Introduction

In the digital age, traveling abroad and managing finances seamlessly has become more accessible than ever. Axis Bank, one of India’s leading banks, offers a convenient and secure solution for global travelers: the Axis Prepaid Debit Card Forex. This card seamlessly combines the advantages of a debit card with the flexibility of foreign exchange, allowing you to explore the world worry-free and manage your expenses with ease.

Image: forexretro.blogspot.com

When venturing into unfamiliar territories, carrying large amounts of cash can be a burden and a security risk. The Axis Prepaid Debit Card Forex eliminates these concerns by providing a safer and more convenient alternative. Its acceptance at millions of merchants and ATMs worldwide ensures you have access to funds whenever and wherever you need them.

Benefits of Using Axis Prepaid Debit Card Forex

- Security: Eliminate the risk of carrying cash and protect yourself from theft or loss.

- Convenience: Access your funds easily at ATMs and merchant outlets worldwide.

- Competitive Exchange Rates: Get favorable exchange rates without hidden fees or commissions.

- Transparency: Track your transactions in real-time through online and SMS alerts.

- Multi-currency Support: Load multiple currencies onto your card for hassle-free travel across different countries.

Understanding Forex on Axis Prepaid Debit Card

Foreign exchange (forex) refers to the conversion of one currency into another. When loading funds onto your Axis Prepaid Debit Card Forex, you can choose from a wide range of foreign currencies. The card automatically converts the amount you load into the chosen currency at a competitive exchange rate, saving you the hassle of currency exchange at physical exchange bureaus.

The exchange rate is determined by the prevailing market conditions and is updated regularly. You can view the latest exchange rates on the Axis Bank website or mobile application. By using the Axis Prepaid Debit Card Forex, you can lock in a favorable exchange rate and avoid the fluctuations that may occur during your travels.

Latest Trends and Developments in Travel Forex

The travel forex industry is constantly evolving to meet the changing needs of global travelers. Here are some notable trends and developments:

- Digital Currency Exchanges: Online platforms and mobile applications now offer competitive exchange rates and convenient currency conversion services.

- Biometric Security: Contactless payments and biometric verification are enhancing the security and convenience of forex transactions.

- Blockchain Technology: Blockchain-based solutions are emerging as a secure and transparent alternative to traditional forex systems.

- Personalized Forex Services: Travelers can now access personalized forex advice and tailored currency solutions based on their travel itineraries.

- Increased Focus on Sustainability: Travel forex providers are adopting sustainable practices to reduce their environmental impact, such as minimizing waste and supporting eco-friendly initiatives.

