Unlock the Profitable Secrets of Intraday Trading

Are you ready to transform your forex trading journey and unlock consistent profits? Discover the power of the Average Daily Range (ADR) scalping strategy, a time-tested approach that leverages the natural volatility of currency pairs. This comprehensive guide will provide you with a free download of this remarkable strategy, empowering you to seize every market opportunity.

Image: www.dolphintrader.com

What is the Average Daily Range Scalping Strategy?

The ADR scalping strategy centers around the concept of identifying and exploiting the typical price range of a currency pair within a specific time period, often within a single trading session. This strategy capitalizes on the assumption that, on average, the price of a currency pair will fluctuate within a predictable range, creating opportunities for traders to profit from short-term fluctuations.

To implement the ADR scalping strategy, traders calculate the ADR of a currency pair over a past period, typically based on daily or weekly data. The ADR represents the average difference between the high and low prices of a currency pair over that period. Once the ADR is determined, traders place buy orders at a price just below the upper boundary of the ADR and sell orders at a price slightly above the lower boundary of the ADR.

The objetivo is to capture the natural price fluctuations within the ADR range, as the currency pair typically moves back and forth within this range throughout the trading session. When the price reaches the upper boundary, traders expect a pullback, allowing them to place sell orders and profit from the price decline. Conversely, when the price approaches the lower boundary, traders anticipate a bounce and place buy orders to benefit from the price increase.

Unleashing the Power of the ADR Scalping Strategy

The ADR scalping strategy offers numerous advantages for traders seeking intraday profits:

- Enhanced Accuracy: The ADR concept provides a solid foundation for predicting price movements, increasing the probability of successful trades.

- Risk Mitigation: By trading within a defined range, traders can manage their risk effectively, as the strategy limits the potential loss to the range boundaries.

- Automation Potential: With the help of automated trading platforms, traders can automate the execution of the ADR strategy, freeing up their time while maintaining a disciplined approach to trading.

li>Scalability: The ADR scalping strategy can be adjusted to various time frames and currency pairs, allowing traders to customize it according to their risk tolerance and trading preferences.

Your Ticket to Success: Tips and Expert Advice

To enhance your ADR scalping strategy, consider these invaluable tips:

- Select Liquid Currency Pairs: Choose currency pairs with high liquidity, ensuring ample market depth and minimal slippage, which can impact trading profitability.

- Set Realistic Targets: Establish realistic profit targets based on the ADR range and your risk tolerance. Avoid overtrading and focus on capturing consistent small profits over time.

- Manage Your Risk: Employ proper risk management techniques, such as stop-loss orders and position sizing, to protect your capital and prevent significant drawdowns.

