I began my foray into Forex trading with a glimmer of hope, fueled by promises of lucrative returns. However, the reality proved to be a turbulent sea, and my trading strategies resembled a ship caught in a storm. Desperate for guidance, I stumbled upon the enigmatic world of chart patterns, little knowing that they would transform my trading journey.

Image: lupon.gov.ph

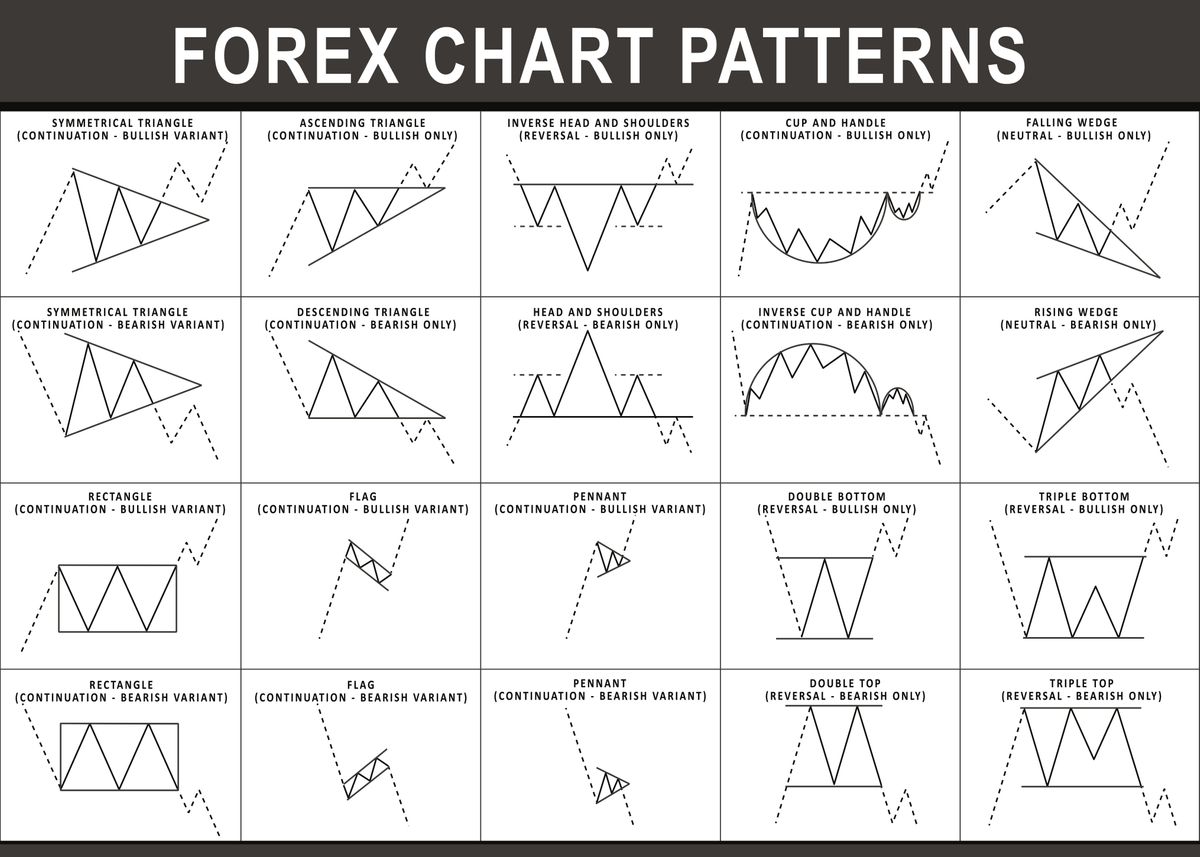

Chart Patterns: A Guiding Light in Forex Trading

Chart patterns are distinct formations that emerge from price movements on Forex charts. These patterns provide traders with valuable insights into the prevailing market sentiment, allowing them to make informed trading decisions. By analyzing these formations, traders can identify potential trading opportunities, assess the strength of a trend, and pinpoint potential reversal points.

