In the bustling world of foreign exchange (forex) trading, one pivotal phenomenon emerges that can dramatically impact traders’ strategies: the 4 o’clock fix. This intriguing event, occurring daily at the stroke of 4 PM London time, holds significant implications for currency movements and trading opportunities. Join us as we delve into the intricacies of the 4 o’clock fix, its history, mechanics, and the profound impact it holds in the world of forex trading.

Image: otrabalhosocomecou.macae.rj.gov.br

Understanding the 4 O’Clock Fix: A Brief Historical Overview

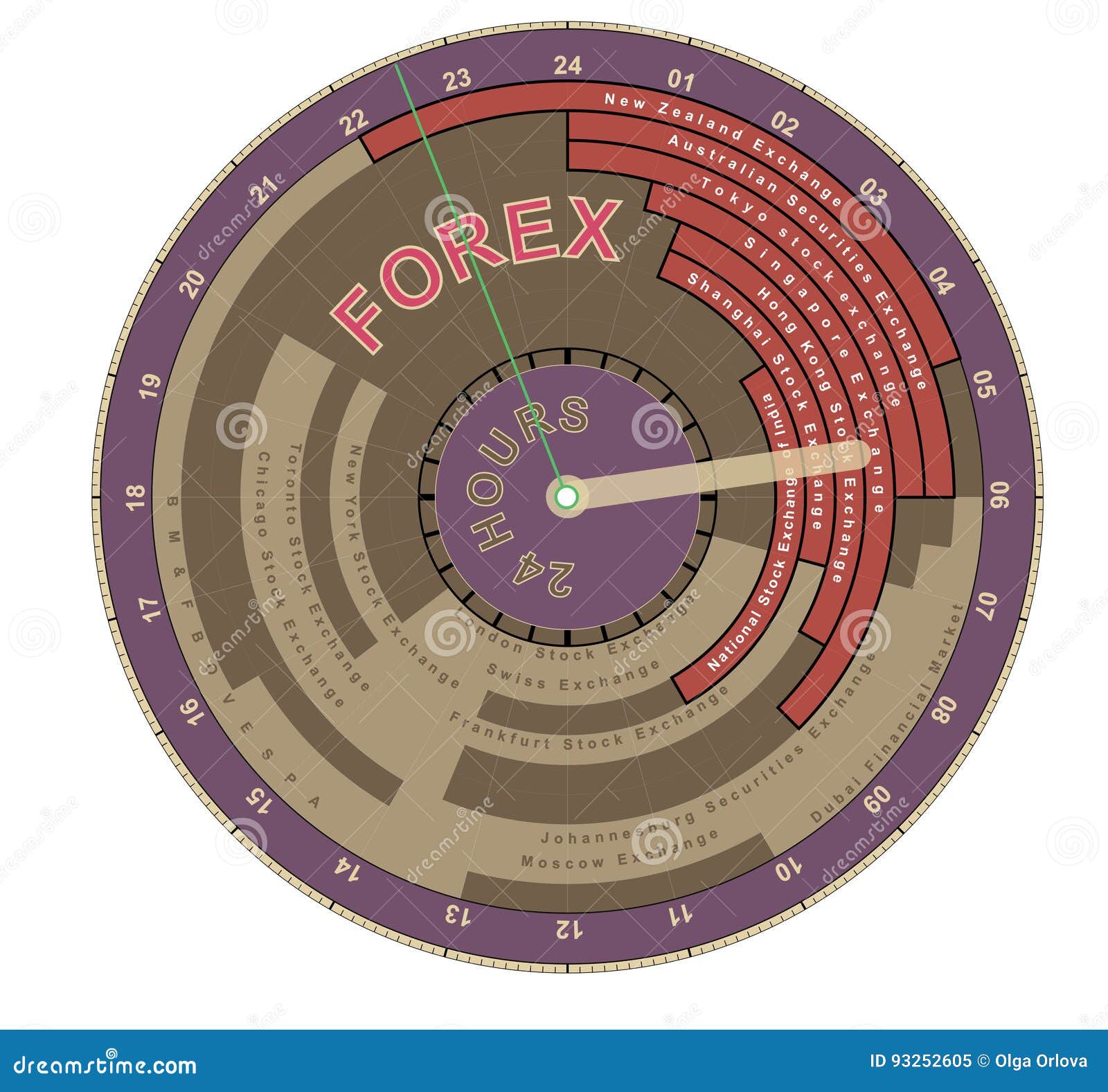

The 4 o’clock fix traces its roots back to the days when global financial markets operated under the confines of rigid time zones and the limitations of outdated technology. Prior to the advent of electronic trading, all transactions were manually executed over the phone or through inter-dealer brokers. By 4 PM in London, most orders from the Asian and European marketplaces had been processed, and the dominant financial centers were preparing for the close of their trading sessions.

As a result, a window of relative illiquidity emerged around this juncture, marked by a confluence of closing orders and a lull in fresh trades. This vacuum created an opportunity for major banks and institutions to exert greater influence on currency prices by executing large trades. By coordinating their actions at approximately 4 PM, these market participants could manipulate prices in their favor. This coordinated manipulation is known as the 4 o’clock fix.

Decoding the Mechanics of the 4 O’Clock Fix

The 4 o’clock fix is not a rigidly structured event but rather an informal understanding among major market participants. There are no specific regulations or guidelines dictating how these trades should be executed or what specific instruments should be involved. The participants’ actions hinge upon their individual interests and market analysis, with the goal of steering price movements to their advantage.

While the 4 o’clock fix is commonly associated with major currency pairs like EUR/USD and USD/JPY, it encompasses a wide range of forex instruments. The exact selection of currencies depends on market conditions and the objectives of the market participants involved.

Unveiling the Impact of the 4 O’Clock Fix on Forex Trading

The impact of the 4 o’clock fix on forex trading can be substantial, particularly during periods of heightened market volatility or economic uncertainty. The concentration of trading activity and the potential for price manipulation can introduce significant volatility in the lead-up to and during the execution of the fix.

Strategic traders meticulously monitor price behavior around the 4 o’clock fix, anticipating potential breakouts or reversals. Some traders aim to capitalize on the increased volatility by implementing scalping or range trading strategies. Others adopt a more patient approach, waiting for significant price movements to crystallize before initiating positions.

Image: forexscalpersignals1.blogspot.com

Strategies for Navigating the 4 O’Clock Fix

To navigate the complexities of the 4 o’clock fix, traders can employ several effective strategies:

- Awareness: Remaining abreast of geopolitical events, economic data, and other market catalysts that may influence the 4 o’clock fix is crucial.

- Technical Analysis: Identify technical patterns and indicators that can help predict price movements around this event.

- Risk Management: Establish robust risk management protocols, including setting stop-loss and take-profit levels, to mitigate potential losses.

- Diversification: Diversify trading activity across various currency pairs and time frames to minimize exposure to the impact of the 4 o’clock fix.

- Avoidance: For traders seeking to steer clear of market turbulence, it may be prudent to avoid trading close to the 4 o’clock fix.

4 O Clock Fixing Forex

Conclusion

The 4 o’clock fix in forex trading presents both opportunities