In the captivating realm of forex swing trading, where market whims dance in perpetual motion, traders seek solace in the timeless wisdom of moving averages—a beacon of technical analysis, guiding their navigation through the choppy trading waters. Embark on an exhilarating odyssey as we delve into the world’s best moving averages for swing trading forex, illuminating their nuances and empowering you to harness their power.

Image: www.norfolkfxtrader.com

Unraveling the Moving Averages Enigma

Moving averages, the quintessential technical indicators, are crafted by smoothing out raw price data, painting a clearer picture of market trends and investor sentiment. They come in diverse forms, each with a unique character and purpose. Let us unveil their enigmatic nature:

-

Simple Moving Average (SMA): A straightforward calculation of the average of closing prices over a predefined period, revealing general market direction.

-

Exponential Moving Average (EMA): An advanced iteration of the SMA, weighting recent prices more heavily, ensuring a more responsive adaptation to market fluctuations.

-

Weighted Moving Average (WMA): A variant that assigns varying weights to prices based on their chronological proximity, amplifying the influence of current data.

Selecting the Swing Star: Choosing the Optimal Moving Averages

The choice of moving average is a delicate dance, a harmonious blend of personal trading style and market conditions. Consider the following guiding principles:

-

Time Frames: Swing trading typically spans from several days to several weeks, aligning well with moving averages between 10 and 200 periods.

-

Market Momentum: EMAs triumph when rapid price action demands sensitivity, while SMAs excel in stable market conditions. WMAS can balance both worlds.

-

Trading Strategy: Your trading blueprint dictates the ideal moving average. Scalpers favor shorter EMAs, while position traders find solace in longer SMAs and WMAS.

Tactics for Mastery: Exploiting Moving Averages in Swing Trading

With the optimal moving averages at your disposal, embark on a strategic campaign to conquer the forex markets:

-

Trend Identification: Moving averages serve as visual trend indicators, revealing the dominant market direction. Buy when prices rise above the moving average and sell when they fall below.

-

Support and Resistance: Moving averages can transform into dynamic support or resistance levels, acting as price magnets that influence trader behavior.

-

Crossovers and Divergence: Crossover events, when one moving average intersects another, signal potential trend changes. Divergence, when moving averages deviate from price action, provides valuable insights into market sentiment.

-

Moving Average Convergence Divergence (MACD): A combination of two EMAs, the MACD uncovers hidden momentum and trend reversals.

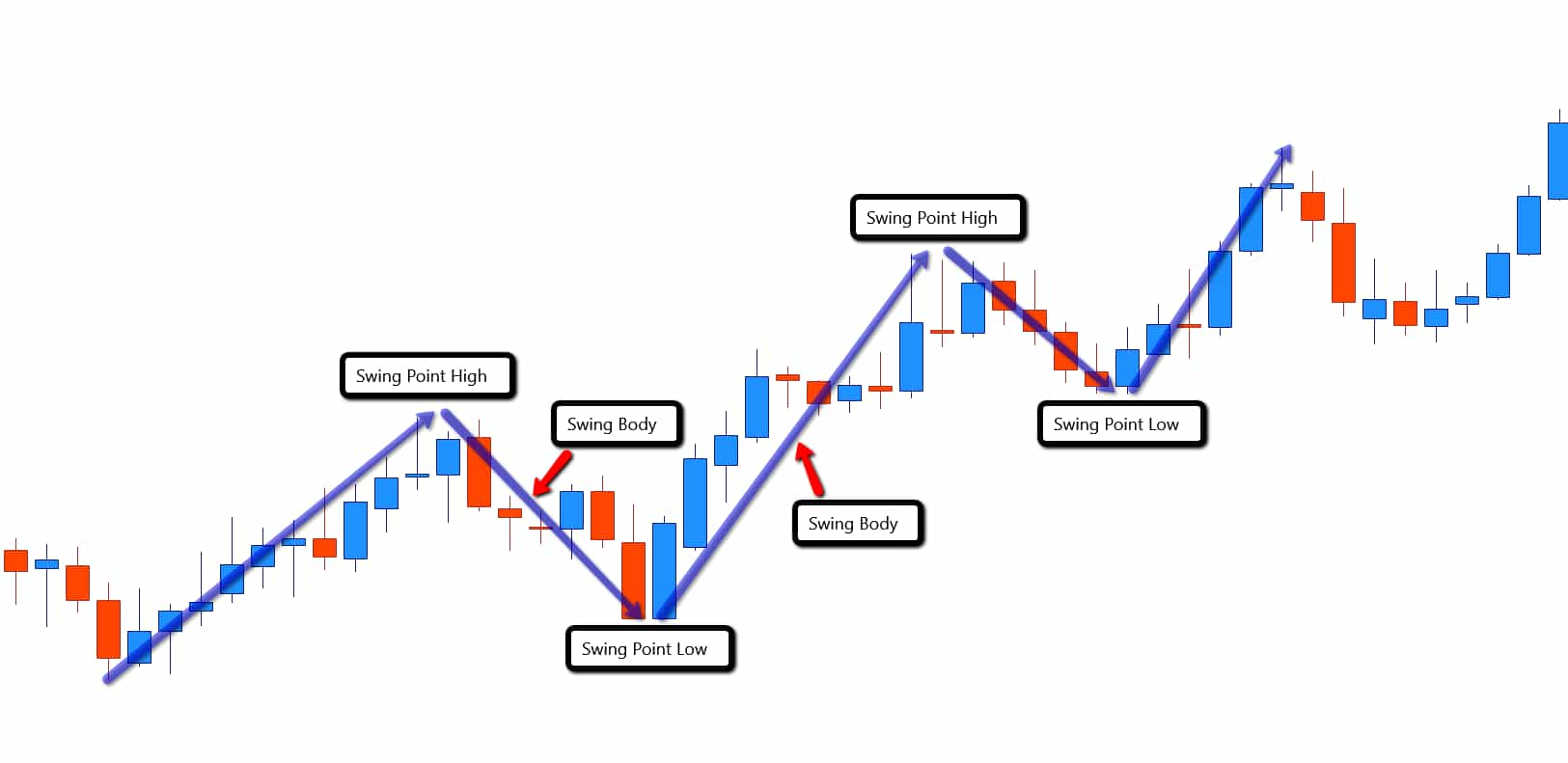

Image: forexindicator.in

Best Moving Averages For Swing Trading Forex

Conclusion: A Forex Symphony

In the grand symphony of forex swing trading, moving averages are the virtuosic conductors, guiding traders through market movements with precision and elegance. By mastering the art of selecting and deploying the best moving averages, you unlock the secrets to profitable trading. As you traverse the exhilarating path of forex swing trading, may your moving averages serve as your unwavering compass, propelling you towards financial conquest.