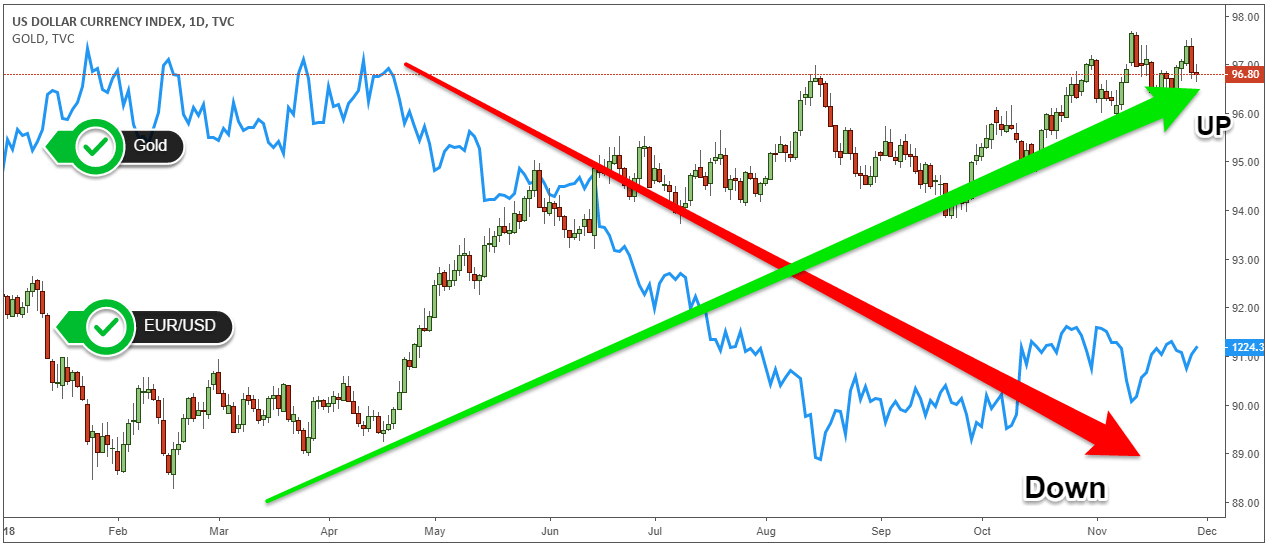

In the ever-evolving global marketplace, the foreign exchange (forex) market plays a pivotal role in facilitating international trade and investment. However, fluctuating currency values can pose significant risks to businesses and individuals transacting across borders. Enter forex hedging strategies, a financial safeguard that mitigates these risks and ensures peace of mind in the face of forex market volatility.

Image: www.forex.academy

Understanding Forex Hedging

Forex hedging is a financial technique that involves using financial instruments to offset the potential adverse effects of currency fluctuations. By strategically employing hedging instruments, businesses and individuals can lock in favorable exchange rates and protect their profits or investments from currency risks. The forex market is vast and complex, with numerous hedging strategies available to suit varying needs and risk profiles.

Common Forex Hedging Instruments

Among the most common forex hedging instruments are:

-

Forward Contracts: Customizable contracts that lock in an exchange rate for a future date.

-

Futures Contracts: Standardized contracts traded on exchanges that obligate parties to buy or sell a specific currency at a predetermined price on a future date.

-

Options Contracts: Contracts that give the holder the right, but not the obligation, to buy or sell a specific currency at a specified price on a future date.

-

Currency Swaps: Agreements to exchange currencies at predetermined rates on specified dates.

Benefits of Forex Hedging

The primary benefit of forex hedging is its ability to reduce the financial impact of currency fluctuations. By locking in favorable exchange rates, businesses can protect their profit margins and ensure stable cash flows. Individuals investing abroad can safeguard their investments from currency贬值. Additionally, hedging can improve financial planning by providing predictability and reducing uncertainty.

Image: pezewehemave.web.fc2.com

Expert Insights on Forex Hedging

“Forex hedging is a crucial risk management tool for businesses operating in the global marketplace,” notes Dr. Emily Carter, a leading economist at the International Monetary Fund. “By carefully selecting and implementing hedging strategies, companies can mitigate the negative consequences of currency fluctuations and enhance their financial performance.”

Actionable Tips for Effective Forex Hedging

Effective forex hedging requires careful planning and execution. Consider these tips:

-

Assess Risks and Objectives: First, determine your risk tolerance and the specific currency risks you need to hedge.

-

Research Available Instruments: Explore the various hedging instruments available and select those that align with your risk profile and financial situation.

-

Monitor Market Conditions: Stay abreast of forex market trends and economic indicators that may impact currency values.

-

Seek Professional Advice: If necessary, consult with financial experts to guide you through the complexities of forex hedging and implement customized strategies.

What Is Forex Hedging Strategy

Conclusion

Forex hedging strategies are indispensable tools for navigating the uncertainties of the forex market. By employing these strategies, businesses and individuals can mitigate currency risks and secure their financial well-being. The benefits of reduced uncertainty, improved financial planning, and enhanced investment protection make forex hedging an essential component of global financial management. Remember to carefully evaluate risks, explore hedging instruments, monitor market conditions, and seek professional advice if needed to maximize the effectiveness of your forex hedging strategy.