In the dynamic and fiercely competitive world of forex trading, understanding arbitrage can be the key to unlocking exceptional returns with minimal risk. Arbitrage in forex, simply put, is a trading strategy that capitalizes on price differentials between two or more currencies across different exchanges or platforms, allowing traders to profit from the misalignment. By leveraging the myriad of currency markets available, forex arbitrageurs strive to identify and exploit these price variances, creating opportunities to extract risk-free gains.

Image: www.fxpremiere.com

This guide will delve into the intricacies of forex arbitrage, providing you with a thorough understanding of its history, basic concepts, and practical applications. Learn about the essential strategies, market dynamics, and risk management techniques employed by successful forex arbitrageurs. Whether you’re a novice trader dipping your toes into the waters of forex or an experienced professional seeking to expand your skillset, this comprehensive exploration will equip you with the knowledge and strategies to navigate the intricacies of forex arbitrage effectively.

The Historical Roots of Arbitrage

The concept of arbitrage has been embedded in the fabric of financial markets for centuries. Its origins can be traced back to the ancient Greek merchants who profited by buying goods in one city and selling them at a higher price in another. In the modern era, arbitrage has become an indispensable tool for investors seeking to exploit price discrepancies across different markets. The advent of electronic trading platforms and high-speed data feeds has further propelled arbitrage into the realm of lightning-fast execution, enabling traders to identify and capitalize on market inefficiencies with remarkable precision.

Types of Forex Arbitrage

The terrain of forex arbitrage encompasses various techniques, each designed to capitalize on specific market conditions. Understanding the nuances of these strategies is paramount for aspiring arbitrageurs. Let’s explore some prevalent types of forex arbitrage:

• Pure Arbitrage: This strategy, also known as triangular arbitrage, involves exploiting price discrepancies between three or more currencies. By buying and selling these currencies in a sequential manner, pure arbitrageurs aim to lock in profit irrespective of exchange rate fluctuations.

• Carry Trade Arbitrage: Carry trade arbitrage entails borrowing a currency with a lower interest rate and investing it in a currency with a higher interest rate. The difference between the two interest rates, known as the carry, represents the potential profit.

• Statistical Arbitrage: This technique leverages statistical models and data analysis to identify and capitalize on recurring price patterns in the forex market. By meticulously studying historical data, statistical arbitrageurs seek to exploit inefficiencies and maximize their returns.

Understanding Market Dynamics

The forex market, the largest and most liquid financial market globally, is a complex ecosystem influenced by numerous factors. To succeed in forex arbitrage, it is imperative to possess a comprehensive understanding of the market dynamics that drive price movements. These factors include:

• Economic Data: Economic indicators, such as GDP growth, inflation, and unemployment rates, can significantly impact currency values by providing insights into the overall health of a country’s economy.

• Political Events: Political instability, elections, and changes in government policies can introduce volatility into the forex market, creating opportunities for arbitrageurs to profit from sudden price shifts.

• News and Market Sentiment: Breaking news, geopolitical developments, and shifts in market sentiment can trigger rapid price movements, offering arbitrageurs fleeting opportunities to capitalize on market reactions.

Image: erokytumak.web.fc2.com

Risk Management in Forex Arbitrage

While forex arbitrage is often perceived as a low-risk trading strategy, it’s crucial to acknowledge that no investment is entirely devoid of potential risks. To mitigate these risks, successful arbitrageurs adhere to stringent risk management practices:

• Diversify Trading: Spreading investments across multiple arbitrage strategies reduces overall risk exposure. By not relying heavily on a single technique, arbitrageurs enhance their chances of consistent profitability.

• Monitor Positions: Continuous monitoring of open arbitrage positions is essential to ensure timely adjustments based on market movements. This proactive approach enables arbitrageurs to minimize losses and maximize gains.

• Set Stop-Loss Orders: Employing stop-loss orders is a prudent strategy for limiting potential losses. By automatically exiting trades when predetermined price levels are reached, stop-loss orders safeguard against substantial drawdowns that could erode profits.

Harnessing Technology for Forex Arbitrage

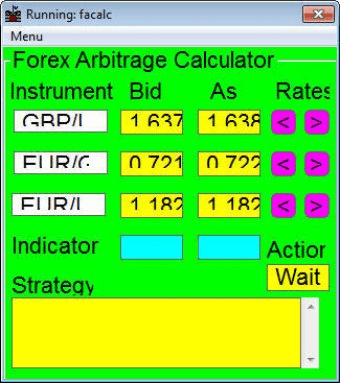

In today’s fast-paced trading environment, technology has become an indispensable ally for forex arbitrageurs. Cutting-edge platforms and automated trading systems empower traders with the tools to:

• Scan for Opportunities: Sophisticated algorithms continuously scan multiple markets in real-time, promptly identifying arbitrage opportunities that match predefined criteria, allowing traders to act swiftly.

• Execute Trades: Automated trading systems seamlessly execute arbitrage trades with remarkable speed and precision, capitalizing on fleeting market inefficiencies before they vanish.

• Manage Risk: Advanced risk management modules enable arbitrageurs to set stop-loss orders, monitor market positions, and receive real-time alerts, enhancing their ability to navigate market volatility effectively.

What Is Arbitrage In Forex

Conclusion: Unveiling the Power of Arbitrage in Forex

Forex arbitrage presents a compelling opportunity for traders seeking to generate low-risk returns by exploiting price discrepancies across different currency markets. By mastering the key strategies, understanding market dynamics, and employing sound risk management practices, aspiring arbitrageurs can unlock the potential of this rewarding trading technique.

Remember, knowledge is the cornerstone of successful arbitrage, and the information provided in this comprehensive guide will serve as a valuable resource on your journey to harnessing the power of arbitrage in forex trading. Embrace the world of forex arbitrage, where meticulous analysis, strategic execution, and robust risk management converge to create a path towards exceptional returns.