In the realm of financial trading, foreign exchange (forex) and binary options stand as two distinct instruments, each catering to different investor profiles and risk appetites. While both involve speculation on financial markets, they differ vastly in their underlying mechanisms, risk-reward profiles, and regulatory frameworks. This article demystifies the key distinctions between forex and binary options, empowering you to make informed trading decisions.

Image: howtotradeonforex.github.io

Forex: The Global Currency Market

Forex, short for foreign exchange, refers to the global decentralized market where currencies are traded. In this vast arena, participants speculate on the relative value of currencies, aiming to profit from exchange rate fluctuations. Forex trading involves buying one currency while simultaneously selling another, with the hope of profiting from subsequent price movements.

Key Features of Forex

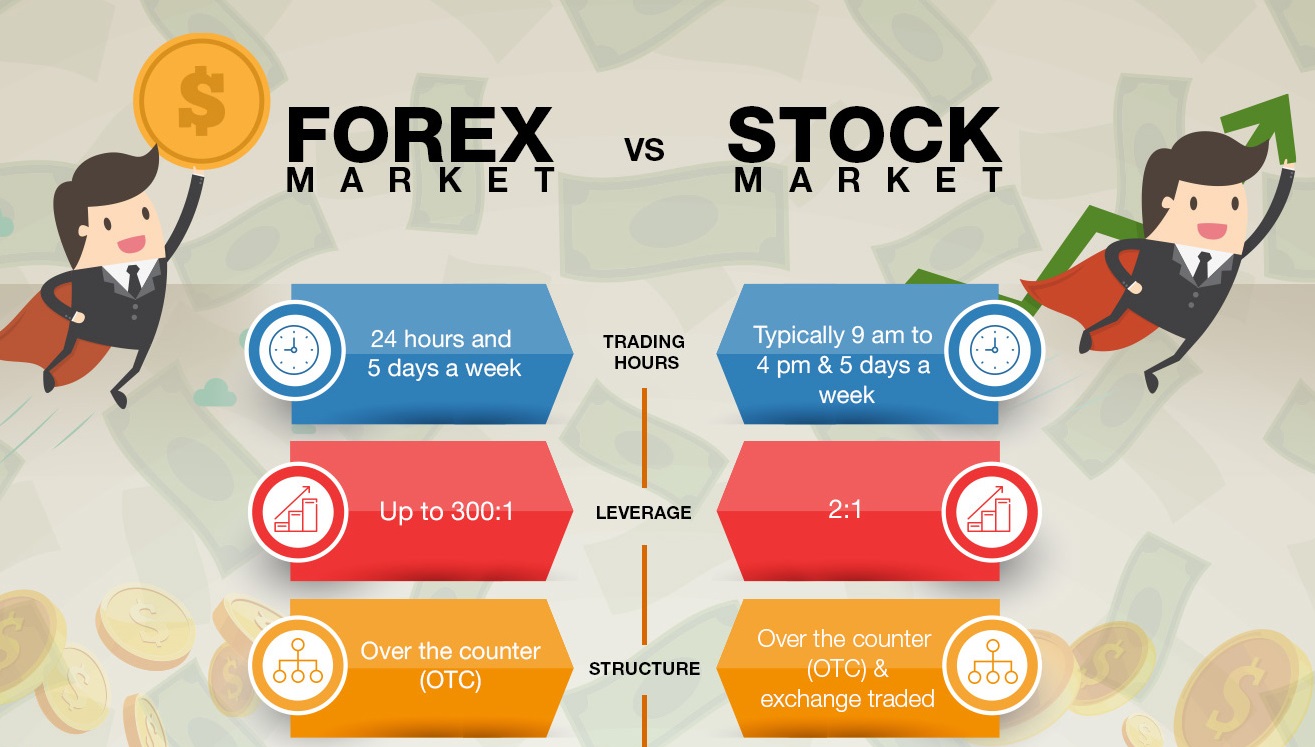

- Traded in Pairs: Forex transactions always involve trading two currencies simultaneously.

- Decentralized: The forex market operates over-the-counter (OTC), meaning there is no central exchange.

- High Liquidity: Forex is renowned for its exceptional liquidity, ensuring ease of entry and exit for traders.

- Leverage Available: Brokers offer leverage, which allows traders to increase their buying power. However, it is crucial to use leverage judiciously as it magnifies both potential gains and losses.

- 24-Hour Market: Forex trading is available round-the-clock, providing opportunities for traders from various time zones.

Binary Options: All-or-Nothing Propositions

In contrast to forex, binary options present a simplified form of trading with a predetermined outcome. Binary options contracts involve predicting whether the price of an underlying asset will rise or fall within a specified time frame. Correct predictions result in fixed payouts, while incorrect ones lead to a loss of the initial investment.

Image: www.pipsafe.com

Key Features of Binary Options

- Fixed Returns: The potential payout for binary options is predetermined, offering a clear profit or loss scenario.

- Time-Bound: Binary options contracts have a specific expiration time, with payouts being determined at the time the contract expires.

- Limited Risk: The maximum risk in binary options trading is limited to the initial investment, unlike forex, where losses can spiral with uncontrolled leverage.

- Simplified Trading: Binary options are marketed as beginner-friendly instruments due to their ease of execution and fixed risk-reward structure.

- Limited Flexibility: Binary options offer limited flexibility compared to forex, as the trading options are confined to simple up or down predictions.

Forex vs. Binary Options: A Comparative Analysis

- Trading Mechanism: Forex involves trading currencies in pairs, while binary options involve predicting price movements of underlying assets.

- Risk-Reward Profile: Forex carries unlimited risk due to leverage, while binary options cap risk at the initial investment.

- Complexity: Forex trading is more complex and requires a deeper understanding of financial markets, while binary options are marketed as simpler instruments.

- Liquidity: Forex boasts exceptional liquidity compared to binary options, ensuring ease of order execution.

- Regulation: Forex trading is overseen by regulatory bodies worldwide, while binary options face varying levels of regulations across jurisdictions.

What Is The Difference Between Forex And Binary

Which Is Right for You: Forex or Binary Options?

The choice between forex and binary options hinges on your risk tolerance, trading goals, and understanding of financial markets.

If you:

- Seek high potential returns and are comfortable navigating complex markets with unlimited risk potential, forex may be a viable option.

- Prefer predictable returns, limited risk, and a simplified trading experience, binary options could be a better fit.

Remember, savvy trading in either market requires thorough research, a comprehensive understanding of the underlying principles, and prudent risk management strategies. It’s advisable to seek guidance from reputable sources and consider your risk tolerance before venturing into financial trading.