuable insights into potential price reversals.

Historical Context and Practical Application:

The concept of support and resistance has deep roots in market analysis, dating back centuries. Its enduring relevance stems from the inherent tendency of market participants to react predictably to specific price levels. By identifying these levels, traders gain a strategic advantage in anticipating market movements and executing profitable trades.

Harnessing Support and Resistance Strategies: A Path to Forex Dominance

Mastering support and resistance trading strategies is paramount for navigating the complex forex realm successfully. These strategies empower traders with the ability to identify optimal entry and exit points, maximizing their profit potential. Numerous techniques exist, each tailored to specific market conditions and trader preferences.

** 1. Identifying Support and Resistance Levels: **

The first step in implementing support and resistance strategies involves identifying these crucial levels. This can be achieved through technical analysis tools such as trendlines, moving averages, and chart patterns. By connecting previous price highs and lows, traders can delineate support and resistance zones that serve as potential turning points for the market.

**2. Utilizing Support and Resistance for Trading: **

Once support and resistance levels are established, traders can employ various strategies to capitalize on market fluctuations. Buying near support levels and selling near resistance levels are common approaches that aim to ride price movements in the desired direction. Additionally, breakout strategies involve entering trades when prices突破s through these levels, signaling a potential trend reversal.

Image: www.kaskus.co.id

Current Trends and Emerging Techniques: Unveiling the Future of Support and Resistance

The world of support and resistance trading is constantly evolving, with new techniques and insights emerging to enhance trading efficiency. Machine learning and artificial intelligence are gaining traction, providing traders with advanced tools for identifying support and resistance levels with greater precision. Social media platforms and forums offer invaluable opportunities to connect with fellow traders, exchange ideas, and stay abreast of market developments.

Best Support Resistance Strategy Forex

Expert Tips and Proven Advice for Forex Mastery:

As an experienced forex trader, I have accumulated a wealth of knowledge and insights that I am eager to share. Here are some invaluable tips to enhance your support and resistance trading strategy:

- Prioritize higher timeframe charts for accuracy: Daily and weekly charts provide a broader perspective, reducing market noise and enhancing the reliability of support and resistance levels.

- Consider multiple support and resistance levels: Prices often respect multiple levels, creating trading opportunities at various price points.

- Confirm support and resistance with indicators: Technical indicators such as the Relative Strength Index (RSI) andStochastic Oscillator can provide additional confirmation of support and resistance zones.

- Manage risk effectively: Always employ proper risk management techniques, such as stop-loss orders, to mitigate potential losses.

** Embrace the Power of Knowledge: Unraveling Forex Acronyms and Concepts

-

MACD: Moving Average Convergence Divergence, a popular indicator that measures momentum and trend strength.

-

Fibonacci retracement levels:Ratios derived from the Fibonacci sequence, used to identify potential support and resistance zones.

-

Correlation: The relationship between the price movements of two or more assets.

-

Pip: The smallest increment of price movement in forex trading.

** Engaging Conclusion:

As we conclude our exploration of support and resistance strategies in forex, I urge you to embrace the knowledge imparted in this comprehensive guide. By mastering these techniques and incorporating them into your trading arsenal, you will gain a significant advantage in navigating the dynamic and often unpredictable forex market. Remember, consistent learning, adaptability, and unwavering determination are the keys to unlocking your full potential as a successful forex trader. Are you ready to embark on this extraordinary journey towards forex mastery?