Introduction: Unlocking the Enigmatic World of Forex Quotes

In the realm of global finance, foreign exchange rates are instrumental in facilitating cross-border transactions and investments. Understanding these rates requires deciphering the intricate notations employed by forex brokers. Among these notations, the 1.998 0.002 figure has sparked curiosity and raised questions. In this comprehensive guide, we embark on a quest to unravel the mysteries behind this enigmatic quote, empowering you with the knowledge to navigate the complexities of the forex market.

Image: www.pinterest.com

Breaking Down the Components: A Step-by-Step Guide

The 1.998 0.002 forex quote comprises two essential components:

-

1.998: This number represents the bid price, indicating the exchange rate at which you can sell the base currency (in this case, typically the US dollar) in exchange for the quote currency (commonly the euro in this context).

-

0.002: This value represents the spread, indicating the difference between the bid price and the ask price (the rate at which you can buy the quote currency).

Practical Application: A Numerical Example

To further solidify your understanding, let’s consider a practical example:

Suppose the quote is 1.998 0.002, and you intend to exchange $100 into euros. Using the bid price of 1.998, you would receive:

*Euros = $100 1.998 = €199.8**

Now, if you decide to buy euros instead, you would need to use the ask price, which is typically slightly higher than the bid price. Assuming the ask price is 2.000, the calculation would be as follows:

*$100 = €199.8 2.000**

Currency Pairing: Interpreting the Base and Quote Currencies

In forex quotes, the first currency listed represents the base currency, while the second currency is known as the quote currency. Forex pairs fluctuate constantly, influenced by a myriad of economic and political factors. Therefore, staying abreast of these market movements is crucial for informed decision-making.

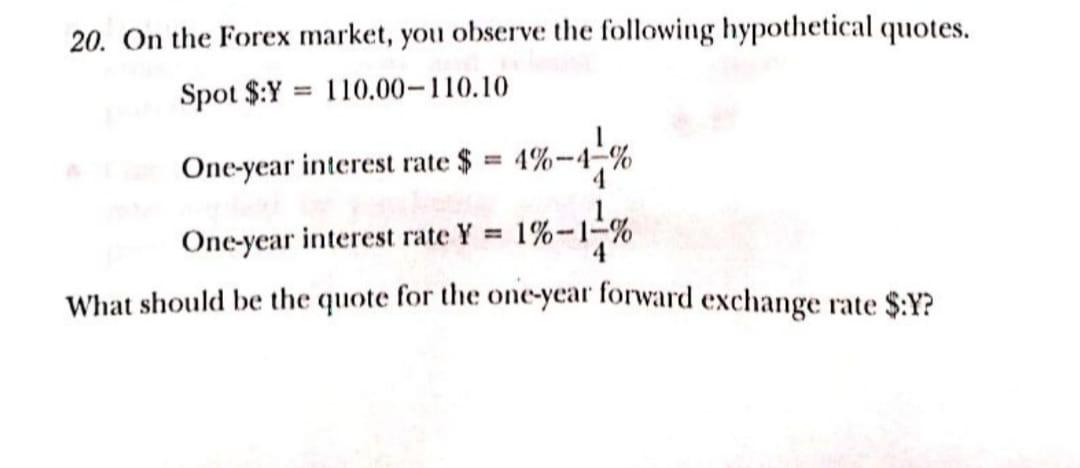

Image: www.chegg.com

Currency Notations: Embracing the Common Formats

Forex quotes can be expressed in various notation formats, depending on the market convention or broker’s preference. Here are some commonly encountered formats:

-

1.9980: This format omits the decimal point and presents the spread in points, where each point equals 0.0001.

-

1.998/2.000: This notation explicitly states the bid price and the ask price, separated by a slash.

-

EUR/USD 1.998 0.002: This format includes the currency pair, making it clear which currencies are being quoted.

Market Factors: Understanding the Forces that Drive Forex Rates

A complex interplay of economic and political factors influences the ebb and flow of forex rates. These factors include, but are not limited to:

-

Interest Rates: Changes in central bank interest rates can significantly impact currency values.

-

Economic Growth: Strong economic growth in a particular country can boost the value of its currency.

-

Inflation Rates: Rising inflation rates tend to weaken a currency’s value.

-

Political Stability: Political turmoil or uncertainty can lead to currency fluctuations.

-

Supply and Demand: The ratio of supply and demand for a particular currency also affects its exchange rate.

Tips for Success: Navigating the Forex Market

If you’re venturing into the forex market, here are some tips to consider:

-

Choose a Reputable Broker: Partnering with a reliable and regulated forex broker is paramount.

-

Understand Currency Pairs: Familiarize yourself with the different currency pairs and their underlying dynamics.

-

Monitor Market News: Stay informed about global economic and political events that may impact currency rates.

-

Use a Demo Account: Practice your trading strategies in a risk-free environment before investing real funds.

-

Manage Risk: Utilize stop-loss and limit orders to manage potential losses and protect your capital.

1.998 0.002 How To Read This Forex Quote

Conclusion: Powering Informed Decisions in the Forex Market

Understanding how to read forex quotes, such as 1.998 0.002, unlocks a world of financial possibilities. By deciphering these intricate notations, you equip yourself to make informed decisions and navigate the ever-evolving forex market effectively. Remember, knowledge is power, and in the realm of forex, this power grants you the ability to harness financial opportunities and achieve your investment goals.