In a world where global connectivity has become an indispensable part of life, traveling abroad and conducting business across borders is now commonplace. However, managing finances while traversing different currencies can often be a costly endeavor due to hefty cross-currency conversion fees. That’s where forex cards step in as a game-changer, offering a solution that eliminates these exorbitant charges. In this comprehensive guide, we delve into the realm of forex cards, unraveling their intricacies and empowering you with the knowledge to choose the best forex card with zero cross-currency conversion fees that suits your travel and financial needs.

Image: www.tradingwithrayner.com

Embark on a Journey of Seamless International Transactions

Forex cards, also known as travel cards or multi-currency cards, are prepaid cards that allow you to load multiple currencies onto a single card. They are widely accepted at ATMs, point-of-sale terminals, and online merchants worldwide, providing the flexibility to avoid carrying large amounts of foreign cash or exchanging currency at unfavorable rates. Unlike traditional credit or debit cards, forex cards often come with significantly lower or even zero cross-currency conversion fees, making them an ideal choice for those who frequently travel or conduct business abroad.

Unveiling the Mechanics of Zero Cross-Currency Conversion Fees

Cross-currency conversion fees are charges levied by banks or card issuers when you use your card to make a transaction in a currency different from the one your card is denominated in. These fees can vary depending on the card issuer and the currency being converted. Forex cards that offer zero cross-currency conversion fees essentially eliminate these charges, allowing you to make purchases and withdraw cash without incurring additional costs. This eliminates the hidden expenses that can accumulate during international travel, saving you money and providing peace of mind.

Navigating the Landscape of Forex Card Options

Choosing the right forex card can be a daunting task, given the array of options available. Here are some key factors to consider when making a decision:

- Fees: Compare the fees associated with different forex cards, including issuance fees, annual fees, reloading fees, and cross-currency conversion fees.

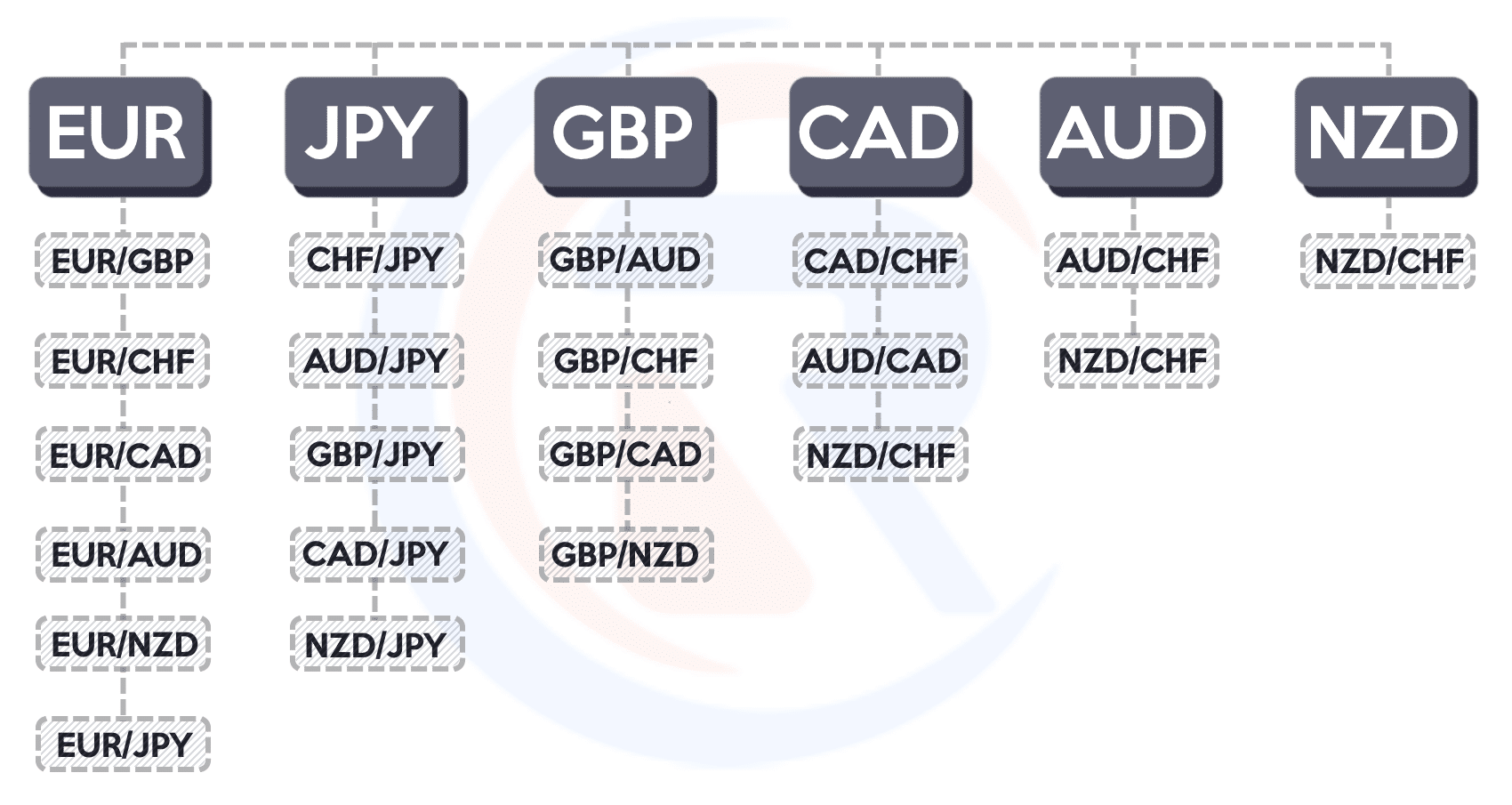

- Currencies: Determine the currencies you need for your travel or business needs and ensure that the forex card supports those currencies.

- Acceptance: Consider the acceptance network of the forex card to ensure it is widely accepted at the locations you plan to visit.

- Security: Look for forex cards that offer robust security features such as chip-and-PIN technology, fraud protection, and mobile alerts.

- Convenience: Choose a forex card that is easy to use, with convenient reloading options and a user-friendly online or mobile banking platform.

Image: m2pfintech.com

Harnessing the Benefits of Zero Cross-Currency Conversion Fees

Using a forex card with zero cross-currency conversion fees offers numerous advantages:

- Significant savings: Eliminating cross-currency conversion fees can accumulate substantial savings, especially for those who make frequent international transactions.

- Ease of budgeting: Knowing the exact amount you are spending in your home currency eliminates surprises and helps you stay within your budget.

- Enhanced convenience: Forex cards offer the convenience of carrying multiple currencies on a single card, reducing the need to exchange currency or carry cash.

- Increased security: Forex cards are generally more secure than carrying large amounts of cash and provide added protection against fraud and unauthorized transactions.

- Peace of mind: Using a forex card gives you peace of mind, knowing that you are getting the best exchange rates and avoiding hidden charges.

Any Forex Card Without Cross Currency Conversion Fee

Conclusion

In the realm of international finance, forex cards with zero cross-currency conversion fees stand as a beacon of savings, convenience, and peace of mind. By understanding the intricacies of forex cards and carefully considering the factors outlined in this guide, you can make an informed decision and choose the best forex card that meets your specific needs. Embrace the freedom of seamless international spending, unlock significant savings, and elevate your financial experience with a forex card that empowers your global endeavors.