Embark on a Forex trading odyssey where every tick of the clock holds immense potential. Stepping into the vibrant world of 1-minute charts, we unravel the hidden secrets that empower traders to harness the market’s ebb and flow. At the heart of this strategy lies a fundamental tool—the moving average (MA)—a beacon of clarity amidst the market’s chaos.

Image: forexganar.com

Fine-Tuning the Moving Average: A Journey to Precision

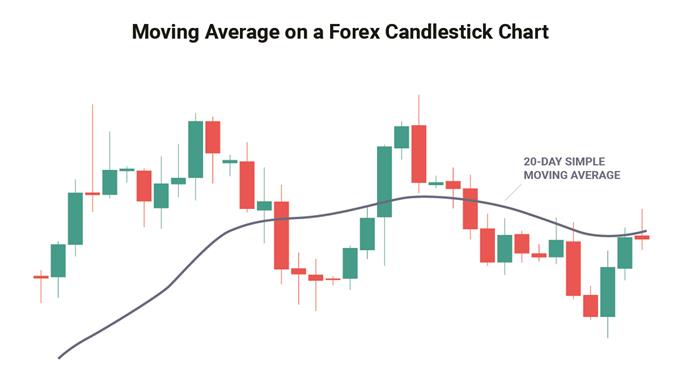

The moving average, a mathematical marvel, transforms raw price data into a smoother, more manageable representation of market trends. By calculating the average price over a specified period, it filters out the noise and reveals the underlying direction. However, finding the optimal MA setting for 1-minute charts is an art form that requires a delicate balance of sensitivity and reliability.

Determining the Ideal Moving Average Period

The choice of the MA period hinges on the desired level of smoothness and responsiveness. Shorter periods, such as 5 or 10, offer greater sensitivity to price movements, potentially capturing quick fluctuations. Conversely, longer periods like 50 or 100 provide a smoother average, reducing volatility and enhancing trend identification.

The optimal period hinges on the individual trader’s style and market conditions. Those seeking to trade highly volatile markets may prefer shorter periods to capture rapid price swings. On the other hand, traders navigating less erratic markets may find solace in longer periods that provide a more stable trendline.

The Magic of Multiple Moving Averages

The versatility of moving averages extends beyond a single period. Employing multiple moving averages with varying periods offers a multidimensional perspective of the market. A combination of a short-term MA (e.g., 10-period) and a long-term MA (e.g., 50-period) enables traders to identify both short-term fluctuations and long-term trends.

When the short-term MA crosses above the long-term MA, it often signals a bullish trend. Conversely, a cross below indicates a bearish trend. By monitoring the relationship between multiple MAs, traders gain a deeper understanding of market momentum and potential turning points.

Image: howtotrade.com

Latest Advancements and Insights from the Trading Arena

The financial world is constantly evolving, necessitating traders to stay abreast of industry trends and technological advancements. Forums, social media platforms, and news sources offer a wealth of insights from seasoned traders, expert commentators, and industry analysts.

Engaging in these online communities exposes traders to diverse perspectives, enabling them to refine their strategies and adapt to changing market dynamics. By harnessing the collective wisdom of the trading community, traders can stay at the forefront of innovation and enhance their trading prowess.

Expert Advice and Proven Strategies for Trading Success

Navigating the labyrinthine world of 1-minute Forex charts requires guidance from experienced traders who have mastered the art of moving averages. Here are some pearls of wisdom to elevate your trading acumen:

1. **Trend Following:** Identify the prevailing trend using moving averages and trade in its direction. Buy when the price is above the MA and sell when it’s below.

2. **Range Trading:** Exploit sideways markets by buying near the lower boundary of the MA range and selling near the upper boundary.

3. **Crossover Strategies:** Capitalize on price crossovers of moving averages. Buy when the shorter-term MA crosses above the longer-term MA and sell when it crosses below.

Empowering Traders with Expert Knowledge

These strategies are not mere theories; they have been honed and refined by expert traders who command the intricacies of 1-minute Forex charts. By assimilating their insights, traders can enhance their understanding of market behavior and increase their chances of success.

FAQ: Unraveling Common Trading Queries

Q: Which moving average period is best for 1-minute charts?

A: The optimal period depends on individual trading style and market conditions. Try different periods (e.g., 5, 10, 50) and find what works best for you.

Q: How do multiple moving averages enhance trading?

A: Multiple moving averages provide different perspectives of the market, helping traders identify short-term fluctuations and long-term trends.

Q: Where can I find reliable trading insights?

A: Engage with trading forums, social media platforms, and news sources to stay informed about market trends and expert opinions.

Best Moving Average Setting For 1 Minute Chart Forex

Conclusion: A Call to Mastery

Mastering the art of moving averages for 1-minute Forex charts is an empowering skill that unlocks a world of trading opportunities. By embracing the knowledge and strategies outlined in this article, traders can transform their trading endeavors and harness the potential of this fast-paced market.

Are you ready to embark on this exciting journey and elevate your trading prowess? Dive into the realm of moving averages and discover the path to unlocking optimal profits in the dynamic world of Forex trading.