Deciphering the Language of Chart Patterns

Chart patterns have their own unique language, with each formation carrying a specific message. Some of the most common patterns include:

- Reversal: Head and Shoulders, Double Top/Bottom, Cup and Handle

- Continuation: Triangle, Flag and Pennant, Wedges

- Neutral: Range, Rectangle

Understanding the implications of each pattern is crucial for successful trading. Reversal patterns, for instance, indicate a potential shift in the market trend, while continuation patterns suggest a pause before the trend resumes.

Empowering Traders with Chart Pattern Analysis

The benefits of utilizing chart patterns in Forex trading are multifaceted. By harnessing these formations, traders can:

- Identify Trading Opportunities: Chart patterns highlight potential breakouts and reversals, enabling traders to pinpoint entries and exits.

- Assess Trend Strength: Patterns provide insights into the strength of the prevailing trend, empowering traders to make informed decisions about trading direction.

- Manage Risk: Reversal patterns offer early warnings of potential trend changes, allowing traders to adjust their positions and manage risk proactively.

- Improve Accuracy: Expert analysis of chart patterns improves the accuracy of trading predictions, reducing losses and enhancing profits.

Image: forextraininggroup.com

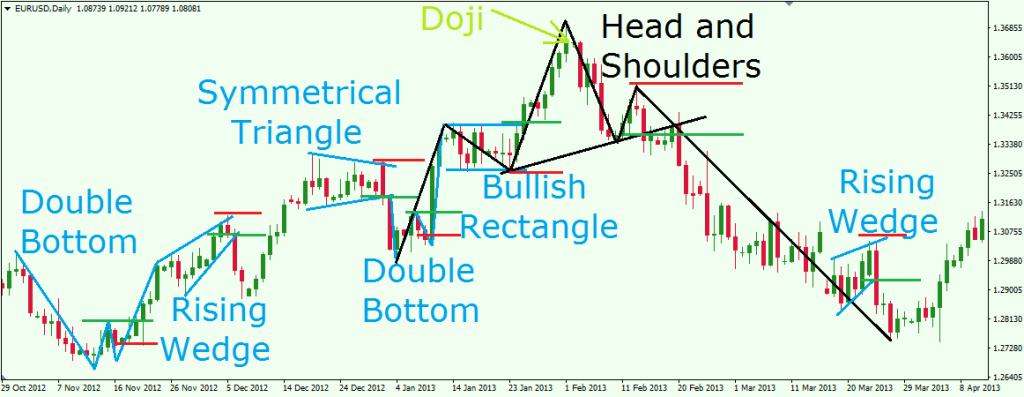

Expert Insights: Unveiling the Secrets of Chart Patterns

Seasoned Forex traders emphasize the significance of understanding the context surrounding chart patterns. Key factors to consider include:

- Volume: High volume confirms the validity of a pattern, while low volume may indicate false signals.

- Timeframe: Patterns should be analyzed across multiple timeframes to ensure reliability.

- Trend Confirmation: Patterns should align with the prevailing trend to increase the likelihood of successful trades.

FAQs on Chart Patterns

Q: How can I identify chart patterns effectively?

A: Practice on historical charts, use technical analysis tools, and consult with experienced traders.

Q: Are all chart patterns reliable?

A: No, not all patterns are reliable. It’s important to consider context, volume, and trend confirmation to enhance reliability.

Q: How can I improve my chart pattern analysis skills?

A: Study market behavior, attend webinars, and read books on technical analysis.

Benefits Of Chart Patterns In Forex Trading

Embracing the Power of Chart Patterns

Chart patterns are an invaluable tool for Forex traders, offering a glimpse into the enigmatic world of market movements. By embracing these formations, traders can unlock a wealth of trading opportunities, assess risk effectively, and improve their overall trading outcomes. Embrace the power of chart patterns and elevate your Forex trading journey today!

Are you curious about how chart patterns can transform your Forex trading experience? Join our vibrant community where experts share their insights and strategies, empowering you to navigate the financial markets with confidence.