Title: Master the Forex Markets: Unlocking the Secrets to Success

Image: bitrebels.com

Introduction:

Venturing into the realm of forex trading can evoke a whirlwind of emotions, from the exhilaration of potential profits to the trepidation of market volatility. But amidst this whirlwind, there lies a beacon of hope: carefully crafted strategies that can guide you towards success. In this comprehensive guide, we will unveil the best strategies in the forex markets, empowering you with the knowledge and confidence to conquer this dynamic arena.

Understanding the Forex Landscape:

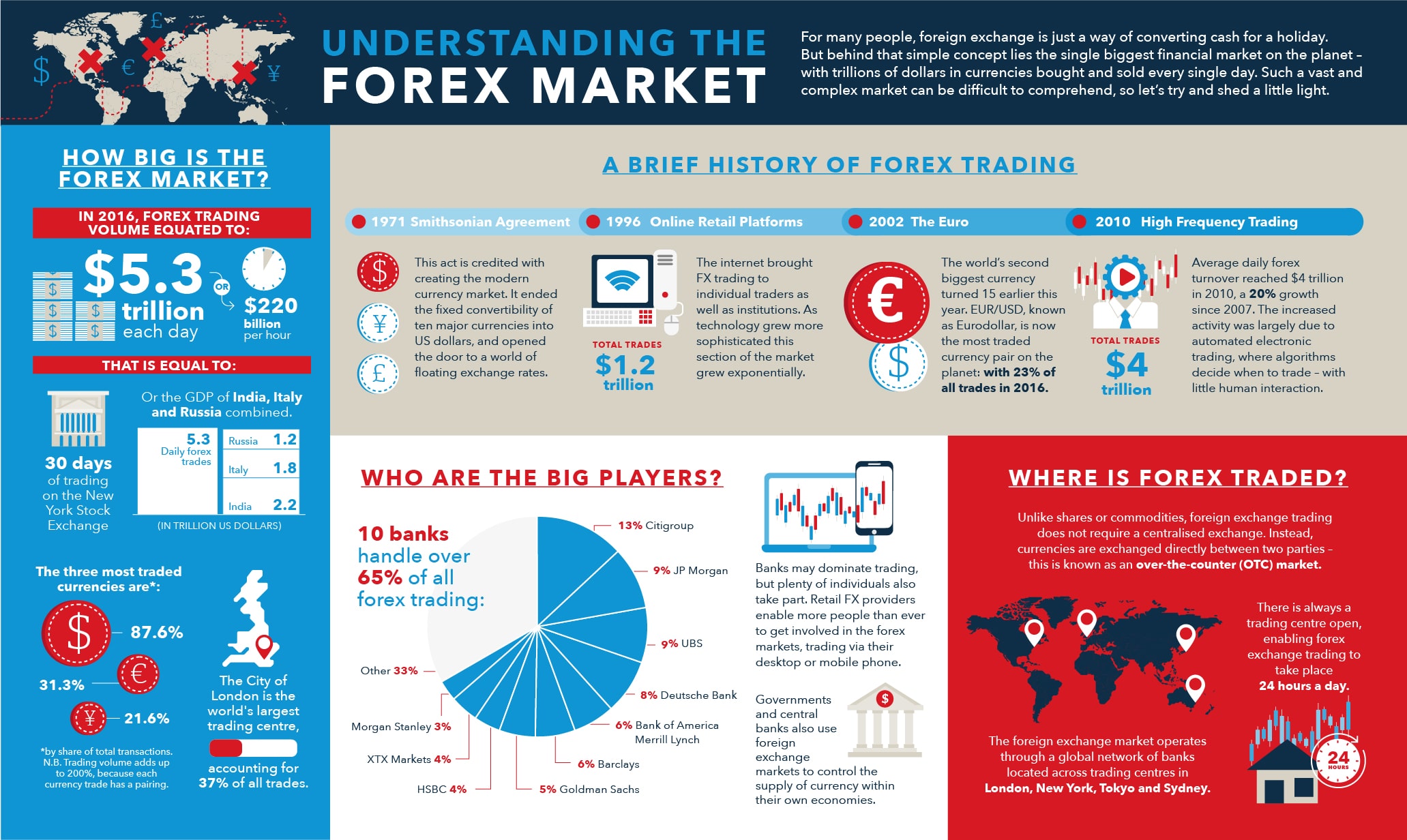

Before embarking on our strategic journey, let’s establish a firm foundation. The forex market, short for foreign exchange market, is an immense global marketplace where currencies are traded against each other. Its sheer size and liquidity make it an attractive venture for both seasoned traders and aspiring investors alike. However, navigating this complex terrain requires a strategic compass, and that’s where our guide comes in.

