For the discerning forex trader, mastering the art of identifying and capitalizing on price patterns is paramount to achieving consistent profitability. Among the diverse array of patterns, the Bat pattern stands out as a highly effective and lucrative trading strategy, offering unparalleled opportunities for profit. In this comprehensive guide, we will delve into the intricacies of the Bat pattern, equipping you with the knowledge and skills to harness its power in the dynamic forex market.

Image: forexvisit.com

Defining the Bat Pattern: A Harmonic Symphony

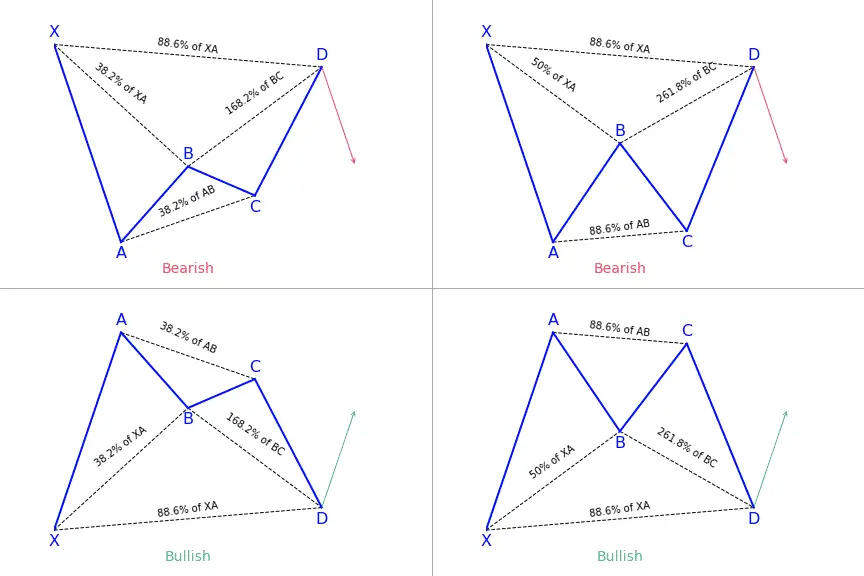

The Bat pattern is a harmonic pattern that conforms to specific Fibonacci ratios, providing a unique insight into potential price reversals. Named after its resemblance to a bat’s open wings, the pattern consists of five distinct points, labeled X, A, B, C, and D. The relationships between these points are defined by precise Fibonacci relationships, with the following ratios serving as the foundational criteria:

- AB = 0.382 of XA

- BC = 0.500 of AB

- CD = 0.886 of BC

- AD = 1.618 of BC (XA)

In other words, the length of AB should be approximately 38.2% of XA, BC should be around 50% of AB, CD should be close to 88.6% of BC, and AD should be approximately 161.8% of BC (or equal to XA). These precise ratios create a unique harmonic balance that often coincides with price reversals, making the Bat pattern a highly sought-after trading setup.

Image: patternswizard.com

Bat Pattern In Forex Groups

Identifying the Bat Pattern: A Step-by-Step Approach

Mastering the art of identifying the Bat pattern requires a keen eye and a meticulous adherence to the defined Fibonacci ratios. Here’s a step-by-step guide to help you accurately identify Bat patterns in the forex market:

Step 1: Locate a Clear Downtrend (or Uptrend)

The Bat pattern typically occurs at the end of a significant market move, be it a downtrend or an uptrend. Look for a clear downtrend (a series of lower lows and lower highs) or an uptrend (a series of higher highs and higher lows).

Step 2: Identify Point A

Find a swing high (in a downtrend) or a swing low (in an uptrend) that marks the start of a corrective move. This point is labeled as point A.

Step 3: Draw XA and Project AB (0.382)

Draw a line from the start of the downtrend (or uptrend) to point A (XA). Then, calculate 38.2% of XA and draw a horizontal line at that level. This line represents the potential location of point B.

Step 4: Swing High to Swing Low (0.500)

Identify the swing high (in a downtrend) or swing low (in an uptrend) that follows point A and marks the end of the first corrective wave. Label this point as point B and draw a horizontal line representing the 50% Fibonacci retracement of AB. This line can provide support or resistance, acting as a potential reversal zone.

Step 5: Swing High to Swing Low (0.886)

Locate the next swing high (in a downtrend) or swing low (in an uptrend) following point B. This point is labeled as point C and serves as the start of the extended corrective wave. Draw a horizontal line at the 88.6% Fibonacci retracement of BC, which can indicate a potential reversal area.

Step 6: Confirm the Bat Pattern

To complete the Bat pattern, we need to find point D, the potential reversal point. Draw a vertical line from the swing low (or swing high) closest to point C, perpendicular to the X