Introduction

Account volume size, a pivotal aspect of forex trading, profoundly influences a trader’s profitability potential. It represents the magnitude of an individual’s trading activity and serves as a cornerstone for strategic decision-making. Grasping the significance of account volume size enables traders to optimize their forex experiences and elevate their trading performance to greater heights.

Image: howtotradeonforex.github.io

Comprehending this concept empowers traders with the ability to effectively manage risk, enhance adaptability to market fluctuations, and maximize potential gains. By carefully calibrating account volume size, traders can align their trading strategies with their financial objectives, risk tolerance, and individual circumstances.

The Interplay of Volume Size and Risk Management

Account volume size directly correlates with risk exposure in forex trading. Higher volume size implies greater potential profits but also entails amplified potential losses. Conversely, a smaller volume size reduces both potential gains and losses, creating a more conservative trading environment.

Striking the equilibrium between risk and reward is essential. Traders must meticulously assess their risk appetite and allocate account volume size accordingly. A misalignment between risk tolerance and volume size can lead to substantial financial setbacks, highlighting the importance of judicious risk management practices.

Volume Size in Relation to Market Volatility

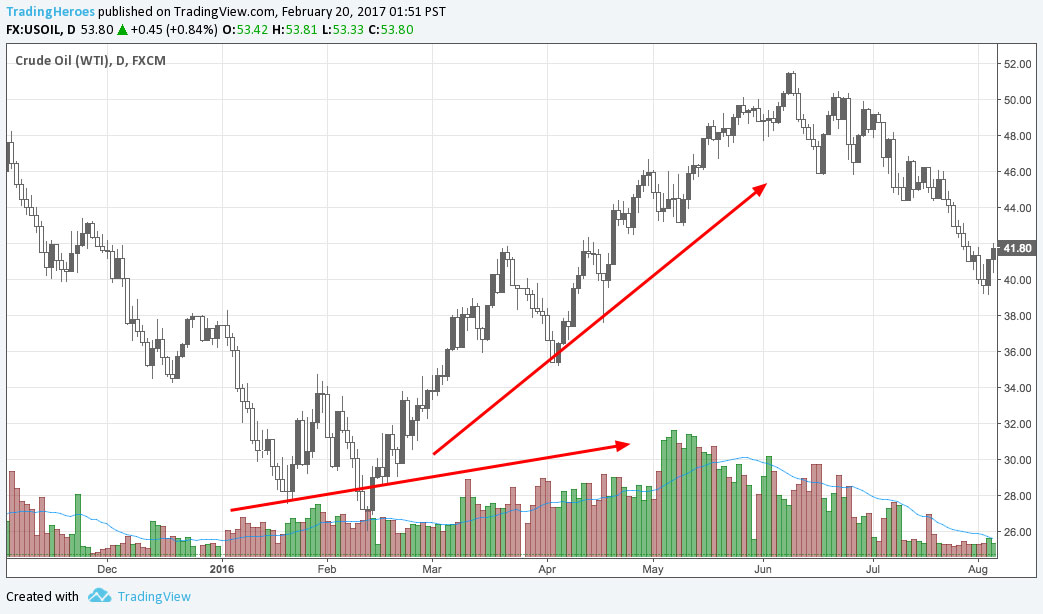

Market volatility, the ebb and flow of price fluctuations, significantly influences account volume size considerations. Periods of high volatility may demand reduced volume size to mitigate risk, while tranquil markets may allow for increased volume size to capitalize on potential opportunities.

Traders should continuously monitor market volatility and adjust their volume size accordingly. This dynamic approach ensures optimal risk management and maximizes profit potential.

Volume Size and Trading Strategy Alignment

Account volume size should align seamlessly with an individual’s trading strategy. Scalpers, who execute numerous short-term trades within a day, typically employ smaller volume sizes to manage risk and optimize profit potential. On the other hand, long-term traders, who hold positions for extended periods, often utilize larger volume sizes to capture market trends.

Choosing an appropriate volume size ensures that trading strategies are executed effectively and align with specific market conditions.

Image: www.babypips.com

Effective Volume Size Management Strategies

Managing account volume size effectively demands a proactive approach. Traders should consider the following strategies:

- Risk-Based Volume Determination: Allocate volume size proportional to risk tolerance, ensuring that potential losses align with financial capabilities.

- Position Sizing Discipline: Establish clear guidelines for position sizing based on market conditions, risk appetite, and trading strategy.

- Dynamic Volume Adjustment: Continuously evaluate market conditions and adjust volume size accordingly to optimize risk management.

- Progressive Volume Increase: Gradually increase volume size as trading experience grows and risk tolerance expands.

Account Volume Size In Forex

Conclusion

Account volume size in forex trading plays a pivotal role in enhancing performance and maximizing profitability. By comprehending its significance and implementing effective management strategies, traders can optimize their trading experiences and achieve their financial goals. Remember that volume size should align with risk tolerance, market volatility, trading strategy, and financial objectives.

Always prioritize prudent risk management, diligently monitor market conditions, and continuously refine your trading approach to excel in the dynamic world of forex trading.