The Art of Forex Trading: Uncovering the Best Indicator Combinations for Success

Image: forexpops.com

Are you ready to unlock the secrets of forex trading and conquer the financial markets? When it comes to making informed trading decisions, the right combination of technical indicators becomes an indispensable tool. In this comprehensive guide, we’ll delve into the world of technical analysis, exploring various indicators and identifying the most effective combinations to optimize your trading strategy.

What are Forex Indicators?

Forex indicators are mathematical calculations applied to price data, aiding traders in identifying trends, patterns, and potential trading opportunities. They offer valuable insights into market dynamics, helping you anticipate price movements and make informed decisions.

Choosing the Right Forex Indicators

Selecting the appropriate forex indicators is crucial. Traders should consider their trading style, risk tolerance, and market conditions. Here are some factors to keep in mind:

- Trend-following indicators: Identify the direction and strength of market trends (e.g., moving averages, Bollinger Bands)

- Momentum indicators: Measure the speed and acceleration of price changes (e.g., Relative Strength Index, Stochastic Oscillator)

- Volume indicators: Reflect the level of trading activity (e.g., Accumulation Distribution Index, On Balance Volume)

- Volatility indicators: Indicate the extent of price fluctuations (e.g., Average True Range, Volatility Index)

Layering Indicators: The Power of Combinations

The true power of technical analysis lies in combining multiple indicators. By layering indicators, traders can gain a more comprehensive understanding of market behavior. Here are some effective combinations:

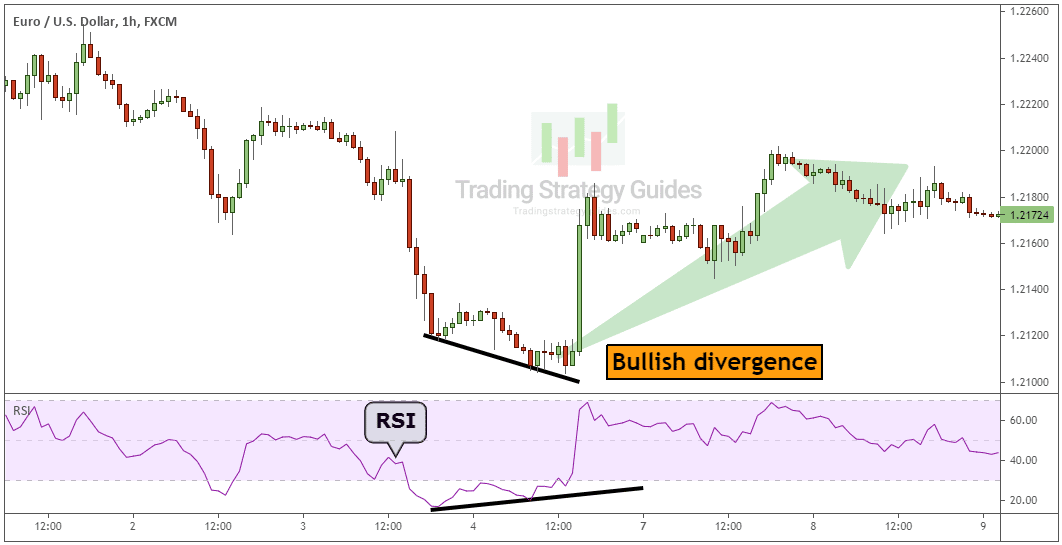

- Moving Average (MA) + Bollinger Bands + Relative Strength Index (RSI)

- Identify trends, volatility, and overbought/oversold conditions

- Ichimoku Cloud + Moving Average Convergence Divergence (MACD)

- Determine trend direction, momentum, and potential reversals

- Fibonacci Retracements + Support and Resistance

- Recognize potential retracement levels based on historical support and resistance zones

- Stochastic Oscillator + Commodity Channel Index (CCI) + Volume

- Identify overbought/oversold conditions, evaluate momentum, and gauge market sentiment

Beyond the Indicators: Trading with Wisdom

While technical indicators provide valuable insights, they should not solely drive your trading decisions. Use them as supplements to your analysis and complement them with:

- Fundamental data: Economic events, interest rate changes, political news

- Price action analysis: Studying price charts to identify patterns and market psychology

- Risk management: Determining appropriate position sizes and stop-loss levels

Trading with Confidence: Mastering the Art

Mastering the world of forex indicators takes practice and patience. Experiment with different combinations to find what works best for you, and remember:

- No indicator is foolproof. Always interpret results in context and never rely solely on one indicator.

- Confirm your signals. Look for confirmation from multiple indicators to enhance accuracy.

- Manage your emotions. Avoid impulsive trading and let your analysis guide your decisions.

- Continuous learning. Stay updated with the latest market trends and indicator developments.

Embrace the journey of forex trading with the power of technical analysis. By understanding the best cobination of indicators, layering them effectively, and complementing them with other trading techniques, you’ll unlock the pathway to success and conquer the financial markets.

Image: tradingstrategyguides.com

Best Cobination Of Forex Indicators