Introduction

In the dynamic world of international finance, the regulation of foreign exchange plays a pivotal role in maintaining economic stability and transparency. In India, the Reserve Bank of India (RBI) holds the responsibility of overseeing foreign exchange transactions, ensuring their compliance with established guidelines. Annexure-1 of Foreign Exchange Circular No. 52 serves as a comprehensive document that outlines the detailed regulatory framework for such transactions.

Image: www.studocu.com

This article delves into the nuances of Annexure-1 of Forex Circular No. 52, explaining its significance, scope, and implications for individuals and businesses engaging in foreign exchange transactions in India. By gaining a clear understanding of this regulatory framework, readers can navigate the complexities of international finance with confidence and compliance.

Understanding Annexure-1 of Forex Circular No. 52

Annexure-1 of Forex Circular No. 52 is a comprehensive document that details the specific requirements and procedures for various types of foreign exchange transactions. The scope of the annexure encompasses:

- Permitted and prohibited transactions

- Documentation and reporting requirements

- Authorized dealers

- Foreign exchange remittance limits

- Penalties for non-compliance

Significance of Annexure-1

Understanding the provisions of Annexure-1 is essential for businesses and individuals seeking to engage in foreign exchange transactions. Adherence to these guidelines ensures compliance with RBI directives and avoids potential legal complications.

Implications for Businesses

Corporations regularly involved in foreign exchange transactions must meticulously follow the guidelines stipulated in Annexure-1. Proper documentation and adherence to remittance limits are crucial to ensure smooth operations and minimize compliance risks.

Image: www.forex4noobs.com

Implications for Individuals

Individuals planning foreign travel or educational pursuits overseas need to familiarize themselves with the regulations outlined in Annexure-1, particularly regarding permissible expenses and documentation requirements.

Key Provisions of Annexure-1

Annexure-1 of Forex Circular No. 52 encompasses a wide range of provisions governing foreign exchange transactions. Key aspects include:

- Permitted transactions: Defines the eligible transactions for individuals, such as travel, studies, and medical expenses.

- Prohibited transactions: Outlines transactions that are forbidden under the circular.

- Authorized dealers: Lists institutions authorized by RBI to facilitate foreign exchange transactions.

- Documentation requirements: Specifies the mandatory documents required for different types of transactions.

- Foreign exchange remittance limits: Imposes limits on the amount of foreign currency that can be remitted for various purposes.

Latest Trends and Developments

The RBI periodically revises and updates Annexure-1 to align with evolving market conditions and government policies. Staying abreast of these changes is essential for ensuring continued compliance and smooth execution of foreign exchange transactions.

Expert Advice and Tips

Complying with Annexure-1 of Forex Circular No. 52 involves navigating complex regulations. To ensure seamless transactions, consider these expert tips:

- Consult with authorized dealers for proper guidance and documentation.

- Maintain meticulous records and retain supporting documents for all transactions.

- Stay informed about any updates or revisions to the circular.

- Seek professional advice if any uncertainties or complexities arise.

FAQ

Q: What is the purpose of Annexure-1 of Forex Circular No. 52?

A: Annexure-1 provides detailed guidelines for various types of foreign exchange transactions, ensuring compliance and transparency.

Q: Who is responsible for regulating foreign exchange transactions in India?

A: The Reserve Bank of India (RBI) is the regulatory authority overseeing foreign exchange transactions in India.

Q: Which transactions are prohibited under Annexure-1?

A: Transactions such as capital account transactions, purchase of lottery tickets, and gambling-related activities are prohibited under Annexure-1.

Q: What are the penalties for non-compliance with Annexure-1?

A: Non-compliance may lead to fines, penalties, or other legal consequences.

