Introduction

Are you embarking on an international journey or embarking on a business transaction that requires you to exchange currencies? If so, understanding the foreign exchange (forex) charges levied by your bank is crucial to avoid unexpected financial surprises. This article delves into the world of Axis Bank’s forex transaction charges, providing a detailed guide and equipping you with the knowledge and support you need for seamless cross-border transactions.

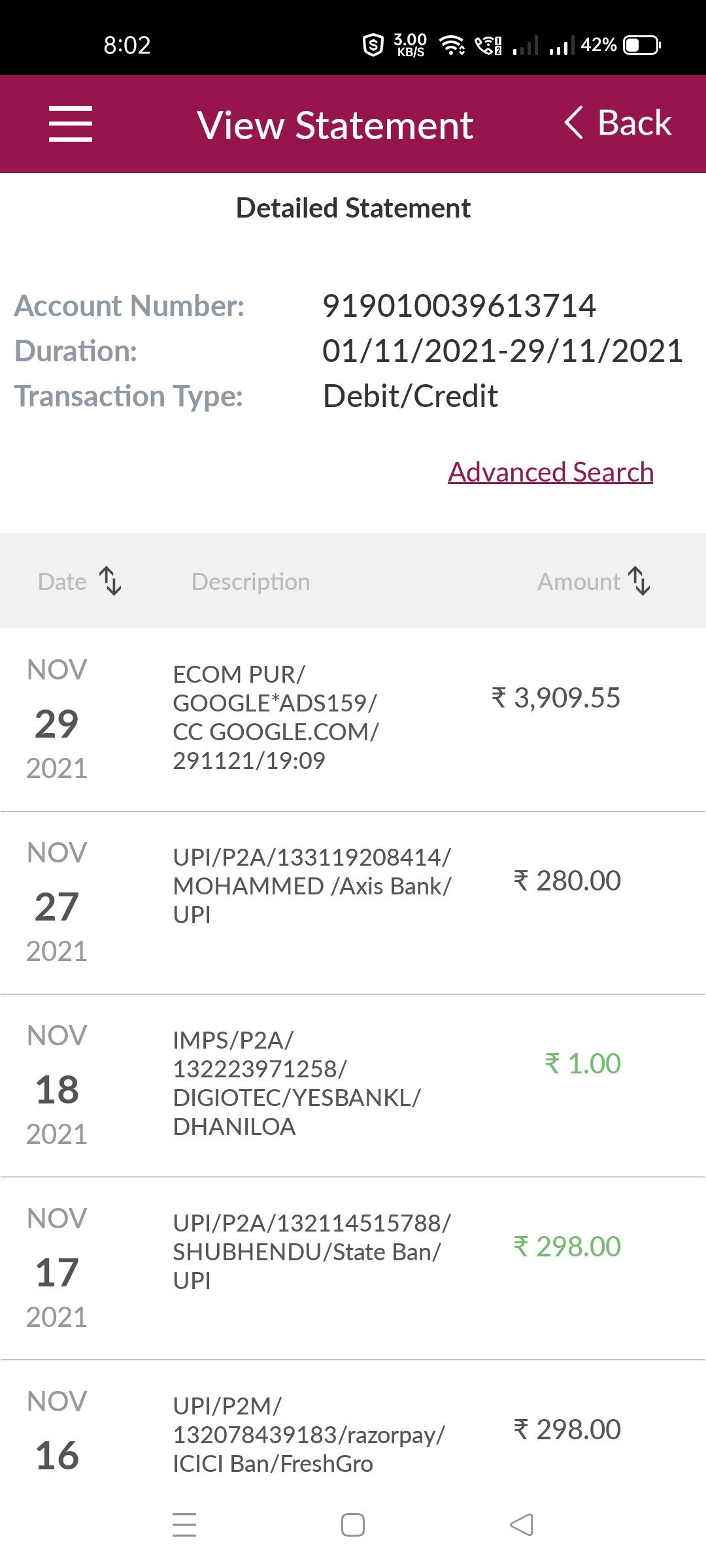

Image: consumercomplaintscourt.com

Decoding Forex Transaction Charges

Forex transactions involve the exchange of one currency for another, and banks like Axis Bank charge a fee for this service. These charges typically include:

- Transaction Fee: A flat fee charged per transaction, regardless of the amount exchanged.

- Exchange Rate Margin: This is the difference between the interbank exchange rate and the rate offered to customers, often expressed as a percentage.

- Service Tax: A government-imposed tax on all forex transactions.

The exchange rate margin varies depending on the currency and the amount being exchanged. Axis Bank provides a live currency converter on its website and mobile app, allowing you to preview the exchange rates and charges before initiating a transaction.

Axis Bank Forex Transaction Charges

Axis Bank offers multiple channels for forex transactions, including:

- NetBanking: Log into your Axis Bank NetBanking account and select the ‘Foreign Exchange’ option under the ‘Payments’ tab.

- Mobile Banking: Access the ‘Axis Mobile’ app and navigate to ‘Foreign Exchange.’

- Branch Banking: Visit your nearest Axis Bank branch with the required documents.

The charges for these channels may vary slightly. Customers are advised to check with their branch or contact the bank’s customer care for the latest pricing information.

Additional Charges to Consider

Apart from the forex transaction charges, there may be additional costs associated with international money transfers, such as:

- Beneficiary Bank Charges: Some beneficiary banks may charge a fee for receiving international funds.

- Intermediary Bank Charges: If the transfer involves multiple intermediary banks, each may charge a fee.

- Wire Transfer Fee: If the funds are transferred via wire, there may be an additional charge.

To minimize these additional charges, it is advisable to explore the most cost-efficient transfer method and inquire about any fees with both sending and receiving banks.

Image: www.youtube.com

Customer Care Support for Forex Transactions

Axis Bank provides dedicated customer care support to assist with forex transactions and address any queries customers may have. Here’s how you can reach out:

- Phone Banking: Dial 1860 419 5555 or 1860 500 5555.

- Email: Write to [email protected] with your query.

- Visit Branch: Visit your nearest Axis Bank branch for in-person assistance.

The customer care team is available 24/7 to assist customers with forex transactions. They can provide real-time updates on exchange rates, help with transaction initiation, and resolve any issues that may arise.

Axis Bank Forex Transaction Charges Details Customer Care Mailid

Conclusion

Understanding Axis Bank’s forex transaction charges is essential for planning your international financial transactions. By leveraging the information provided in this article, you can make informed decisions, avoid unexpected costs, and enjoy a seamless cross-border banking experience. Whether you’re planning a vacation or conducting business abroad, remember that Axis Bank’s customer care support is always available to guide you through the process and ensure a smooth and secure transaction.