Harnessing the Power of Technical Indicators for Profitable Scalping

As a seasoned forex trader, I’ve always been intrigued by the dynamic nature of markets. The constant ebb and flow of prices can be both exhilarating and challenging. Over the years, I’ve discovered that having a solid strategy in place is crucial for navigating the complexities of the forex market. In this article, I’ll share my experience using a 5-minute forex scalping strategy that combines the Stochastic Oscillator and Supertrend Indicator. This strategy has proven to be highly effective in identifying short-term opportunities and maximizing profits.

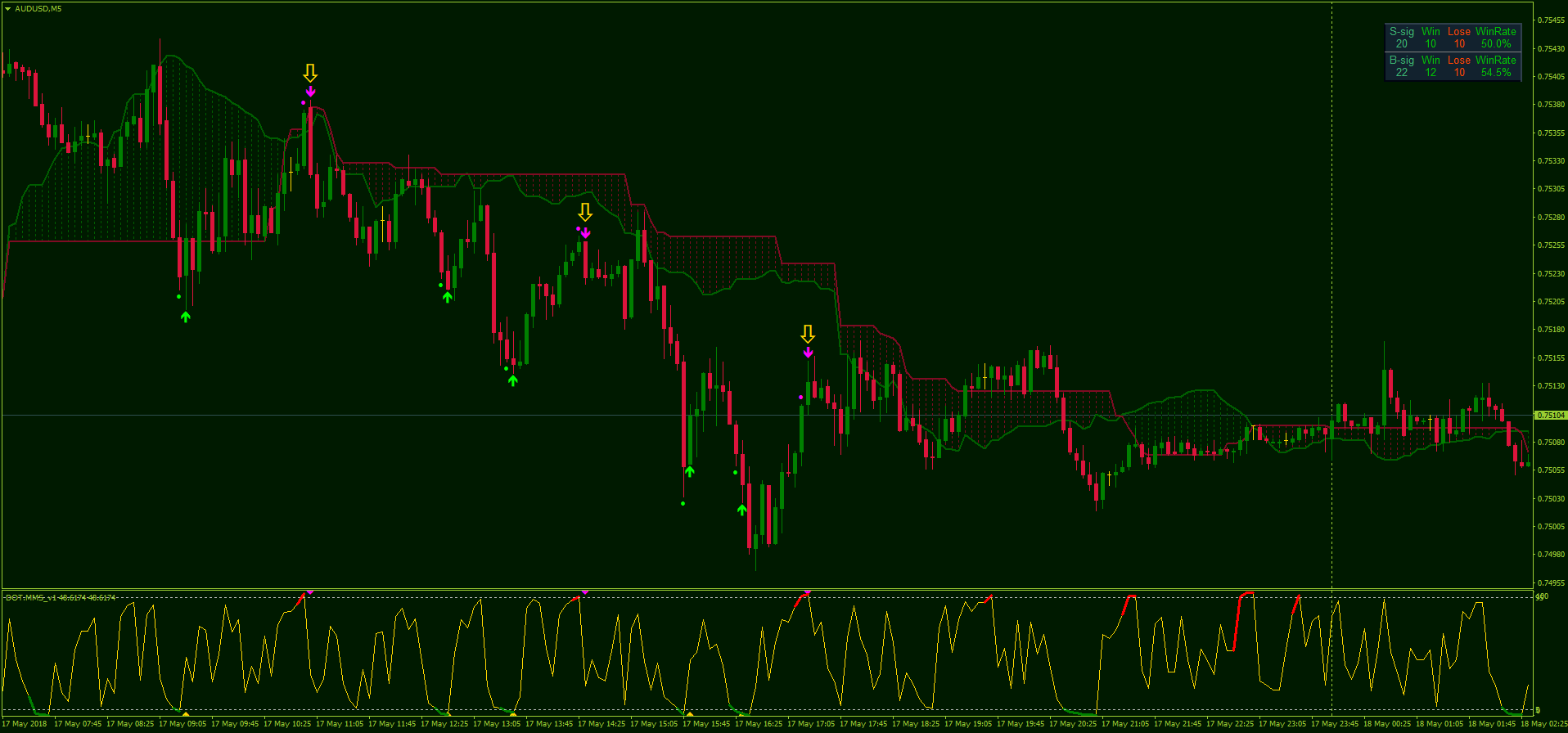

Image: ddfxforextradingsystemreview.blogspot.com

Understanding Scalping and Its Benefits

Scalping is a high-frequency trading approach characterized by placing a large number of small trades over short timeframes. The goal of scalping is to capture quick profits from small price movements. This approach requires a combination of technical analysis skills, market knowledge, and a disciplined mindset. The 5-minute timeframe provides a balance between speed and accuracy, allowing traders to take advantage of short-lived price changes.

