Embark on an unforgettable journey to the mesmerizing coral shores of Seychelles, where tranquility and adventure intertwine. As you prepare for your sojourn, one crucial aspect to consider is managing your finances seamlessly. The right forex card can empower you with convenient currency exchange, ensuring a stress-free travel experience.

Image: howtotradeonforex.github.io

Navigating the multitude of forex cards available can be daunting, but fret not! This comprehensive guide will guide you in selecting the best forex cards for Seychelles from India, empowering you with the knowledge to make informed decisions and maximize your financial security.

Understanding Forex Cards: A Gateway to Global Transactions

Forex cards, also known as multi-currency cards, are prepaid cards designed specifically for international travelers. They allow you to load multiple currencies onto a single card, enabling you to make payments and withdrawals in various countries without incurring exorbitant exchange fees. Unlike traditional credit or debit cards, forex cards offer competitive exchange rates and minimal transaction costs.

Navigating Forex Cards for Seychelles: A Wealth of Options

When selecting a forex card for your Seychelles adventure, several reputable options await your consideration:

-

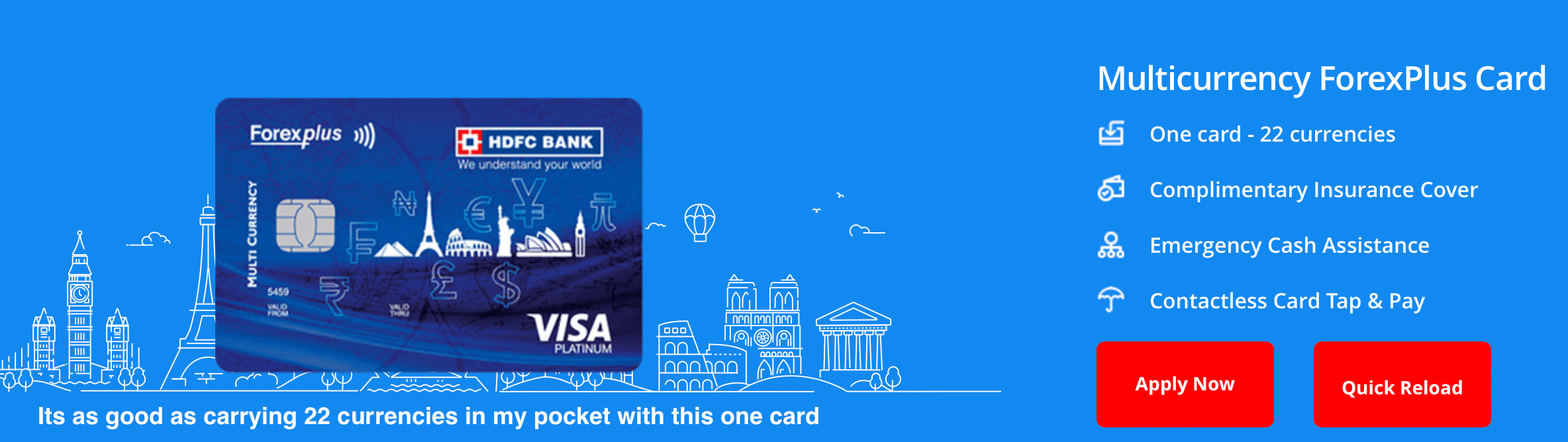

HDFC ForexPlus Card

: Renowned for its extensive network acceptance, the HDFC ForexPlus Card provides access to over 10 currencies, offering competitive exchange rates and low transaction fees.

-

Image: www.extravelmoney.comICICI Bank Multi-Currency Forex Card

: Another reliable choice for Seychelles travelers, the ICICI Bank Multi-Currency Forex Card features a wide currency portfolio, attractive exchange rates, and convenient mobile app functionality.

-

State Bank of India (SBI) Multi-Currency Forex Card

: Backed by India’s largest bank, the SBI Multi-Currency Forex Card offers a hassle-free experience with competitive exchange rates, multiple currency options, and dedicated customer support.

-

Axis Bank Multi-Currency Forex Card

: Known for its comprehensive travel insurance coverage, the Axis Bank Multi-Currency Forex Card provides peace of mind during your Seychelles sojourn, safeguarding you against unforeseen circumstances.

-

Thomas Cook Forex Card

: A popular option among seasoned travelers, the Thomas Cook Forex Card boasts a user-friendly mobile app, competitive exchange rates, and the convenience of loading funds online.

Choosing the Perfect Match: Tailoring YourForex Card to Your Needs

Selecting the optimal forex card for Seychelles from India requires thoughtful consideration of your individual requirements. Factors to ponder include:

-

Currency Support

: Ensure the card offers Seychelles Rupee (SCR) among its supported currencies to avoid additional exchange fees.

-

Exchange Rates

: Compare exchange rates offered by different cards to maximize your savings. Look for cards with competitive rates and low markups.

-

Transaction Fees

: Consider the transaction fees associated with each card, including withdrawal fees, conversion fees, and ATM charges. Opt for cards with minimal fees to optimize your budget.

-

Convenience

: Evaluate the card’s ease of use, including its mobile app functionality, online account management, and customer support availability.

-

Security Features

: Prioritize cards that offer robust security features such as chip-and-PIN technology, real-time transaction alerts, and fraud protection measures.

Expert Insights: Unlocking the Power of ForexCards

Renowned financial expert, Ms. Kavita Singh, emphasizes the significance of choosing a reliable and comprehensive forex card. She advises travelers to explore cards that offer competitive exchange rates, minimal transaction fees, and a user-friendly experience. Additionally, she recommends checking if the card provides travel insurance and other value-added services to enhance your peace of mind.

Actionable Tips: Maximizing Your ForexCard Experience

To make the most of your forex card in Seychelles, follow these practical tips:

-

Load Funds Strategically

: Monitor currency fluctuations and load funds when exchange rates are favorable to minimize conversion costs.

-

Make Large Transactions

: Avoid multiple small withdrawals as they incur higher transaction fees. Instead, opt for fewer, larger withdrawals to save money.

-

Utilize ATMs Wisely

: Choose ATMs affiliated with the card’s network to avoid additional fees. Always check the ATM fee schedule before withdrawing cash.

-

Keep Receipts

: Retain all receipts for your transactions for record-keeping and dispute resolution purposes.

Best Forex Cards For Seychelles From India

Conclusion: Embracing Financial Confidence in Seychelles

Empower yourself with the knowledge to select the best forex card for Seychelles from India and embark on your journey with financial confidence. By carefully considering the factors outlined in this guide, you can optimize your currency exchange, minimize transaction costs, and enjoy a stress-free experience in the breathtaking Seychelles. Remember, every adventure begins with preparation, and a well-chosen forex card will serve as your trusted financial companion along the way.