Have you ever found yourself puzzled by the intricacies of foreign exchange payments? Fear not! This article delves into the world of Axis Bank’s forex payment charges, shedding light on the complexities of international transactions. Whether you’re an experienced globetrotter or an aspiring businessperson, this in-depth guide will equip you with the knowledge to navigate the enigmatic world of forex payments.

Image: wallstreet20forexrobotreview.blogspot.com

Navigating the Labyrinth of Forex Charges

Foreign exchange transactions often involve a myriad of charges, and Axis Bank is no exception. Understanding these charges is paramount to budgeting effectively and avoiding unpleasant surprises. So, let’s embark on a journey to decipher the maze of forex payment charges:

Foreign Exchange Rate Charges

These charges reflect the difference between the buying and selling rates offered by Axis Bank. The spread, or the difference between these rates, represents the bank’s profit margin on the transaction. Fluctuations in the global forex market can impact these rates, so it’s crucial to stay abreast of market trends.

Transaction Fees

Axis Bank charges a transaction fee for processing each forex payment. This fee may vary depending on the amount being remitted, the destination country, and the payment method used. Be sure to inquire about these charges before initiating a transaction to avoid hidden costs.

Image: www.officenewz.com

SWIFT Charges

If your forex payment involves a cross-border transfer, you may encounter SWIFT charges. SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, is a messaging network that facilitates secure international payments. These charges are levied to cover the cost of sending and receiving payment instructions via the SWIFT network.

Other Charges

In certain instances, additional charges may apply based on the payment method you choose. For example, credit card payments may incur processing fees, while wire transfers via intermediary banks may involve correspondent bank charges. It’s wise to inquire about any potential additional charges to avoid any surprises.

Staying Informed for Optimal Outcomes

The forex market is a dynamic and ever-evolving landscape. Keeping yourself informed about market trends and Axis Bank’s latest forex policies is essential for making informed decisions. Monitor news sources and visit the Axis Bank website regularly for updates and announcements. This knowledge will empower you to make calculated transactions and minimize charges.

Expert Tips to Optimize Forex Payments

To help you navigate the complexities of forex payments, here are some expert tips to optimize your transactions:

Compare Exchange Rates

Compare exchange rates offered by different banks and exchange service providers. Don’t hesitate to negotiate with Axis Bank if you find a better rate elsewhere. This simple step can save you a significant amount in the long run.

Minimize Transaction Amounts

Larger transaction amounts typically attract higher fees. If possible, break down large payments into smaller ones to reduce overall charges. This strategy can help you save money on transaction fees.

Utilize Online Banking

Axis Bank offers a convenient online banking platform that allows you to execute forex transactions from the comfort of your home. Online transactions often come with lower fees compared to in-branch transactions.

Leverage Prepaid Forex Cards

Prepaid forex cards can be a cost-effective option for frequent travelers. These cards lock in the exchange rate at the time of purchase, protecting you from market fluctuations. They also eliminate the need for multiple currency exchanges, saving you time and money.

FAQs for Clarity

To further illuminate the subject, let’s address some commonly asked questions regarding Axis Bank’s forex payment charges:

- Q: How can I determine the exact forex charges applicable to my transaction?

A: Contact Axis Bank directly or visit their website to obtain specific charges based on your transaction details.

- Q: What factors influence the foreign exchange rate offered by Axis Bank?

A: The foreign exchange rate is determined by global economic factors, supply and demand, and central bank policies.

- Q: Are there any hidden charges associated with forex payments?

A: While Axis Bank endeavors to provide transparent pricing, it’s always advisable to inquire about any potential additional charges to avoid surprises.

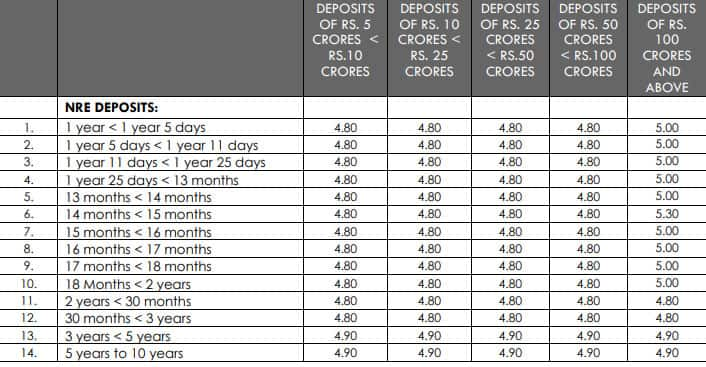

Axis Bank Forex Payment Charges

Conclusion

Navigating the world of Axis Bank’s forex payment charges can be a daunting task. However, with the knowledge acquired through this comprehensive guide, you can approach your international transactions with confidence. Remember to compare rates, optimize transactions, and stay informed to make the most of your forex payments. We encourage you to delve deeper into this fascinating topic by exploring the resources provided by Axis Bank and other trusted sources.

Let us know if you found this article informative and helpful. Your feedback is invaluable in our quest to provide valuable content that empowers our readers. Thank you for choosing our platform to unravel the complexities of forex payments. We invite you to continue your exploration and engage with us for more insights and updates.