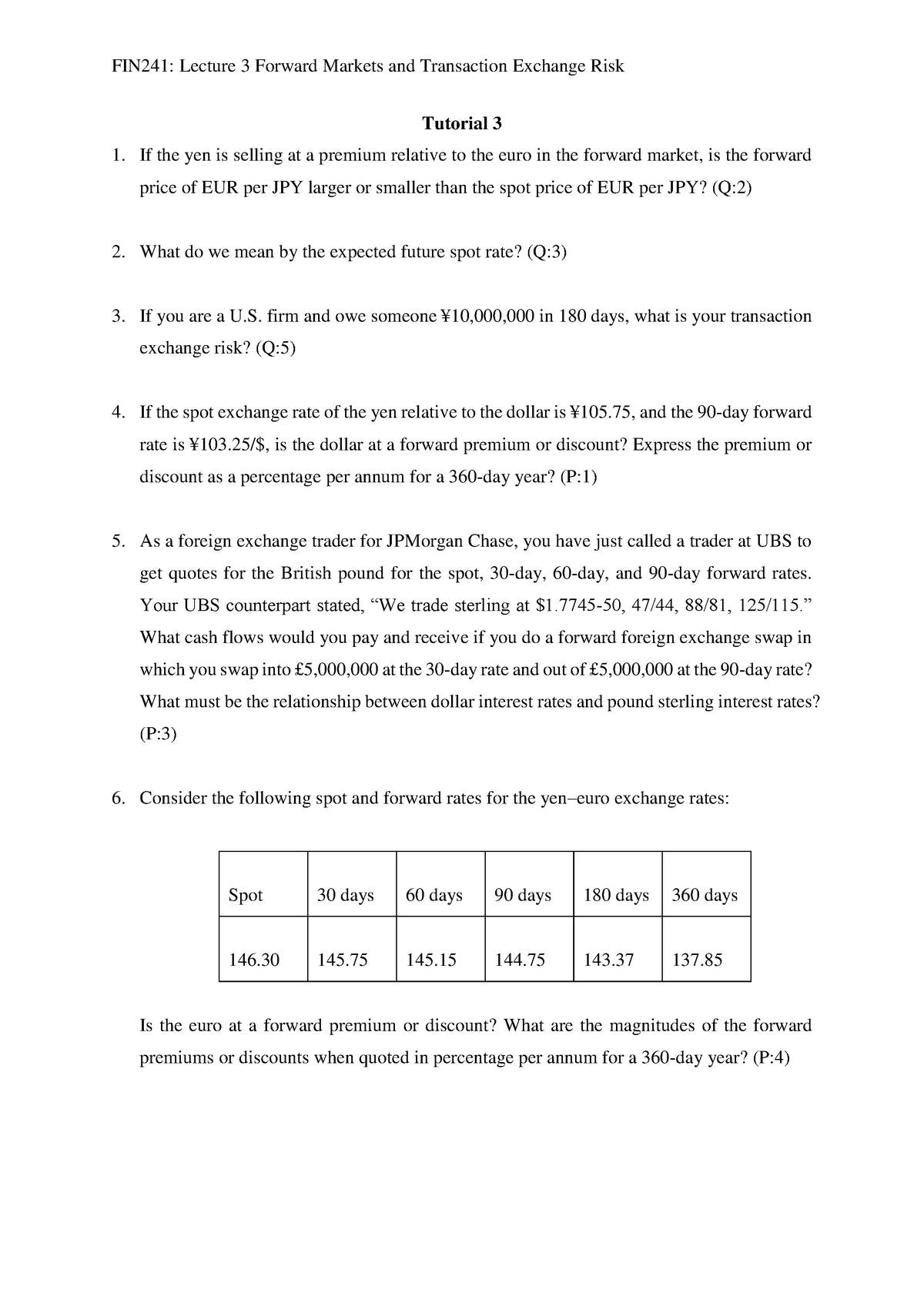

Annexure-1 Of Forex Circuluar No.52

Conclusion

Annexure-1 of Forex Circular No. 52 serves as a vital regulatory framework for foreign exchange transactions in India. Understanding its provisions and implications is paramount for individuals and businesses seeking to engage in cross-border transactions. By adhering to the guidelines outlined in the annexure, individuals and businesses can ensure compliance, mitigate risks, and enhance their ability to navigate the complexities of international finance.

Do you have any questions or require further clarification regarding Annexure-1 of Forex Circular No. 52? Please share your thoughts and engage in the discussion below.