1. Technical Analysis: The Art of Pattern Recognition:

Like master detectives, technical analysts meticulously study historical price data, seeking patterns that reveal future market movements. By analyzing intricate charts, they identify trends, support and resistance levels, and other indicators that help them predict the ebb and flow of currencies. Armed with this knowledge, traders can make informed decisions based on past behaviors, increasing their chances of success.

2. Fundamental Analysis: Delving into the Economic Drivers:

Beyond the charts, fundamental analysts dive deep into the economic factors that influence currency values. They scrutinize interest rates, inflation, political events, and global economic indicators to gauge the overall health of different economies. Understanding these macroeconomic fundamentals allows traders to anticipate market shifts and make strategic decisions that align with the underlying forces shaping the forex market.

3. Trend Trading: Riding the Waves of Market Momentum:

If you’ve ever surfed a perfect wave, you’ll appreciate the thrill of trend trading. By identifying the direction of a currency pair’s movement, traders can ride the wave, entering and exiting positions at opportune times to maximize their profits. Trend trading is a popular strategy for both beginners and experienced traders alike, offering the potential for consistent returns.

4. Scalping: Quick Profits in the Fast Lane:

For those with a restless disposition, scalping offers the thrill of rapid-fire trading. Scalpers enter and exit positions multiple times within a single day, capitalizing on small price fluctuations. While scalping demands sharp execution and a keen eye, it can yield significant profits for traders who have mastered the art of navigating volatile markets.

5. Range Trading: Profits in the Predictability of Boundaries:

Not all traders revel in the volatility of the forex markets. Range trading offers a calmer approach, identifying trading opportunities within specific price boundaries. By understanding the support and resistance levels that define these ranges, traders can enter and exit positions strategically, capitalizing on price reversals and bouncing along the market’s predictable trajectory.

6. Carry Trading: Borrowing and Profiting from Interest Rate Differentials:

Carry trading involves borrowing in one currency with a low interest rate and investing in another currency with a higher interest rate. The difference between these rates, known as the carry, forms the profit for traders. While carry trading can be lucrative, it also carries significant risks, making it a strategy suitable only for experienced traders with a high tolerance for risk.

7. News Trading: Capitalizing on Market Reactions:

The forex market is highly reactive to news and events. News trading involves leveraging sudden market movements caused by announcements, economic releases, or geopolitical developments. By staying abreast of the news and analyzing its potential impact on currency pairs, traders can capitalize on short-term price spikes and dips.

Expert Insights and Actionable Tips:

To help you navigate the complexities of the forex markets, we’ve sought wisdom from veteran traders and analysts. Here are invaluable insights and actionable tips to guide your trading journey:

- “Identify your risk tolerance and trade within those limits,” advises Mark Douglas, renowned trading psychologist. “Risk management is the cornerstone of successful trading.”

- “Focus on one or two strategies that resonate with your trading style,” suggests Anna Coulling, a seasoned forex trader. “Mastering a few strategies is more effective than chasing multiple approaches.”

- “Stay informed about market events and global economic trends,” emphasizes George Soros, legendary hedge fund manager. “Knowledge is power in the forex markets.”

- “Practice trading on a demo account before risking real capital,” recommends Stan Weinstein, technical analysis expert. “Simulation gives you a safe environment to hone your skills and gain confidence.”

Conclusion:

The forex markets present both opportunities and challenges. By embracing the best strategies and adhering to the expert advice outlined in this guide, you can increase your odds of success in this dynamic realm. Remember, trading is an ongoing journey of learning, persistence, and self-improvement. So, equip yourself with knowledge, manage your emotions, and stay disciplined in the pursuit of your financial goals. May the markets be your allies and the profits flow abundantly.

Image: zwemclubstz.be

Best Strategies In Forex Markets