Unveiling the Lucrative World of Forex Brokers: Explore the Path to Profit

Image: www.pinterest.com

In the labyrinthine world of financial markets, forex brokers serve as gatekeepers, connecting traders with the dynamic realm of foreign exchange. Their existence hinges upon a fundamental economic principle: the relentless fluctuation of currency values across borders. These market movements present a fertile ground for profit-minded individuals seeking to capitalize on global currency shifts.

Delving into the Anatomy of Forex Brokerage

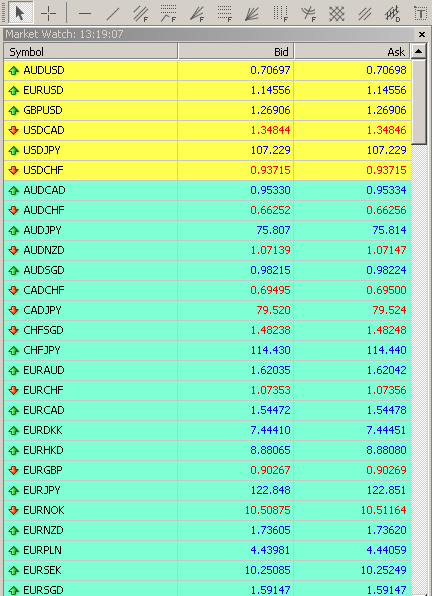

Forex brokers play a multifaceted role in the forex ecosystem. They provide traders with essential services such as access to trading platforms, real-time market data, and execution of buy and sell orders at competitive rates. For this service, they earn commissions and spreads, the lifeblood of their revenue streams. Spreads represent the difference between the bid and ask prices, offering brokers a slice of every trade executed on their platform.

Anatomy of a Forex Broker’s Revenue Model

The average revenue structure of a forex broker encompasses a complex interplay of factors:

-

Commissions: Direct fees charged to traders for each trade executed.

-

Spreads: The difference between the bid and ask prices, capturing a portion of every transaction.

-

Interest differential: Profits generated from discrepancies in interest rates among currencies.

-

Value-added services: Additional revenue sources from offerings such as account management, research tools, and educational resources.

Navigating the Forex Brokerage Landscape

Identifying a reputable and profitable forex broker requires careful research and due diligence. Consider the following parameters:

-

Regulation and Licensing: Seek brokers operating under the oversight of respected financial authorities.

-

Trader Support: Access to responsive and knowledgeable customer assistance is paramount.

-

Trading Platform: Evaluate the platform’s functionality, ease of use, and technical capabilities.

-

Commission and Spread Structure: Compare fees to ensure competitive rates and transparency.

-

Reputation and Reviews: Read online reviews and consult industry experts to gauge the broker’s standing within the market.

Expanding the Knowledge Horizon

To thrive in the forex arena, traders must arm themselves with a comprehensive understanding of the market’s nuances. Seek out educational resources, both on the broker’s platform and beyond, to augment your knowledge and develop a strategic edge.

Embrace Uncertainty with Calculated Risk

Forex trading is an inherently risky endeavor. Currency values fluctuate constantly, and predicting market movements with absolute certainty is an elusive endeavor. Embrace a disciplined approach to risk management, setting clear thresholds for gains and losses.

Embark on the Journey to Financial Empowerment

The world of forex offers a path to financial freedom, but it is a path fraught with challenges. By delving into the intricacies of forex brokerage and honing your trading skills, you can navigate the turbulent waters of currency markets and emerge triumphant. Remember, the true measure of a successful forex trader lies not solely in the profits reaped, but in the knowledge and resilience cultivated along the way.

Image: www.forexfactory.com

Average Revenue Of A Forex Broker

https://youtube.com/watch?v=FfYMIhxG-1g