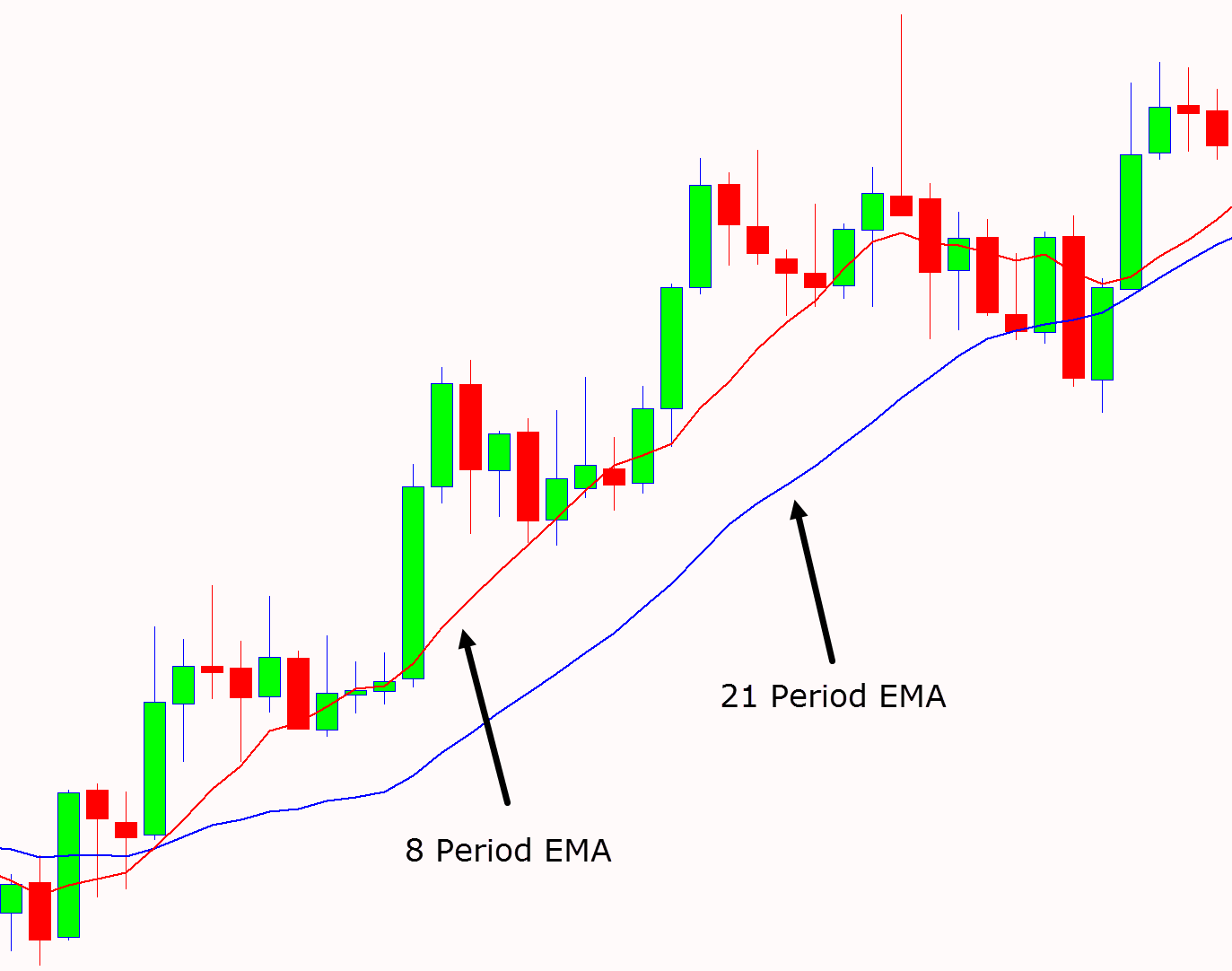

- Use Technical Indicators: Enhance your trading strategy by incorporating technical indicators such as moving averages or Bollinger Bands to confirm trade signals and identify potential reversal points.

- Practice and Patience: As with any trading strategy, practice and patience are crucial. Backtest the ADR scalping strategy and refine your approach based on your observations and market experience.

Image: learnpriceaction.com

Frequently Asked Questions (FAQs)

Q: What are the limitations of the ADR scalping strategy?

A: The ADR scalping strategy is vulnerable to market conditions that violate the assumption of normal price distribution. Extreme market events, such as news announcements or economic shocks, can cause the price to break out of the ADR range, resulting in potential losses.

Q: Can the ADR scalping strategy be used in all market conditions?

A: While the ADR scalping strategy is primarily designed for stable and ranging markets, it can be adapted to other market conditions with careful consideration. Traders should adjust their trading parameters, such as stop-loss levels and profit targets, to account for increased volatility or market trends.

Q: How often should I recalculate the ADR?

A: The frequency of ADR recalculation depends on the time frame of your trading strategy. For intraday scalping, it is recommended to recalculate the ADR daily or even intraday to adapt to changing market conditions.

Q: Is the ADR scalping strategy suitable for beginners?

A: While the ADR scalping strategy is relatively straightforward, beginners should approach it with caution and gain experience in trading before implementing it live. It is essential to understand the concept thoroughly and practice in a simulated environment or with a small account size.

Average Daily Range Forex Scalping Strategy Free Download

https://youtube.com/watch?v=CdAqvxo3sBY

Conclusion

The Average Daily Range forex scalping strategy is a powerful tool for traders seeking to capitalize on the natural volatility of currency pairs. By embracing the key concepts, leveraging expert advice, and implementing proper risk management techniques, you can unlock the potential of the ADR scalping strategy and transform your forex trading journey. Remember, consistency and patience are the keys to long-term success in any trading endeavor. Are you ready to elevate your trading game and experience the benefits of the ADR scalping strategy?