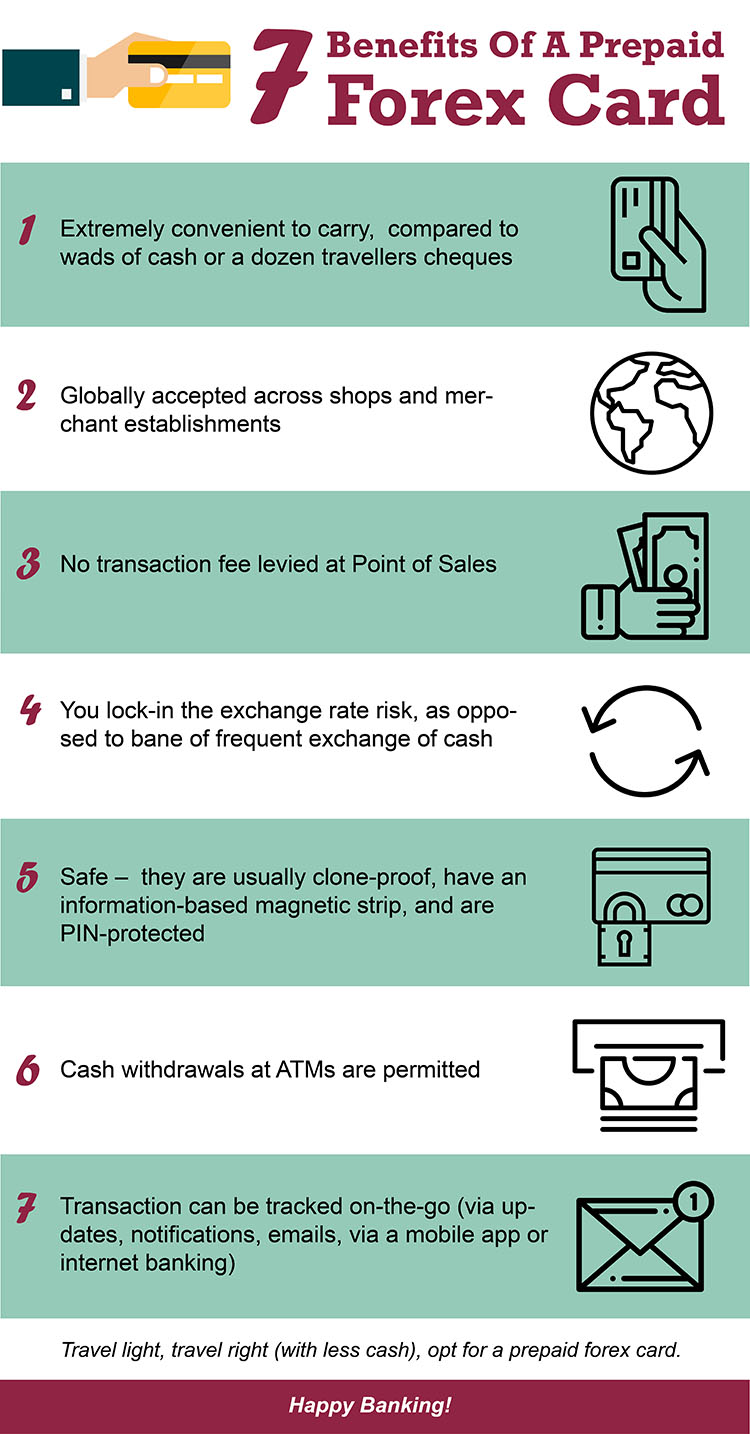

Image: robotforexkaskus.blogspot.com

Tips and Expert Advice for Forex Travelers

- Plan Ahead: Determine the currencies you need for your destination and load them onto your card before you travel.

- Compare Exchange Rates: Research different exchange rate providers to secure the most favorable rates.

- Beware of Hidden Fees: Scrutinize all charges associated with forex transactions, including exchange rate spreads and transaction fees.

- Use Your Card Wisely: Avoid unnecessary withdrawals or currency conversions to minimize exchange rate losses.

- Consider Travel Insurance: Protect yourself against unexpected events that may affect your travel finances, such as lost or stolen cards.

By following these tips, you can optimize your forex experience and ensure that your travel funds are managed efficiently and securely.

Frequently Asked Questions (FAQs)

Q: What is the minimum and maximum amount I can load onto my Axis Prepaid Debit Card Forex?

A: The minimum load amount is INR 10,000, and the maximum load amount is INR 3 lakhs per day.

Q: Are there any additional charges for using the card abroad?

A: No, there are no additional charges for using the card at ATMs or merchant outlets abroad.

Q: What is the PIN number for my Axis Prepaid Debit Card Forex?

A: You can set your PIN number when activating the card on the Axis Bank website or mobile application.

Q: How can I track my transactions on the card?

A: You can track your transactions through online banking, the Axis Bank mobile application, or SMS alerts.

Q: What should I do if my card is lost or stolen?

A: Immediately block your card by calling Axis Bank’s customer care number and file a police report.

Axis Prepaid Debit Card Forex

Conclusion

The Axis Prepaid Debit Card Forex is an indispensable tool for travelers seeking security, convenience, and cost-effectiveness. By seamlessly integrating foreign exchange and debit card functionality, it empowers you to explore the world with peace of mind. Embracing the latest forex trends and incorporating expert advice into your travel plans will further enhance your experience and ensure that your travel funds are optimally utilized.

Are you interested in exploring the benefits of the Axis Prepaid Debit Card Forex for your next adventure? Visit the Axis Bank website or download the mobile application to learn more and get started today.