Navigating the world of travel cards can be a bit overwhelming, especially when it comes to understanding the different fees associated with them. In this comprehensive guide, we’ll deep-dive into the topic of Axis Forex Travel Card cash withdrawal charges, providing you with all the key details you need to make informed decisions about your travel expenses.

Image: allaboutforexs.blogspot.com

Understanding Cash Withdrawal Charges

When using your Axis Forex Travel Card to withdraw cash from an ATM, you will generally incur two types of charges:

- ATM operator fee: This is a charge levied by the ATM operator for using their machine.

- Currency conversion fee: This is a charge applied by Axis Forex for converting the withdrawn amount from one currency to another.

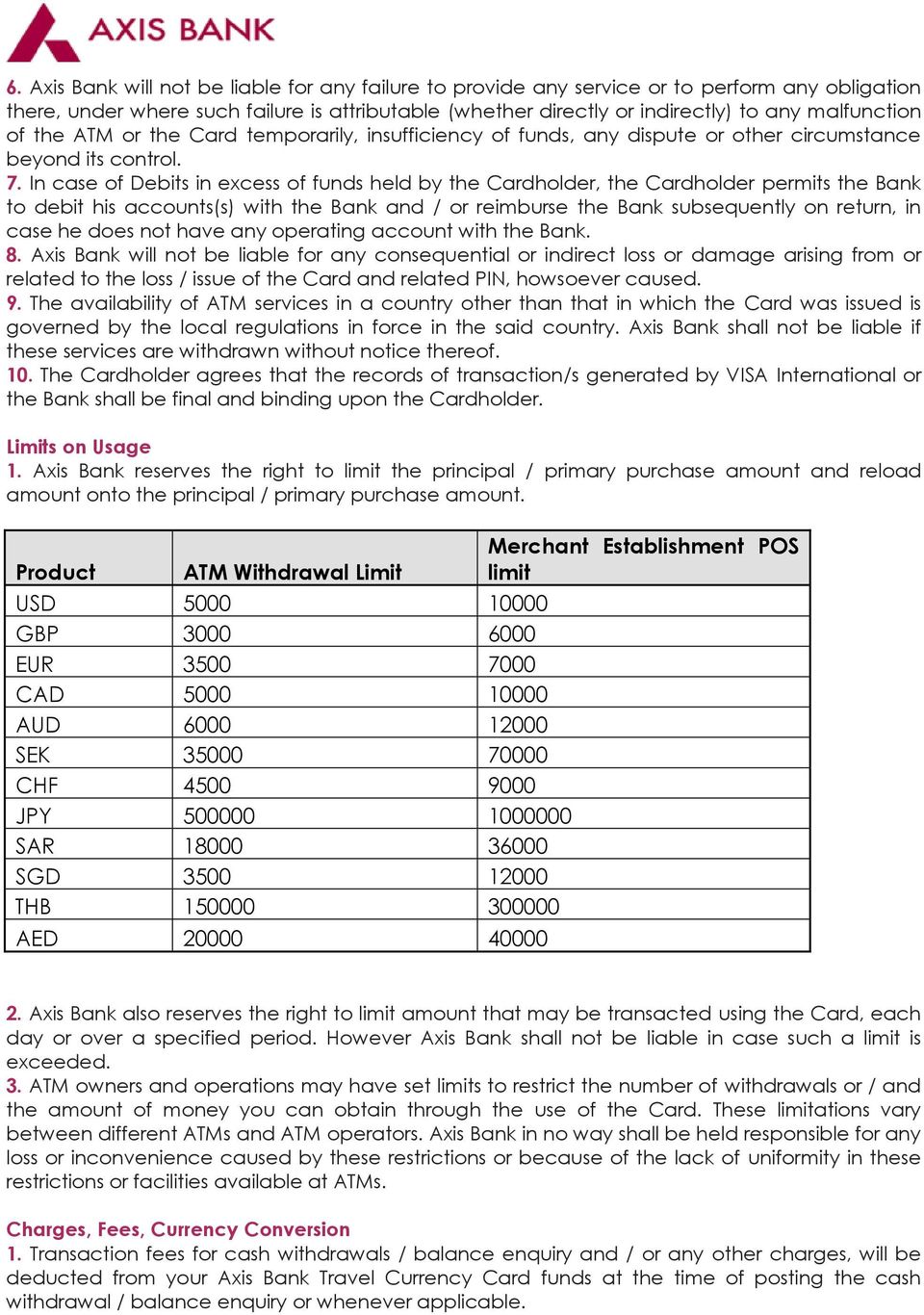

Withdrawal Fee Structure

The withdrawal fee structure of the Axis Forex Travel Card varies based on the type of card you have and the country you’re withdrawing from. Here’s a general overview:

- Platinum Card: ₹150 per transaction

- Classic Card: ₹200 per transaction

In addition to the above charges, Axis Forex also levies a currency conversion fee of 3.5%, which is applicable on all cash withdrawals.

How to Avoid or Minimize Fees

Here are some tips for avoiding or minimizing Axis Forex Travel Card cash withdrawal charges:

- Use ATMs within the Axis Forex network: This can help you avoid the ATM operator fee.

- Withdraw larger amounts less frequently: This can reduce the number of withdrawals you make and thus the overall fees.

- Consider getting a card with lower fees: Axis Forex offers a range of travel cards with varying fee structures, so you can choose one that suits your needs.

Image: financeclap.com

Latest Trends and Developments

In the realm of travel cards, there have been several recent trends and developments:

- Chip-and-PIN technology: Many travel cards now feature chip-and-PIN technology, which offers enhanced security and reduces the risk of fraud.

- Mobile card management: Many issuers now offer mobile apps that allow you to manage your travel card, track spending, and disable/enable it as needed.

- Contactless payments: Contactless payment options are becoming increasingly prevalent in the travel industry, allowing you to make purchases by simply tapping your card on a reader.

FAQs on Axis Forex Travel Card Cash Withdrawal Charges

Q: What is the maximum amount I can withdraw from my Axis Forex Travel Card?

A: The maximum withdrawal limit varies based on the card type and your account balance, but it is typically around ₹1,00,000 per day.

Q: Can I use my Axis Forex Travel Card at any ATM?

A: Yes, you can use your Axis Forex Travel Card at any ATM that accepts Visa or Mastercard. However, it’s important to note that the ATM operator may charge a fee for using their machine.

Q: How can I check the balance on my Axis Forex Travel Card?

A: You can check your balance by calling Axis Forex’s customer care number, using the mobile app, or visiting their website.

Axis Forex Travel Card Cash Withdrawl Charges

Conclusion

Understanding the cash withdrawal charges associated with your Axis Forex Travel Card is crucial for managing your travel expenses. By carefully considering the fee structure and following the tips provided, you can minimize your expenses and make the most of your travel funds. We hope this article has provided you with the necessary information and guidance to make informed decisions when using your Axis Forex Travel Card for cash withdrawals.

Are you interested in learning more about travel cards and making informed decisions about your travel expenses? If so, be sure to check out our other articles and resources on the topic!