Benefits of Scalping

- Profit from small movements: Scalping targets small price fluctuations, allowing traders to capitalize on even minor market changes.

- High liquidity: The forex market is highly liquid, providing ample opportunities for executing multiple trades within a short period.

- Reduced risk: Because scalping involves small-volume trades, it limits the potential losses on any given trade.

Utilizing the Stochastic Oscillator and Supertrend Indicator

To improve precision and reliability, I employ a combination of two powerful technical indicators: the Stochastic Oscillator and the Supertrend Indicator. These indicators complement each other, providing valuable insights and confirmation signals.

Image: aytoo.ma

Stochastic Oscillator

The Stochastic Oscillator measures the momentum of price movements. It fluctuates between 0 and 100, with values above 80 indicating overbought conditions and values below 20 signaling oversold conditions. Scalpers use the Stochastic Oscillator to identify potential reversal points and trade in the direction of the underlying trend.

Supertrend Indicator

The Supertrend Indicator is a trend-following indicator that plots a moving average with a volatility-based stop and reverse mechanism. When the Supertrend line is above the price, the trend is considered up; when it’s below, the trend is down. Scalpers utilize the Supertrend Indicator to determine the primary trend and trade with the direction of least resistance.

Implementing the Strategy

The 5-minute forex scalping strategy using the Stochastic Oscillator and Supertrend Indicator is a five-step process:

- Identify the trend: Use the Supertrend Indicator to determine the overall market direction.

- Confirm the trend reversal: Monitor the Stochastic Oscillator and wait for it to cross below 20 (for bullish trend reversals) or above 80 (for bearish trend reversals).

- Enter the trade: Enter a long trade when the Stochastic Oscillator crosses above 20 and the Supertrend Indicator is above the price. Conversely, enter a short trade when the Stochastic Oscillator crosses below 80 and the Supertrend Indicator is below the price.

- Set stop loss: Place a stop loss order below the recent swing low for long trades and above the recent swing high for short trades.

- Take profit: Close the trade when the Stochastic Oscillator reaches the opposite boundary, or when the Supertrend Indicator reverses direction.

Tips and Expert Advice

To maximize the effectiveness of this strategy, consider the following tips:

- Use a demo account: Before implementing this strategy in a live account, practice on a demo account to gain confidence and avoid the risk of losing real capital.

- Manage risk effectively: Employ proper risk management techniques such as stop-loss orders and position sizing to safeguard your trading capital.

- Stay disciplined: Stick to the trading plan and avoid making impulsive decisions based on emotions.

- Monitor the market constantly: Scalping requires constant market monitoring to identify potential opportunities and adjust positions as needed.

Frequently Asked Questions

Q: Is scalping a profitable trading strategy?

A: Scalping can be profitable if executed correctly. However, it requires discipline, a solid strategy, and proper risk management.

Q: How much capital do I need for scalping?

A: The amount of capital needed depends on the trading volume. It’s recommended to start with a small capital and gradually increase it as you gain experience.

Q: What currency pairs are best for scalping?

A: Major currency pairs such as EUR/USD, GBP/USD, and USD/JPY offer high liquidity and volatility, making them suitable for scalping.

5 Min Forex Scalping Strategy With Stochastic And Supertrend Indicator

Conclusion

The 5-minute forex scalping strategy outlined in this article offers a systematic approach to profiting from short-term price movements. By combining the Stochastic Oscillator and Supertrend Indicator, traders can identify profitable trading opportunities with greater confidence. However, it’s crucial to practice on a demo account, manage risk responsibly, and adhere to the trading plan to maximize the potential of this strategy. If you found this article informative, please share it with others and leave a comment below. Is this a trading strategy that you’re interested in learning more about?