Scalping Forex in 2019: Unveiling the Best Currency Pairs to Conquer the Market

Image: www.youtube.com

Introduction

In the tumultuous arena of forex trading, scalping stands as a high-octane maneuver, where traders seek to harvest fleeting profits from rapid price fluctuations. With lightning-fast trades and a keen eye for patterns, scalpers aim to conquer market volatility and amass staggering returns. However, choosing the right currency pairs is paramount to the success of any scalping strategy. In this article, we embark on an in-depth exploration of the best forex pairs to scalp in 2019, arming you with the knowledge and insight you need to outmaneuver the market.

The Secrets of Effective Scalping

Scalping is not for the faint of heart. It requires a deep understanding of market dynamics, quick reflexes, and the ability to recognize and exploit price movements within extremely tight timeframes. Successful scalpers possess an arsenal of technical analysis tools and strategies, dissecting market data in search of patterns and anomalies that can yield profitable trades.

Choosing the Right Currency Pairs for Scalping

The choice of currency pairs for scalping plays a crucial role in determining your trading success. Ideal currency pairs exhibit high liquidity, narrow spreads, and frequent price fluctuations. Here are some of the best forex pairs to scalp in 2019:

-

EUR/USD: The euro versus the U.S. dollar is the world’s most traded currency pair, boasting high liquidity and substantial volatility.

-

GBP/USD: The British pound versus the U.S. dollar is another popular choice for scalpers, offering a combination of liquidity, movement, and clear trending patterns.

-

USD/JPY: The U.S. dollar versus the Japanese yen is a highly volatile pair, ideal for scalpers seeking frequent and rapid price fluctuations.

-

USD/CHF: The U.S. dollar versus the Swiss franc provides a relatively stable trading environment with occasional bursts of volatility, suitable for scalpers with a moderate risk appetite.

Expert Insights on Scalping

To enhance your scalping prowess, we sought the insights of industry experts. Michel Doucet, a renowned scalper and market analyst, emphasizes the importance of understanding market psychology. “Traders must recognize that the market is not always rational,” he says. “They need to develop a keen sense of intuition and the ability to adapt quickly to changing market conditions.”

Actionable Tips for Scalp Trading Success

-

Master Technical Analysis: Scalping relies heavily on technical analysis. Traders must possess a deep understanding of chart patterns, moving averages, and momentum indicators to identify trading opportunities.

-

Manage Risk Wisely: Scalping involves high-risk, high-reward trades. Traders must implement robust risk management strategies, including stop-loss orders and position sizing techniques, to protect their capital.

-

Stay Disciplined: Scalping requires relentless discipline. Traders must adhere strictly to their trading plan and avoid emotional decision-making.

Conclusion

Scalping the forex market can be an exhilarating and highly lucrative endeavor. However, to succeed, traders must equip themselves with the knowledge, skills, and discipline required to navigate this dynamic environment. By understanding the best forex pairs to scalp and embracing the insights of industry experts, you can unlock the potential for substantial profits and emerge as a formidable force in the global currency markets. In the words of trading legend George Soros, “The highest returns are always found at the greatest levels of risk.” Embrace the challenge, dive into the world of scalping, and conquer the market with razor-sharp precision and an unyielding determination to succeed.

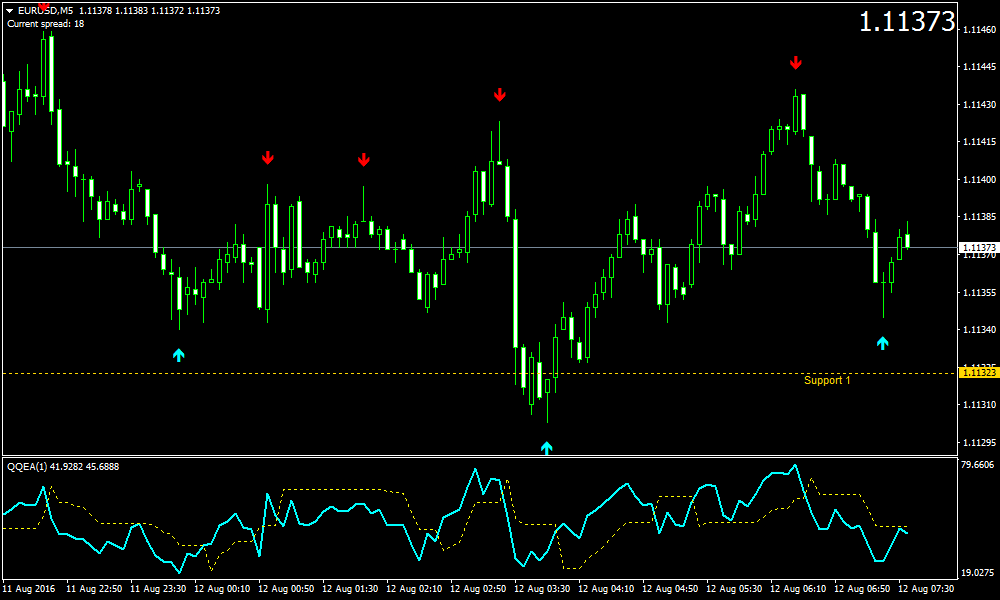

Image: www.forexmt4indicators.com

Best Forex Pairs To Scalp 2019