Introduction

Image: www.vrogue.co

In today’s interconnected global economy, foreign exchange (forex) transactions have become increasingly common. Whether you’re booking an overseas trip, purchasing products from international vendors, or investing in foreign markets, you’ll likely encounter forex charges on your financial transactions. These charges can add up quickly, especially if you’re making frequent or large transactions. Fortunately, many banks and financial institutions offer forex fee waivers, allowing you to save significant amounts of money on your currency conversion costs. In this comprehensive guide, we’ll delve into the ins and outs of forex fee waivers, explaining what they are, how to apply for them, and how to maximize your chances of getting them approved.

What Are Forex Fee Waivers?

A forex fee waiver is a discount or exemption from the fees typically charged by banks or other financial institutions when you convert currency. These fees, which typically range from 1% to 5% of the transaction amount, cover the costs of currency exchange and are a significant source of revenue for financial institutions. By obtaining a forex fee waiver, you can significantly reduce or eliminate these fees, saving you money on every international transaction you make.

Why Are Forex Fee Waivers Important?

Forex fee waivers are important because they can save you substantial amounts of money on foreign currency transactions. These savings can add up quickly, especially if you’re making frequent or large transactions. For example, if you’re making a $1,000 purchase from a foreign vendor and your bank charges a 3% forex fee, you’ll pay $30 in fees. With a forex fee waiver, you would save the entire $30 fee. Over time, these savings can accumulate, freeing up more of your hard-earned money for other expenses.

How to Apply for a Forex Fee Waiver

Applying for a forex fee waiver is typically a straightforward process, but requirements may vary depending on the bank or financial institution. Generally, you’ll need to contact your bank or financial institution and inquire about their forex fee waiver policy. You may be asked to provide information such as your account details, transaction history, and reasons for requesting a waiver. Some banks may offer forex fee waivers automatically to customers who meet certain criteria, such as high-volume traders or those who maintain large account balances.

Tips for Getting Your Forex Fee Waiver Approved

While banks are generally willing to consider forex fee waiver requests, there are certain strategies you can employ to increase your chances of approval. Here are a few tips:

- Be polite and professional:

- When contacting your bank or financial institution, be polite and professional in your request. Remember that the person you’re speaking with may have the authority to approve your waiver on the spot.

- Provide a compelling reason:

- Clearly state your reasons for requesting a forex fee waiver. Explain how the waiver will benefit you and why you believe you deserve it.

- Offer to provide supporting documentation:

- If you have documentation that supports your request, such as proof of high-volume trading or large account balances, offer to provide it to the bank or financial institution.

- Be persistent:

- If your initial request is denied, don’t give up. Contact the bank or financial institution again and try to speak with a different representative.

Conclusion

Forex fee waivers can save you significant amounts of money on international currency transactions. Applying for a forex fee waiver is a relatively simple process, and with the right strategies, you can increase your chances of getting it approved. By following the tips outlined in this guide, you can save money and make your international transactions more affordable. So the next time you’re about to convert currency, don’t hesitate to ask your bank or financial institution for a forex fee waiver.

Image: www.pdffiller.com

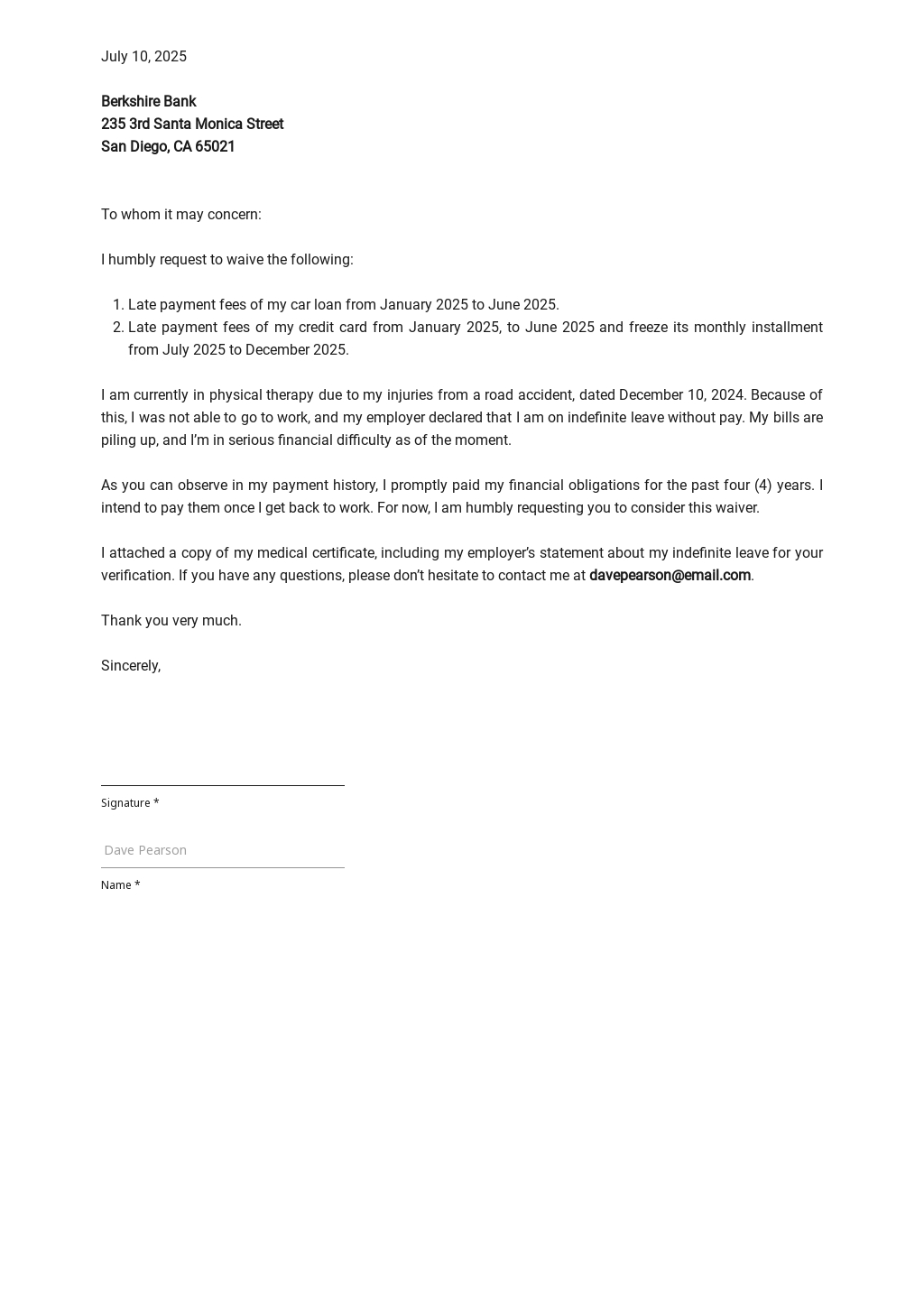

Application For Waiver For Forex Charges