Navigating the world of corporate travel expenses can be a daunting task, especially when dealing with foreign currency exchange fees. Among the most prevalent corporate cards, American Express (Amex) stands out with its extensive global network and array of services. However, understanding the nuances of Amex corporate card foreign exchange (forex) markup fees is crucial for optimizing expense management.

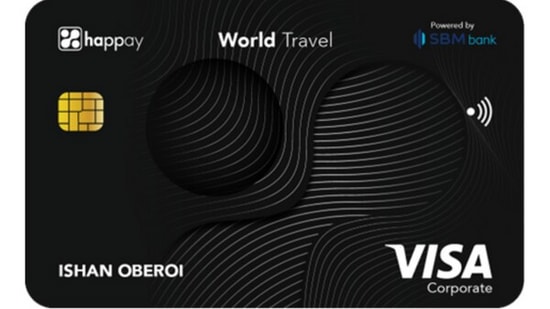

Image: www.hindustantimes.com

Forex markup fees are additional charges levied on transactions involving currency conversion. These fees are typically a percentage of the transaction amount and can significantly impact your overall travel expenses. Compounding with other travel-related costs, the cumulative effect can be substantial. Hence, it is imperative to have a clear comprehension of these fees to make informed decisions and devise effective cost-saving strategies.

Decoding Amex Corporate Card Forex Markup Fees

Amex corporate card forex markup fees are essentially the spread between the interbank exchange rate and the rate applied to your card transaction. The interbank rate, also known as the wholesale rate, is the rate at which banks exchange currencies among themselves. This rate is constantly fluctuating based on market conditions.

However, when you use your Amex corporate card for a foreign currency transaction, the rate applied is not the interbank rate. Instead, Amex adds a markup to this rate, which results in a higher cost for you. This spread, expressed as a percentage, represents the markup fee.

Factors Influencing Markup Fees

Several factors contribute to the determination of Amex corporate card forex markup fees, including:

- Transaction Currency: The currency you are converting to can impact the markup fee. Some currencies have higher exchange rate volatility and pose greater risk to Amex, leading to higher markup fees.

- Transaction Amount: Larger transaction amounts may qualify for lower markup fees as they carry less risk for Amex.

- Merchant Fees: Amex may also pass on merchant fees to the cardholder. These fees are typically charged by the merchant for processing foreign currency transactions and can vary depending on the merchant.

Minimizing the Impact of Forex Markup Fees

While forex markup fees are unavoidable, there are strategies to mitigate their impact:

- Negotiate Card Contract: Depending on the volume and frequency of your foreign currency transactions, you may be able to negotiate a lower markup fee with Amex.

- Utilize Local Currency: Whenever possible, try to make purchases in the local currency to avoid the need for currency conversion.

- Consider Other Payment Options: Explore alternative payment methods, such as wire transfers or using a separate travel card that offers more favorable exchange rates.

Image: www.youtube.com

Amex Corporate Card Forex Markup Fees

Conclusion

Amex corporate card forex markup fees are an inherent part of using the card for foreign currency transactions. By understanding the factors that influence these fees and implementing savvy cost-saving