In the ever-evolving world of forex trading, technical analysis has emerged as a formidable tool, empowering traders to decipher complex market behavior and make informed trading decisions. This comprehensive guide will delve into the intricacies of technical analysis, providing a thorough understanding of its concepts, applications, and benefits. By the end of this article, you will be equipped with the knowledge and skills to harness technical analysis in your trading strategies.

Image: www.youtube.com

Technical analysis is an analytical technique that employs past price data to forecast future price movements. It assumes that price action reflects the collective sentiments of market participants, and by studying these patterns, traders can anticipate potential trends and make profitable trades. Unlike fundamental analysis, which examines factors such as economic indicators and company performance, technical analysis focuses exclusively on price action and historical data.

Key Concepts and Indicators

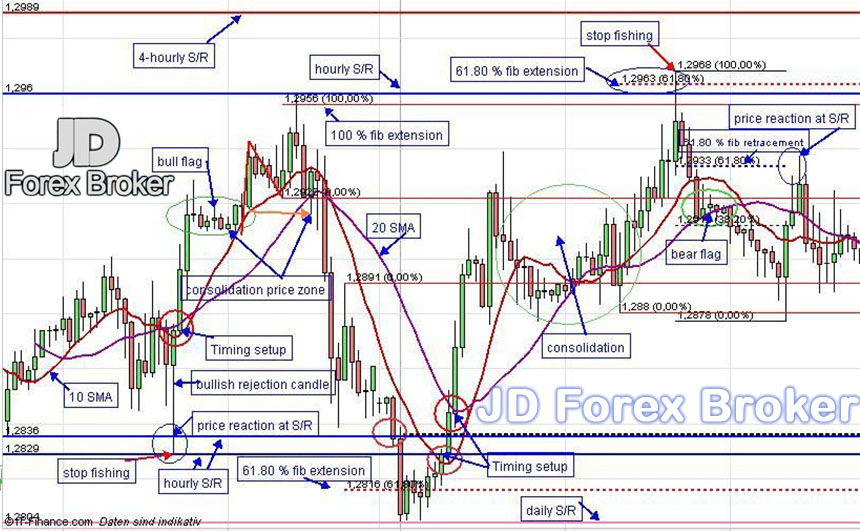

The cornerstone of technical analysis lies in the identification and interpretation of price patterns, chart formations, and technical indicators. These tools provide traders with valuable insights into market sentiment, trend strength, and potential trading opportunities. Some of the most widely used technical indicators include:

- Moving Averages: Calculate the average price over a specific period, smoothing out price fluctuations to identify potential trends.

- Bollinger Bands: Envelope-like bands that indicate volatility and potential overbought/oversold conditions.

- Relative Strength Index (RSI): Measures price momentum and identifies overbought/oversold conditions.

- Stochastic Oscillator: Oscillates between 0 and 100, signaling potential overbought/oversold conditions.

- Momentum Indicators: Measure the rate of price change to identify potential trend continuation or reversals.

Chart Formations: Traders also analyze price action formations, such as head-and-shoulders patterns, double-tops/bottoms, and pennants, to identify potential trend reversals or continuations.

Applications and Benefits

Technical analysis finds multifaceted applications in forex trading, including:

- Trend Identification: Identifying long-term and short-term trends by analyzing price patterns and indicators.

- Trade Timing: Determining optimal entry and exit points by pinpointing support and resistance levels.

- Risk Management: Identifying potential risk areas based on technical indicators and price action.

- Market Sentiment Analysis: Gauging market sentiment by studying price action and indicators.

- Objective Decision Making: Removing emotional bias from trading decisions by relying on objective technical analysis.

Latest Trends

The field of technical analysis is constantly evolving, with new indicators and trading strategies emerging. Some of the latest trends include:

- Machine Learning: Integration of machine learning algorithms into technical analysis tools to automate pattern recognition and trade execution.

- Automated Trading: Development of automated trading systems that use technical analysis to trigger trades based on predefined criteria.

- Data Visualization: Advancements in data visualization techniques to enhance the presentation and interpretation of technical data.

Image: www.jdforexbroker.com

Technical Analysis In Forex Trading Pdf

Conclusion

Technical analysis offers a powerful approach to understanding market behavior and making informed trading decisions. It empowers forex traders with the knowledge and tools to identify trends, anticipate potential price movements, and manage risk effectively. By delving into the complexities of technical analysis, traders can gain a competitive advantage and navigate the ever-changing forex market with greater confidence.

Harnessing the power of technical analysis requires a solid understanding of its concepts, practice, and continuous learning. Traders should supplement their knowledge by engaging in regular research, studying price action, and experimenting with different strategies. As you dedicate time and effort to mastering technical analysis, you will unlock its true potential and transform your forex trading experience.