Journey into the World of Foreign Exchange

Embark on an adventure where currencies dance and financial frontiers collide. Welcome to the intriguing realm of foreign exchange, where the value of one currency against another shapes global trade and personal travels. As a seasoned traveler, you’ll inevitably encounter the complexities of currency conversion, especially if you’re the proud owner of an American Express Platinum Travel Card. This article will delve into the intricacies of Amex Platinum travel card forex rates, empowering you with the knowledge to navigate the foreign exchange market with confidence.

Image: www.schwab.com

Amex Platinum Travel Card: Your Currency Conductor

The Amex Platinum Travel Card is renowned for its exceptional rewards and exclusive perks, making it an ideal companion for jetsetters and frequent travelers. One of its standout features is the favorable forex rates it offers. Understanding these rates is crucial to making informed decisions while traveling abroad. Forex rates fluctuate constantly, influenced by a myriad of factors such as economic conditions, political events, and supply and demand. The Amex Platinum Travel Card strives to provide competitive forex rates, offering cardholders peace of mind knowing they’re getting a fair conversion rate when using their card internationally.

Navigating Forex Rates: A Guide

To fully grasp Amex Platinum travel card forex rates, let’s break down the basics of foreign exchange. Forex rates are quoted in pairs, representing the value of one currency in relation to another. For instance, a quote of “GBP/USD 1.32” indicates that one British pound (GBP) is equivalent to 1.32 US dollars (USD). When converting currencies, you’ll need to consider both the buy rate and the sell rate. The buy rate is the rate at which you can buy foreign currency, while the sell rate is the rate at which you can sell foreign currency. The difference between these two rates is known as the spread, which represents the profit margin for currency exchange providers.

Optimizing Currency Conversion

To maximize the benefits of your Amex Platinum Travel Card forex rates, keep these tips in mind:

-

Monitor exchange rates: Stay abreast of currency fluctuations by using online tools or mobile apps that track real-time rates. This enables you to identify the most favorable conversion windows.

-

Avoid using ATMs for currency exchanges: While convenient, ATMs often offer less competitive forex rates compared to banks or currency exchange specialists.

-

Make large transactions: If possible, consolidate your foreign currency purchases into larger transactions to take advantage of bulk discounts or better exchange rates.

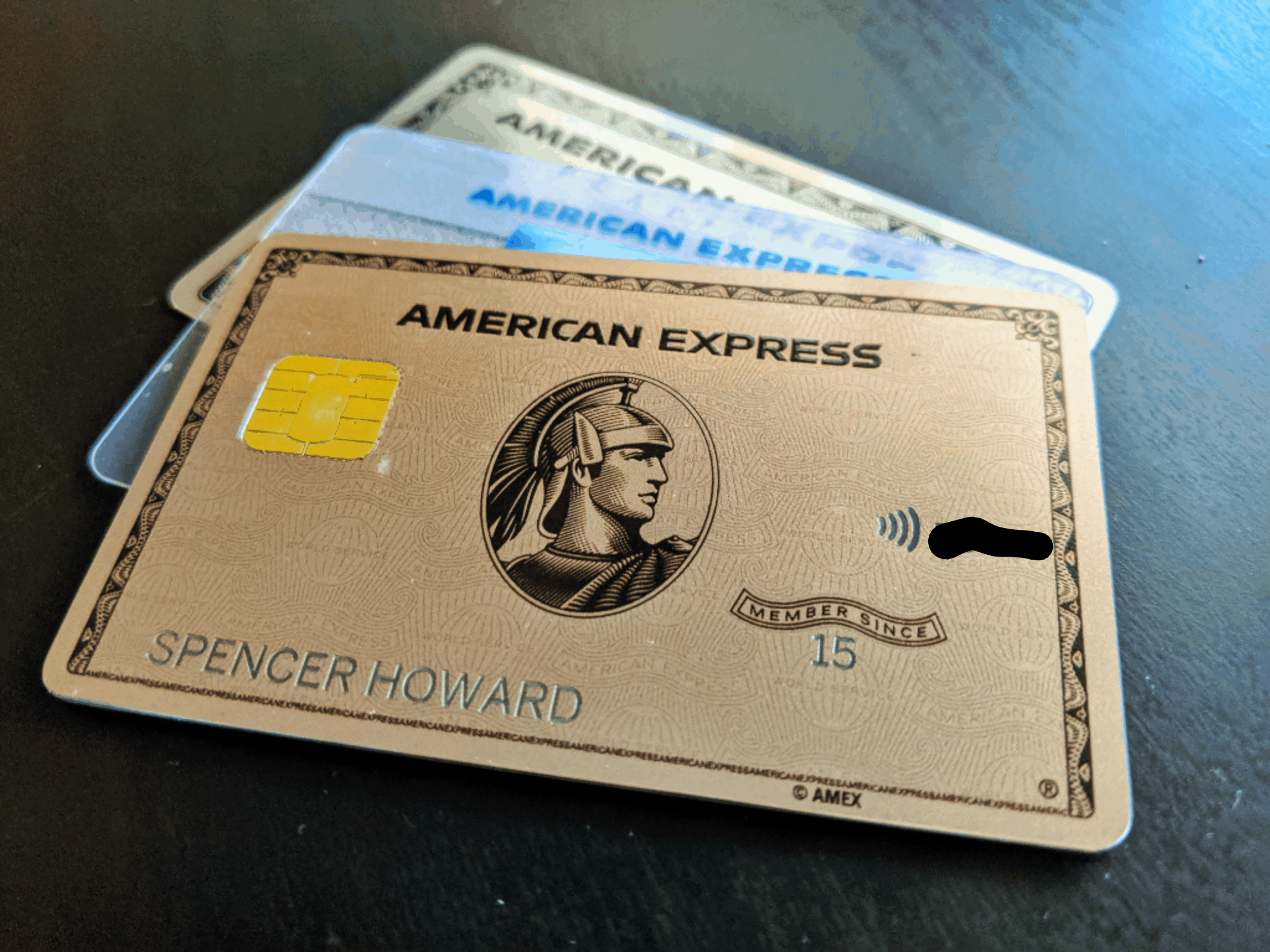

Image: 10xtravel.com

Frequently Asked Questions

Q: Are Amex Platinum travel card forex rates always the best?

A: Although Amex strives to offer competitive rates, it’s advisable to compare rates from multiple providers to secure the most favorable deal.

Q: How can I check the most up-to-date Amex Platinum forex rates?

A: Visit the American Express website or contact their customer service hotline to obtain real-time forex rates.

Amex Platinum Travel Card Forex Rates

Conclusion

Mastering Amex Platinum travel card forex rates is essential for discerning travelers seeking to maximize their financial advantage abroad. By understanding the dynamics of the foreign exchange market and following our expert advice, you can navigate the currency conversion landscape with confidence. Remember, informed decisions empower you to unlock the full potential of your Amex Platinum Travel Card, enhancing your travel experiences with every transaction.